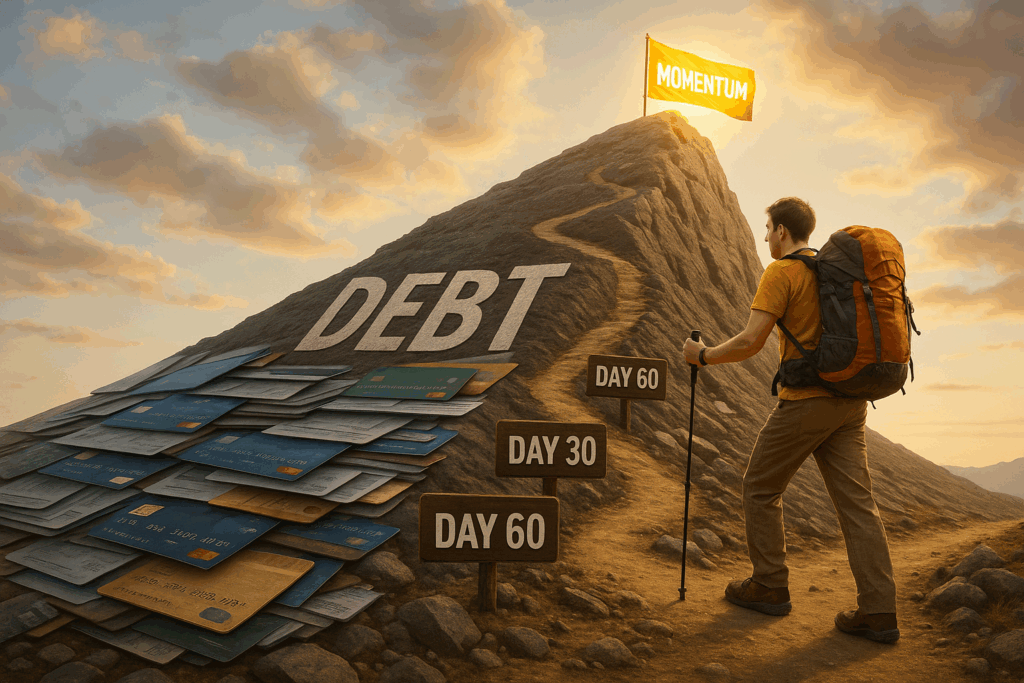

The First 90 Days of Getting Serious About Debt

Getting out of debt is a big goal, and like any big goal, it can feel overwhelming at first. The good news is that the first 90 days are the most important. If you use them wisely, you’ll build momentum, develop new habits, and finally see a clear path forward. Here’s how to make those first three months count.

Days 1–30: Get Clear on the Numbers

The first month is all about awareness. You can’t fix what you don’t measure.

- List Every Debt

Write down each account: balances, interest rates, minimum payments, and due dates. - Face the Total

Add everything up. This step can feel uncomfortable, but it’s necessary to move forward. - Build a Bare-Bones Budget

Track your income and expenses. Identify areas to cut back so you can free up money for debt. - Create an Emergency Buffer

Save at least $500–$1,000 if you don’t already have it. This keeps small emergencies from pushing you further into debt.

Days 31–60: Build Your Strategy

Now that you know the numbers, it’s time to create a plan of attack.

- Choose Your Payoff Method

- Debt Snowball: Pay smallest balances first for quick wins.

- Debt Avalanche: Pay highest interest first for maximum savings.

- For more info on each of these, check out Debt Snowball vs. Debt Avalanche: Which One Works Best?.

- Automate Minimum Payments

Never risk a late fee or a hit to your credit score. Set every minimum payment on auto-pay. - Attack the Target Debt

Any extra money goes to your chosen “target” debt while you keep making minimums on the rest. - Look for Quick Wins

Sell unused items, cut subscriptions, or take on a side hustle. Even $100 extra toward debt each month adds up fast.

Days 61–90: Lock in New Habits

The third month is about consistency. By now, you’ve started to see progress. Maybe a small balance is gone, or you’re finally ahead on payments. Don’t stop.

- Track Progress Weekly

Watch balances go down. Seeing results keeps you motivated. - Adjust Your Budget

Revisit your budget and trim more if possible. Channel every freed-up dollar into debt payoff. - Celebrate Small Wins

Paid off your first card? Cross it off the list. Knocked $500 off a balance? Acknowledge it. Small wins fuel long-term success. - Stay Educated

Keep learning about credit, interest, and financial habits. Knowledge helps you avoid falling back into the same traps.

Final Thoughts

The first 90 days of tackling debt are about building discipline and momentum. You won’t erase everything overnight, but you will create a system that works. One that helps you stay consistent until the debt is gone.

At CreditNerds,com, we’ve seen thousands of people transform their financial lives by sticking to these early steps. If you’re ready to take control of your credit, schedule your free consultation today.