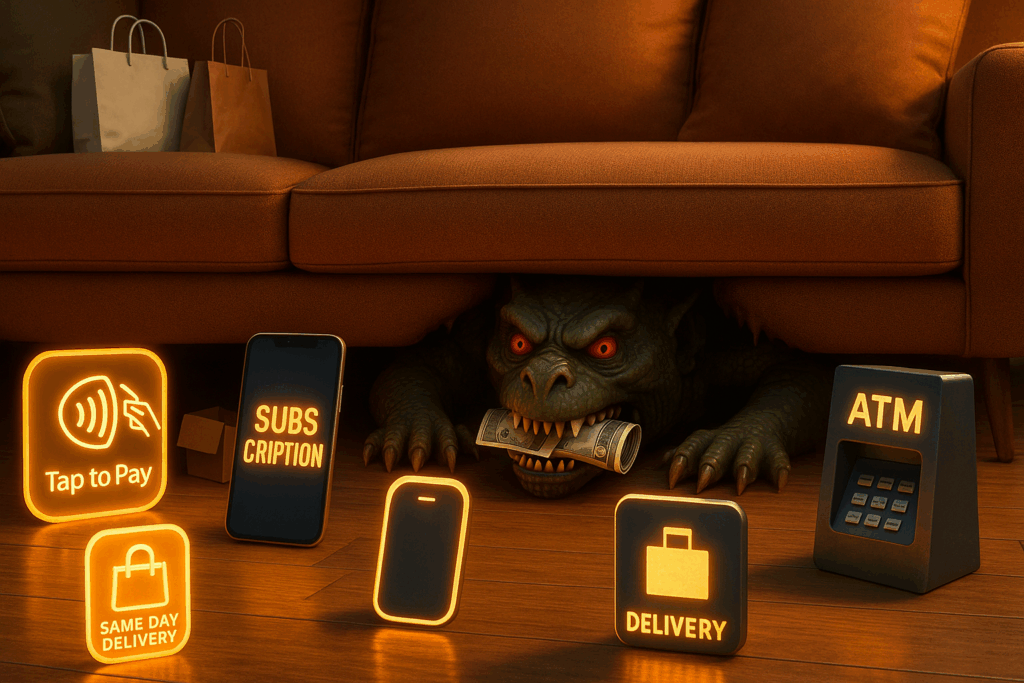

The Hidden Cost of Convenience: How Small Fees Drain Your Wallet

In today’s world, everything is about convenience: tap-to-pay, same-day delivery, subscription services, ATM withdrawals. While these tools save time, they often come with small fees that are easy to overlook. And over time, those “little” charges can quietly cost you hundreds, even thousands, of dollars a year.

The Sneaky Fees to Watch Out For

- ATM Fees

Using an out-of-network ATM might cost $3–$5 each time. Do that twice a week, and you’re out $30+ a month. - Delivery and Service Fees

Food delivery apps tack on hidden charges that can double the cost of your order. - Late Payment Fees

Missing just one due date can cost $25–$40, and sometimes add interest on top. - Subscription Overlaps

Paying $9.99 here and $14.99 there adds up. Many people forget to cancel free trials or unused subscriptions. - Bank Account Maintenance Fees

Some accounts charge $10–$15 per month just for holding your money.

Why They Add Up So Fast

Small fees don’t feel painful in the moment, which is why they slip through so easily. But when you zoom out, they tell a different story:

- $10 a week in fees = $520 a year.

- $50 a month = $600 a year.

- Over 10 years? That’s thousands you could have invested or saved.

How to Take Back Control

- Audit Your Accounts: Go through your last two months of statements and highlight every fee.

- Switch Banks or Cards: Look for fee-free accounts and rewards cards.

- Set Reminders: Avoid late fees by automating payments or setting alerts.

- Review Subscriptions: Cancel what you don’t use, and rotate services instead of stacking them.

- Plan Ahead: Use your bank’s ATM or grab cash when making a purchase to avoid extra charges.

Final Thoughts

Convenience is valuable, but only when it doesn’t quietly drain your wallet. By paying attention to the small fees hiding in your daily life, you can free up money for things that truly matter.

At CreditNerds.com, we believe financial health isn’t just about credit scores. It’s about protecting your money in every area of life. We are here to help you put your credit on track and focus on other areas of your life. Schedule your free consultation here.