The Envelope Method in the Digital Age: Can Old-School Budgeting Still Work?

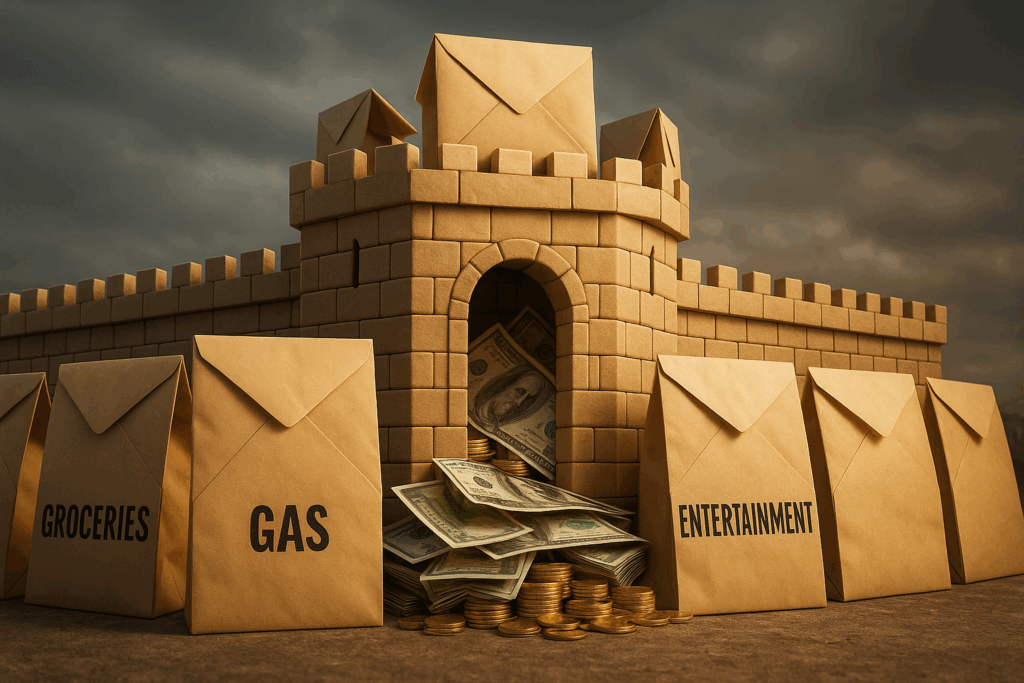

Before budgeting apps and online banking, people had a simple, no-nonsense way to control their spending: the envelope method. Cash was divided into separate envelopes labeled “Groceries,” “Gas,” “Entertainment,” and so on. When the envelope was empty, that category of spending stopped.

It may sound old-fashioned, but here’s the truth: the envelope method still works, and thanks to digital tools, it’s easier to use than ever.

How the Traditional Envelope Method Worked

- Step 1: Decide how much money to spend in each category for the month.

- Step 2: Withdraw cash and place it in envelopes labeled for each expense.

- Step 3: Spend only what’s in the envelope. When it’s gone, no more spending in that category.

It was simple, effective, and physical, which made overspending much harder.

Why It Still Matters Today

The biggest strength of the envelope method wasn’t the paper envelopes. It was the discipline it built. It forced people to prioritize, made them conscious of their spending, and gave them a clear visual of where their money was going.

That same principle is just as powerful in a digital world.

The Digital Envelope System

Even if you never use cash, you can recreate the envelope method with modern tools:

- Bank Sub-Accounts: Many banks let you create multiple savings “buckets” for categories like groceries, dining, or travel.

- Budgeting Apps: Tools like YNAB, Goodbudget, or EveryDollar mimic digital envelopes and track every transaction for you.

- Prepaid Cards: Some people load specific amounts on prepaid debit cards for categories like entertainment to prevent overspending.

- Credit Card Tracking: If you’re disciplined, you can use credit cards for categories and track with apps, but beware of overspending.

Benefits of Going Digital

- No Cash Needed: You can pay bills and shop online while sticking to the method.

- Real-Time Tracking: Apps update automatically so you always know where you stand.

- Easier Adjustments: Move money between digital “envelopes” instantly when priorities change.

- Accountability Tools: Many apps send alerts if you’re close to overspending.

How to Start Today

- Pick three categories where you overspend most often (like dining out, groceries, or entertainment).

- Set limits for each and create digital envelopes through your bank or an app.

- Track weekly. Move money only if absolutely necessary.

- Review at the end of the month and adjust for next time.

Final Thoughts

The envelope method may have started with paper and cash, but its power lies in structure and awareness. In the digital age, you don’t need physical envelopes to get the benefits. You just need a system that helps you stay accountable.

At CreditNerds.com, we believe simple, time-tested strategies like this can make managing money less stressful and more effective. If you’re looking for credit repair that works with you, schedule your free consultation here.