Why Credit Repair Takes Time (Even When It’s Done Right)

Let’s get one thing out of the way:

Fixing your credit isn’t like ordering fast food.

There’s no instant fix, no one-click solution, and definitely no magic letter that wipes your credit clean overnight.

Here’s the real reason credit repair takes time, even when you’re doing everything right.

Your Credit Didn’t Break Overnight

Credit problems usually build up over time:

- A missed payment here

- A medical bill you didn’t even know about

- A maxed-out card that got away from you

- A collection you thought insurance covered

So it only makes sense that rebuilding it also takes time.

Your credit report is like a financial résumé, and updating it isn’t just about making a few calls. It’s about:

- Identifying what’s inaccurate or outdated

- Disputing it with the right documentation

- Waiting for the bureaus and creditors to investigate

- Verifying outcomes and following up

It’s a process, and every step is important.

The Credit Bureaus Have Up to 30 Days to Respond

When a dispute is submitted, the credit bureau has 30 days (sometimes 45) to investigate and respond.

That means:

- You submit a dispute

- They reach out to the data furnisher (creditor or collector)

- That company has to verify the info

- Then the bureau updates the report, if needed

Even if your case is clear-cut, that clock still ticks.

And if the first dispute doesn’t resolve the issue, follow-up disputes or escalations can add more time.

Not All Accounts Can Be Disputed at Once

Credit repair isn’t just about throwing 30 disputes at the wall and seeing what sticks. In fact, sending too many disputes at once can get you flagged for frivolous filings.

Legitimate repair involves:

- Targeting the most impactful accounts first

- Spacing out disputes for credibility and compliance

- Reviewing updated reports between rounds

- Avoiding red flags that can delay or block your progress

This step-by-step strategy might feel slow, but it gets real results. And avoids getting your disputes ignored.

Some Items Require Extra Proof or Investigation

Not every dispute is cut and dry.

Sometimes creditors dig in their heels.

Sometimes a debt was sold three times before landing on your report.

And sometimes you have to track down old statements, billing errors, or settlement letters to support your case.

Legit credit repair companies (or smart DIYers) take the time to gather and submit real documentation, because that’s what gets items removed.

Shortcuts might feel satisfying, but they often backfire.

Credit Repair Is Only Part of the Picture

Even as your credit report improves, your credit score may not jump immediately. Especially if:

- You’re still using too much of your available credit

- You haven’t added any new positive history

- Old negatives are still aging off

Credit repair clears the path, but credit building is what fills the gaps. That means:

- Paying down balances

- Making on-time payments

- Possibly adding new credit (like a secured card or loan)

These positive actions take time to show up, and time to gain weight in your score. If you’re looking for a more in depth view of credit repair vs. credit building, check out The Difference Between Credit Repair and Credit Building (And Why You Need Both).

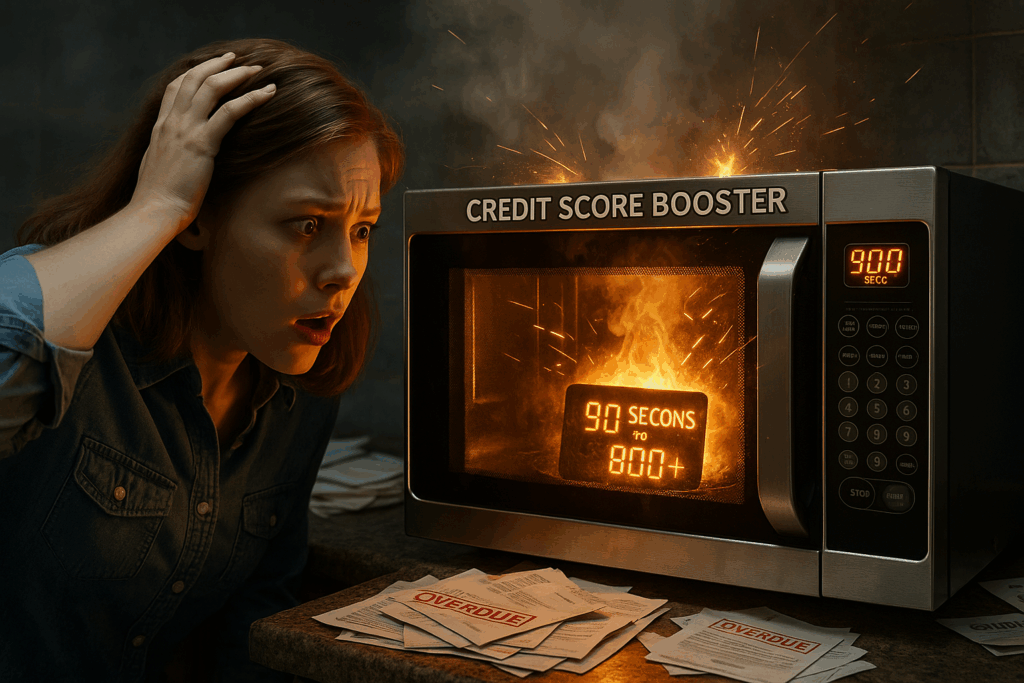

Be Careful with “Too-Good-To-Be-True” Promises

Any company that says they can:

- Erase bankruptcies

- Delete every negative item no matter what

- Guarantee a 700+ score in 30 days

…is not being honest with you.

The Credit Repair Organizations Act (CROA) actually makes it illegal to promise or guarantee specific results before they happen.

Real credit repair takes:

- Skill

- Patience

- A game plan

- And your involvement

But when done correctly, it’s absolutely worth it. If you’d like a more in depth discussion, check out How to Spot a Fake Credit Repair Offer (Before It Scams You).

Bottom Line

Credit repair is a process. Not a product.

And just like losing weight, building muscle, or growing a business, it requires time, consistency, and the right strategy.

So if it’s taking a little longer than you hoped?

That doesn’t mean it’s not working.

It means you’re doing it the right way.

Need help doing it right? Without hype or scams?

At CreditNerds.com, we only charge when we get results.

No upfront fees. No fake promises. Just real credit repair, done by people who care.

Schedule your free consultation and let’s fix what’s broken.