The Nerds are Here to Help

Ready to Improve

Your Credit? Your Finances? Your Life?

The six-minute video below tells you exactly what kind of results to expect, exactly what types of items we can help remove, exactly when to expect those results, and exactly what you will pay along the way.

No Hype. No Fluff. Just the truth.

How Does It Work?

A Simple Yet Powerful System

Our proven process is easy to follow, built around real results, and designed to help you take control of your credit with confidence.

First, We Talk.

We start with your free no-obligation call to make sure we are the right fit for your needs.

We Get to Work.

All our services are done BEFORE you pay so there is no risk to you or your wallet.

Then... You Pay.

It is only after our results have been obtained that you would have any fees due.

Customer Testimonials

We Love Our Clients and They Love Us

The best way to showcase our commitment is through the experiences and stories of those who have actually worked with us.

Over the last year it has been truly my pleasure to be able to attend multiple of Eric Counts' live training events. The information that I learned was brilliantly mind blowing. Even after attending multiple events I still know that there is more that I can learn from this man and it's also a plus that he is so entertaining to watch!

LaDarrell Lawrence

I had the pleasure of sitting and hearing Eric's credit seminar about at least four times in the last 3 and 1/2 years. Each and everytime I listened to his teachings i walk away with so much helpful information than the previous time. I am also a client of his Credit restoration company and words can not explain how his services has impacted my life tremendously. I was in a bad place credit wise for a period of time until I met Eric and his Nerds! They definitley earn thier bragging rights! Thank you so much Eric and your Nerds! <3

Amanda Glass Robinson

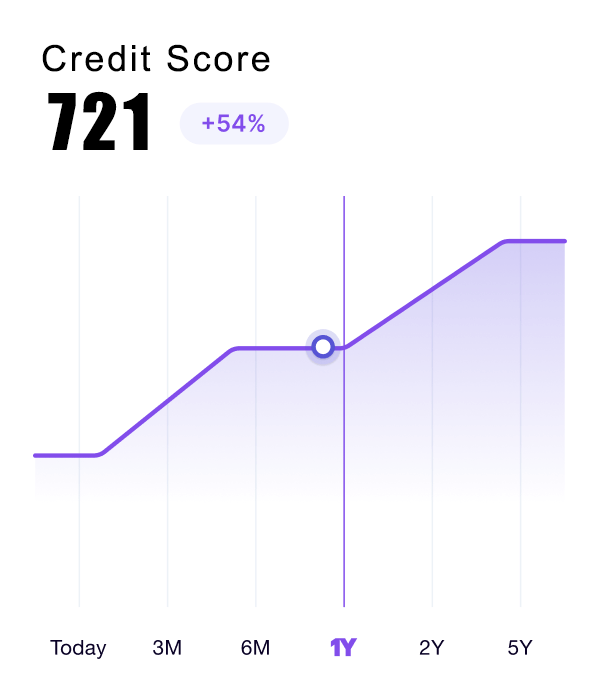

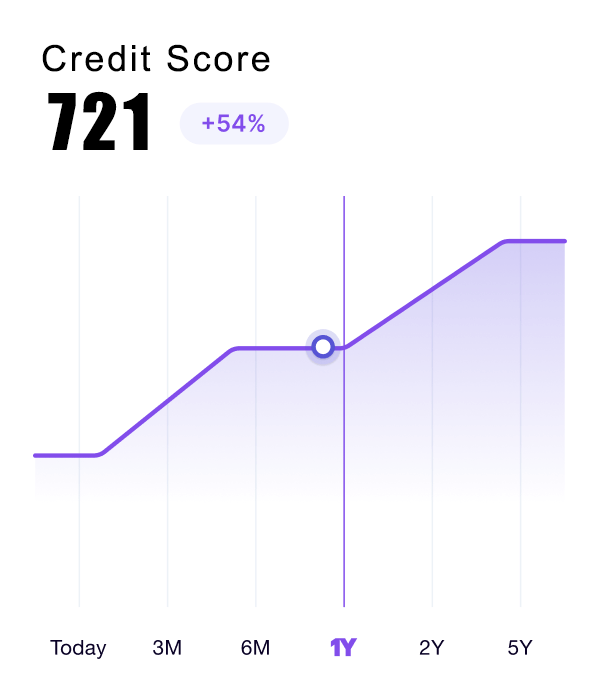

I'm so grateful for CreditNerds help in correcting my credit reports and ratings. I'm just sorry I didn't accept your assistance earlier. With your team's expertise and professional support you helped me improve my credit score by over 100 points in 3 months. What you do works and it is important to follow the directions in a timely manner. Do that and the results are great! I've obtained a number of new credit lines and now have the education to use them wisely. Thank you.

Carol Ann Murray

CreditNerds has opened my eyes about how your credit score is actually formed! The good and the bad, utilization, rules of disputing and maximizing credit worthiness!!! I can't wait to attend his next event, Eric definitely makes learning about credit an absolutely FUN experience!!!

Christine Devore

I didn't know what I didn't know about the credit system in our country until I attended one of the CreditNerds training sessions. They know the industry inside and out so can certainly provide the information, but they also speak in layman's terms so that you can actually understand what they are saying. The fact that you enjoy yourself and have a few good laughs along the way is just icing on the cake. I would highly recommend any program or training that CreditNerds puts on, without hesitation.

