Why Consistency Is Important to Building Strong Business Credit

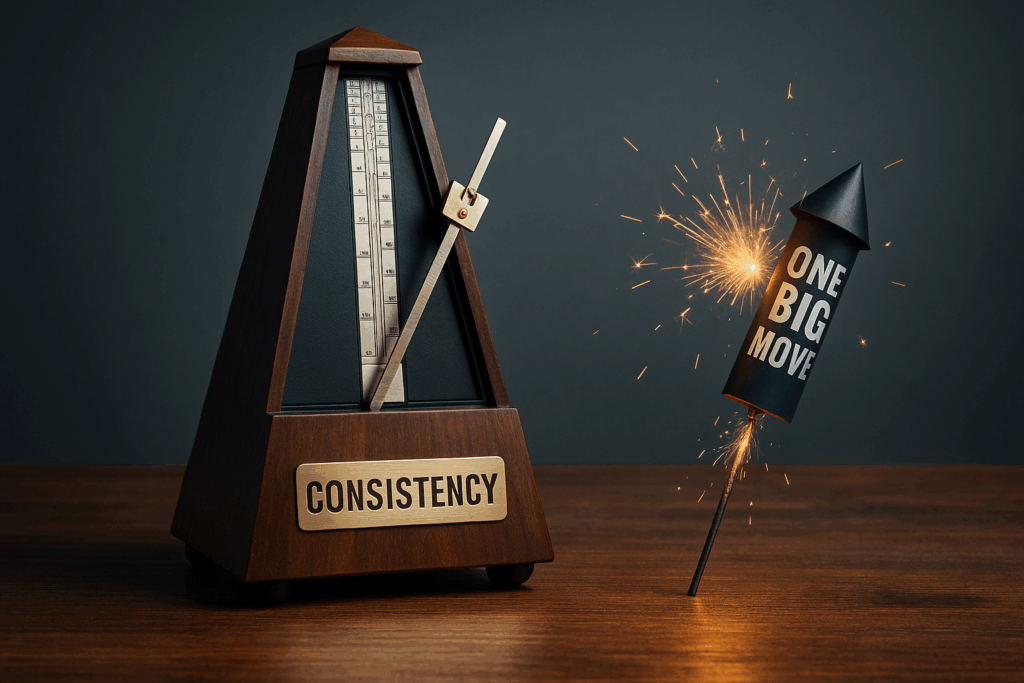

When it comes to business credit, most people focus on the big steps: getting an EIN, opening business accounts, or applying for funding. But what really separates strong credit profiles from weak ones isn’t just setup. It’s consistency.

Steady, responsible activity over time can do more for your business credit than one big loan ever could.

Why Consistency Matters So Much

Business credit is built on trust. Lenders, vendors, and credit bureaus want to see a pattern of reliability, not just one good month. Consistent activity shows that your business can handle credit responsibly over time.

✅ Regular payments signal stability

✅ Active accounts build history

✅ Predictable patterns strengthen your profile

1. Make On-Time Payments. Every Time

On-time payments are the single most powerful factor in building business credit. A single late payment can stick around for years, while consistent payments build trust quickly.

Even small vendor accounts can boost your profile if managed well.

2. Use Credit Strategically, Not Sporadically

Many business owners make the mistake of opening accounts and then letting them sit unused. Regular, modest use is better than random bursts of spending.

✅ Make small purchases you can pay off each month

✅ Keep balances low to maintain a healthy utilization ratio

3. Keep Accounts Open and Active

Length of credit history matters. Closing accounts too early can erase years of positive payment history. Keeping long-standing accounts open strengthens your credit profile over time.

4. Monitor Your Business Credit Reports

Even if you’re consistent, reporting errors can still pop up. Regularly checking your business credit reports with Dun & Bradstreet, Experian Business, and Equifax Business helps ensure your efforts are being accurately reflected.

5. Build Slowly, Grow Steadily

You don’t need to rush to get a huge credit line. A few well-managed accounts used consistently can build a stronger foundation than overextending early on.

Final Thoughts

Building business credit isn’t about overnight wins. It’s about creating a steady, reliable pattern that lenders and vendors trust. Consistency builds credibility, and credibility opens doors to funding, partnerships, and growth.

At CreditNerds.com, we help business owners build strong personal credit step by step. Get started on your credit journey today.