Why People Don’t Trust Their Scores (Even When They’re Improving)

One of the biggest challenges in credit repair has nothing to do with late payments, collections, or utilization.

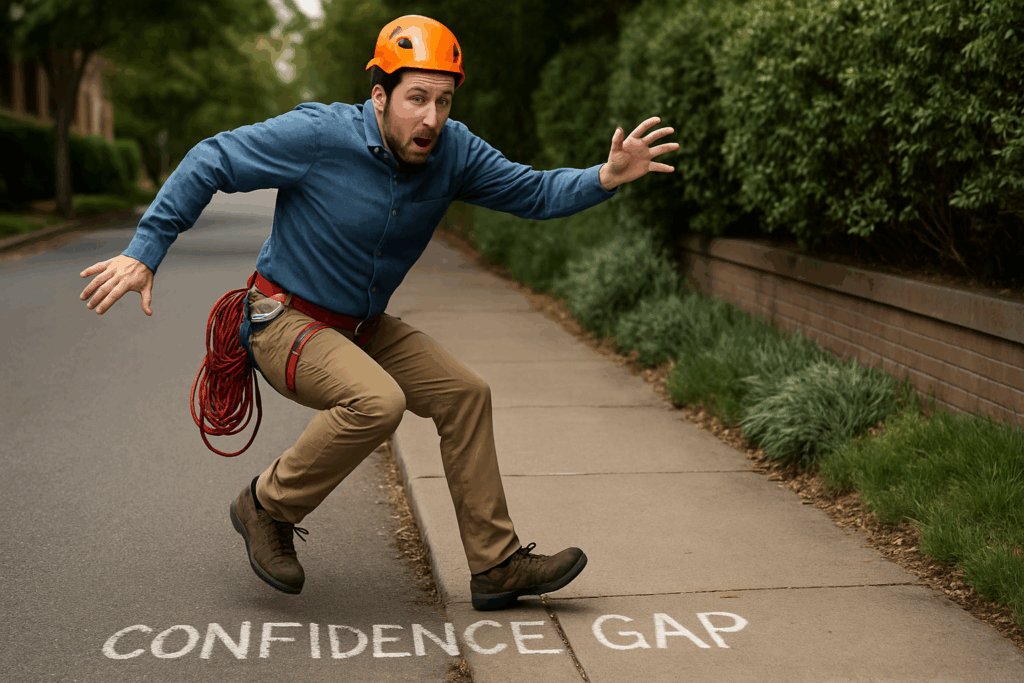

It’s something far more psychological. The confidence gap.

This is the moment when someone’s credit is genuinely improving, but they still don’t trust the process, the score, or themselves.

And that lack of confidence often slows the progress more than any negative account ever could.

Let’s break down why this happens and how to fix it.

1. People Remember the Damage More Than the Progress

If someone struggled with credit in the past (missed payments, maxed cards, financial stress), those memories stay loud.

Even when their score improves, the emotional memory of “messing up” feels stronger than the evidence of improvement.

Progress feels fragile.

Mistakes feel permanent.

That imbalance affects decision-making.

2. Small Score Drops Feel Like Huge Setbacks

Credit scores fluctuate.

Even when everything is going right, a score can dip 10 to 30 points because of:

- Normal reporting cycles

- Slight utilization changes

- A dormant card reporting late

- Data updates

- Closed accounts aging

- A loan being paid off

But people often panic at the dip and assume they’re “doing something wrong.”

The truth is: credit is not linear.

It moves in waves, not straight lines.

3. They Don’t Understand Why Their Score Is Going Up

A lot of people see improvement but don’t know what caused it.

When you don’t know why something is working, it’s hard to trust that the progress will continue.

Understanding the “why” builds real confidence.

4. Old Habits Don’t Disappear Overnight

People who once struggled with money often carry that mindset with them, even long after their habits have improved.

It feels like:

“I’m doing well now, but what if I slip again?”

“What if this doesn’t last?”

“What if I ruin it by accident?”

The fear of backsliding can be just as intense as the fear of low credit.

5. Credit Feels Mysterious on Purpose

Let’s be honest. The credit system isn’t designed to be simple.

It’s:

- Automated

- Algorithm-based

- Secretive

- Slow

- Full of scoring models

- Different across lenders

Because of that, even smart people struggle to trust what they don’t understand.

How to Close the Credit Confidence Gap

✔ Track habits, not just scores

Did you pay on time?

Did you keep balances low?

Did you avoid new inquiries?

These habits matter more than the number in the moment.

✔ Expect fluctuations

Small dips are normal.

They’re not failures. They’re part of the cycle.

✔ Celebrate the wins

Every on-time payment is momentum.

Every low balance is progress.

Every aging account helps your future.

✔ Keep learning

The more you understand credit, the less intimidating it becomes.

Final Thoughts

Credit isn’t just about numbers. It’s about trust.

Trusting the process.

Trusting the habits.

Trusting yourself.

And once someone builds that credit confidence, they don’t just raise their score.

They raise their entire financial future.

At CreditNerds.com, we help people build scores and confidence, because both matter. Start your credit journey today.