Liz Skoglund Lewis

I come from 12 years in the retail banking industry...and I know more than the average Jill about credit and the reporting agencies. I sat thru my 1st Eric Counts class on Credit Repair and Management, and within 20 minutes I was blown away! I "thought" I knew a thing or three about credit... but this guy...is a credit genius. He is knowledgeable, he is real, and he is funny! He is that proverbial "Bag of Chips!"

Cynthia Calhoun

Tired of Being Let Down?

Other Companies Make False Promises They Simply Can't Deliver On

At CreditNerds®, we don’t believe in hype or empty guarantees. We give honest, realistic expectations so you always know what to expect and when to expect it.

What's the Catch?

We Believe HONESTY is the Best Policy.

People want to know the bad stuff right along with the good.

So, if you're looking for the "catch" it is probably one of these three things.

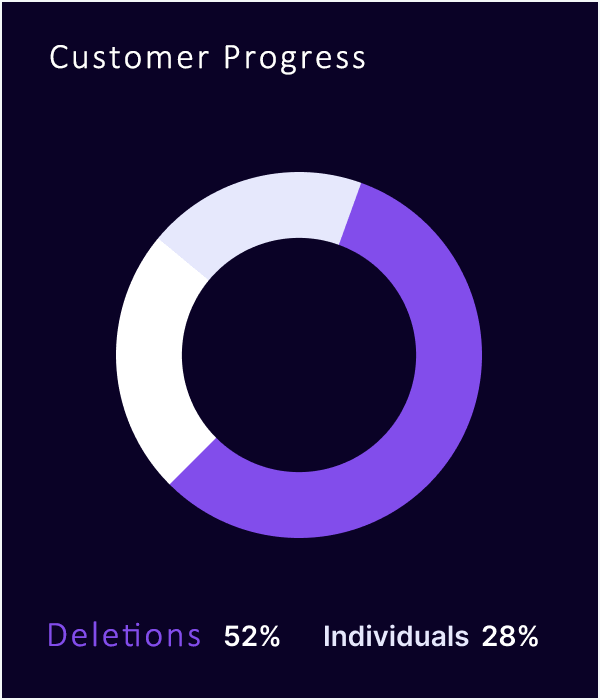

Real Results

Real Results from

Real Clients

We get it. You want to know if this really works. Check out our results page to see even more awesome client outcomes.

We have removed:

- Collections

- Reposessions

- Late Pays

- Bankruptcy

- Foreclosure

- Charge Offs

- Student Loans

- Judgments

- MORE

Flexible Pricing

The Fairest Pricing. Period.

There is simply not a more fair way to charge for credit repair services. With us, you only pay for exactly what you get. No surprises.

Credit Repair

Our flagship service. CreditNerds has been providing first class credit repair services since 2008 and uses the "Pay-Per-Deletion" model. This means you ONLY pay us for results. If we can't get items removed, then you don't have to pay. Simple. Fair.

- US Based Service

- Pay-For-Delete Model

- Monthly Service Option

- Over 15 Years Experience

- A+ BBB Rating

Funding Consultation

Some companies charge THOUSANDS to help you get access to funding. They normally charge success fees of 10-12%. NOT US. We simply charge a $197 fee and walk you through exactly how to get the funding you need.

- One-on-One Call

- Trained Advisors

- Zoom Based

- Results Driven

- The $$$ You Need

CreditNerds Affiliate Program

As a CreditNerds® affiliate, you can offer your clients credit repair with no service fees, making you the hero in their financial journey. All they need is a monitoring account, and we handle the rest. This leads to faster approvals, more closings, more sales, more commissions, and stronger client relationships. You stay top of mind as the one who helped them move forward, and you earn commissions and bonuses in the process. It is not just smart business... It is good karma.

- Send Unlimited Customers

- They pay nothing for deletions

- No long-term contracts

- Affiliate dashboard for tracking

- 10% Commissions of ANY purchase

Funding Consultation

Some companies charge THOUSANDS to help you get access to funding. They normally charge success fees of 10-12%. NOT US. We simply charge a $197 fee and walk you through exactly how to get the funding you need.

- One-on-One Call

- Trained Advisors

- Zoom Based

- Results Driven

- The $$$ You Need

Credit Repair

Our flagship service. CreditNerds has been providing first class credit repair services since 2008 and uses the "Pay-Per-Deletion" model. This means you ONLY pay us for results. If we can't get items removed, then you don't have to pay. Simple. Fair.

- US Based Service

- Pay-For-Delete Model

- Monthly Service Option

- Over 15 Years Experience

- A+ BBB Rating

CreditNerds Affiliate Program

As a CreditNerds® affiliate, you can offer your clients credit repair with no service fees, making you the hero in their financial journey. All they need is a monitoring account, and we handle the rest. This leads to faster approvals, more closings, more sales, more commissions, and stronger client relationships. You stay top of mind as the one who helped them move forward, and you earn commissions and bonuses in the process. It is not just smart business... It is good karma.

- Send Unlimited Customers

- They pay nothing for deletions

- No long-term contracts

- Affiliate dashboard for tracking

- 10% Commissions of ANY purchase

24/7 Online Access

Our Portal Makes It Easy for You to Track Your Progress.

Need to know how its going at 2:38 am? We got you. With our always on portal, you can get an update 24 hours a day, 7 days a week.