The Credit Comeback: How to Bounce Back After a Financial Setback

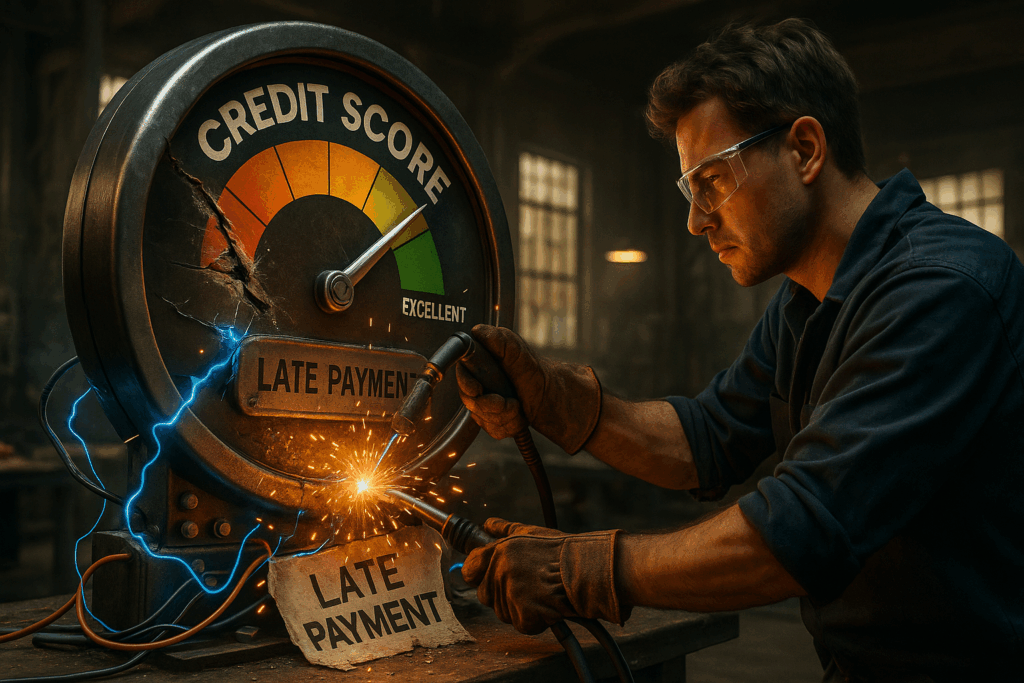

Everyone hits financial rough patches. A job loss, a medical bill, a bad loan, or just a few tough months that spiral into late payments. The good news? Credit damage isn’t permanent.

Your credit score is designed to reflect your current financial behavior, which means you can recover, rebuild, and come back stronger than before.

Here’s how to start your credit comeback.

1. Face the Damage. Don’t Fear It

Ignoring your credit report doesn’t make the problems go away. The first step to recovery is awareness.

Get your free reports from all three bureaus: Experian, TransUnion, and Equifax.

Look for:

- Late payments

- Collection accounts

- Charge-offs or errors

Knowing what’s hurting your score gives you the power to fix it.

2. Focus on the Next 6 Months

Rebuilding credit isn’t about yesterday’s mistakes. It’s about what you do now.

Start by creating a six-month recovery plan that includes:

- Paying every bill on time

- Keeping balances under 30% of your limits

- Avoiding new hard inquiries

Even a few months of consistent behavior can start showing results.

3. Negotiate or Settle Old Debts

If you have collection accounts, contact the creditor to negotiate payment or settlement.

Some will even agree to remove negative marks once the balance is resolved (“pay for delete”), though it’s not guaranteed.

Every resolved debt is one less anchor holding down your score.

4. Rebuild With Positive Accounts

You don’t need perfect credit to start rebuilding it. Tools like:

- Secured credit cards

- Credit-builder loans

- Authorized user accounts

…can help you add positive payment history quickly and safely.

5. Track Progress and Celebrate Wins

Your score won’t jump 100 points overnight, but steady improvement is proof your comeback is working.

Even small jumps (10, 20, or 30 points) mean lenders are seeing you differently.

Every good month is a step toward full recovery.

Final Thoughts

Bad credit isn’t the end. It’s a temporary chapter.

The real story is how you respond. With the right strategy, patience, and a little help, your credit comeback can become your biggest financial victory.

At CreditNerds.com, we help people turn credit struggles into success stories. One smart step at a time.