Why Your Financial Mindset Shapes Your Results

Most financial advice focuses on numbers: income, expenses, interest rates, credit scores, debt payoff strategies.

But there’s another part of money that gets overlooked, even though it quietly influences every decision you make:

Your money energy.

Money energy is the mindset, emotion, and intention you bring to your financial life.

It’s how you think, how you react, and how you make choices, especially when things get stressful.

And here’s the interesting part:

Two people with the same income and the same bills can experience completely different financial outcomes simply because their money energy is different.

Let’s break down why it matters and how to shift it.

1. Your Money Energy Affects Your Spending Decisions

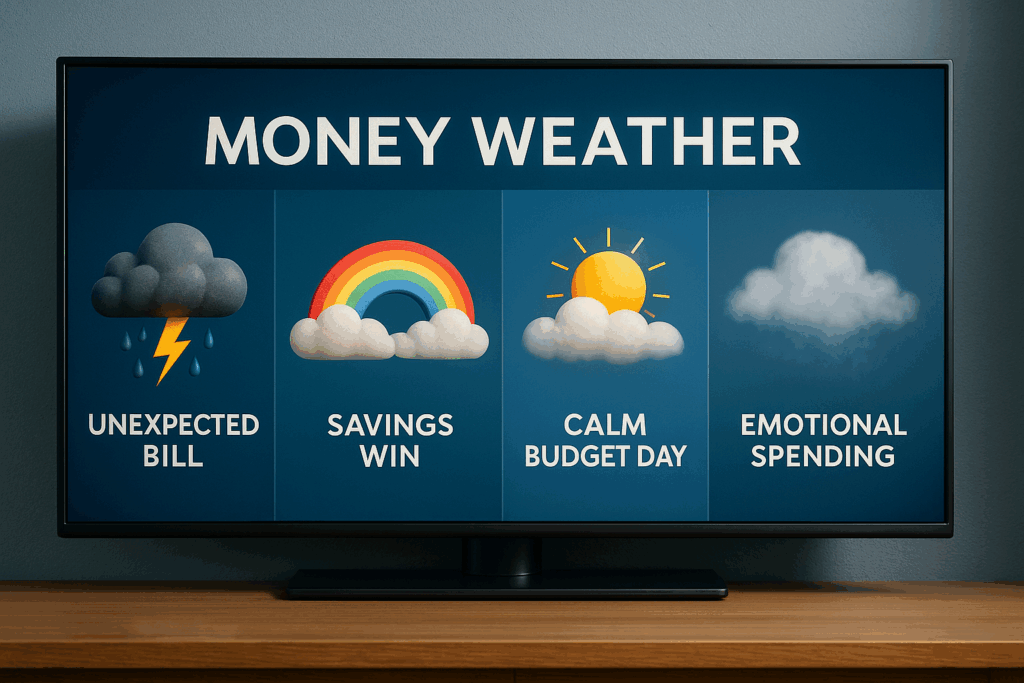

When you’re stressed, tired, or overwhelmed, money choices become emotional instead of strategic.

That’s when you see:

- Impulse buying

- “I deserve this” spending

- Paying for convenience

- Avoiding your budget or banking app

When your energy is low, your spending tends to rise.

Changing your mindset changes the decisions you make.

2. Your Money Energy Affects Your Earning Potential

People with positive money energy (confidence, clarity, and openness) are more likely to:

- Negotiate pay

- Start side hustles

- Raise prices in their business

- Apply for better opportunities

- Learn skills that boost income

People with negative money energy often avoid opportunities because they fear failure or feel undeserving.

Your mindset doesn’t just manage money — it creates it.

3. Your Money Energy Affects Your Credit Behavior

Credit success isn’t just actions — it’s consistency.

People with strong money energy tend to:

- Check their credit regularly

- Respond quickly to problems

- Monitor utilization

- Celebrate small improvements

People with anxious or avoidant energy often delay checking their reports, skip monitoring, or let issues build up.

4. Your Money Energy Shapes Your Habits

Money energy shows up in your routines.

When you feel empowered, you’re more likely to:

- Budget weekly

- Save automatically

- Stick with goals

- Track progress

When your energy is reactive, you bounce between feeling motivated and feeling defeated.

Habits follow mindset. Not the other way around.

5. How to Raise Your Money Energy Starting Today

Here are small, practical shifts that make a huge difference:

Celebrate tiny wins

Paid a bill early? Saved $10? Reduced a balance?

Acknowledge it. Energy grows where attention goes.

Check your accounts without judgment

Awareness isn’t punishment. It’s power.

Create a weekly “Money Reset”

10 minutes.

Look at your balances, upcoming expenses, and a simple goal for the week.

Speak about money differently

Replace:

“I’m terrible with money” with “I’m improving every week.”

“I never have enough” with “I’m learning how to manage what I have better.”

Your words shape your outcomes.

Final Thoughts

Money isn’t just math. It’s energy.

When your mindset is clear, calm, and focused, your financial decisions improve and your results follow.

You don’t need perfection to change your financial life.

You just need a shift in energy. One choice at a time.

At CreditNerds.com, we help you build both smart habits and a strong mindset, because lasting financial change starts on the inside. Start your credit journey today.