Why Cash Flow Matters More Than Profit for Small Businesses

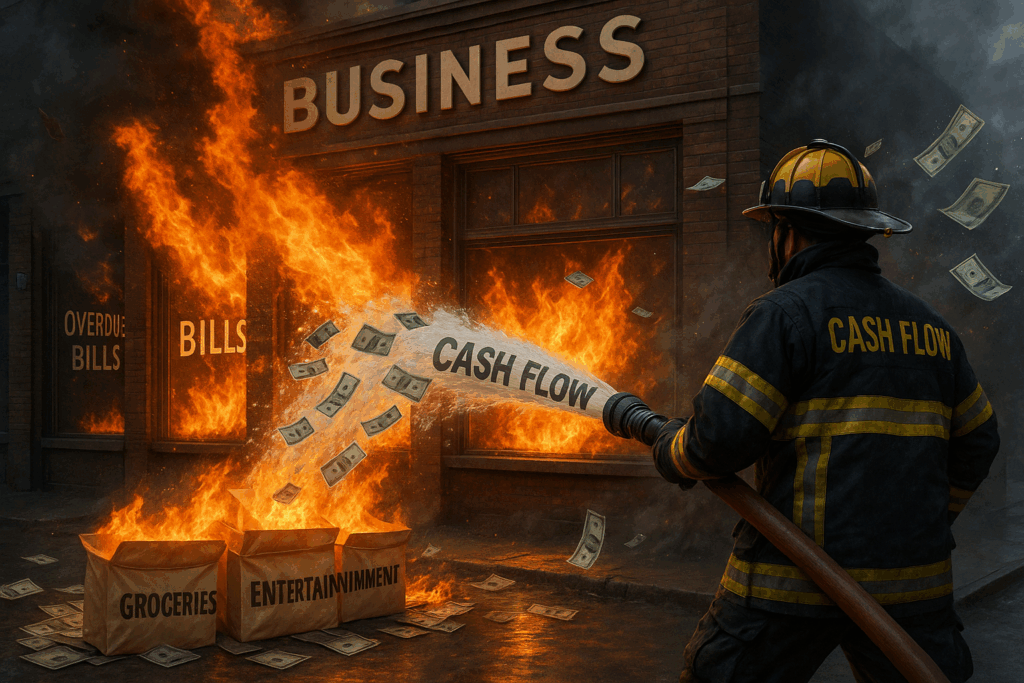

Most entrepreneurs dream of seeing big profits on their income statements. But here’s the truth: profit doesn’t keep the lights on. Cash flow does.

Cash flow is the movement of money in and out of your business, and it’s often the difference between businesses that survive and those that fail.

Profit vs. Cash Flow: What’s the Difference?

- Profit is what’s left over after expenses are subtracted from revenue.

- Cash flow is the actual timing of when money moves in and out of your accounts.

You can be profitable on paper but still struggle to pay bills if your customers are slow to pay or your expenses pile up at the wrong time.

Why Cash Flow Is King

- Covers Day-to-Day Operations

Rent, payroll, and suppliers can’t wait for future profits. Cash flow keeps the lights on. - Supports Growth

Expanding too fast without steady cash flow can sink a business. You need money in hand, not just revenue on the books. - Protects Against Emergencies

A strong cash position helps you handle sudden repairs, market dips, or unexpected expenses. - Builds Credibility

Lenders, investors, and vendors often care more about your cash flow than your profit margin when deciding to work with you.

How to Improve Your Cash Flow

- Invoice Faster: Send invoices as soon as work is complete.

- Offer Payment Incentives: Discounts for early payments can speed up receivables.

- Negotiate Vendor Terms: Longer payment terms give you breathing room.

- Use Business Credit Wisely: A line of credit or vendor accounts can smooth out the gaps.

- Track It Monthly: Don’t wait until year-end. Cash flow needs regular check-ins.

Final Thoughts

Profit looks good on paper, but cash flow keeps your business alive. By paying close attention to when money comes in (and when it goes out), you’ll avoid sleepless nights, strengthen your relationships with lenders and vendors, and set your business up for long-term stability.

At CreditNerds.com, we help entrepreneurs clean up their personal credit, so they can begin focusing on their business credit without worries. Schedule your free consultation today.