Should You Close Old Credit Cards? Here’s What It Does to Your Score

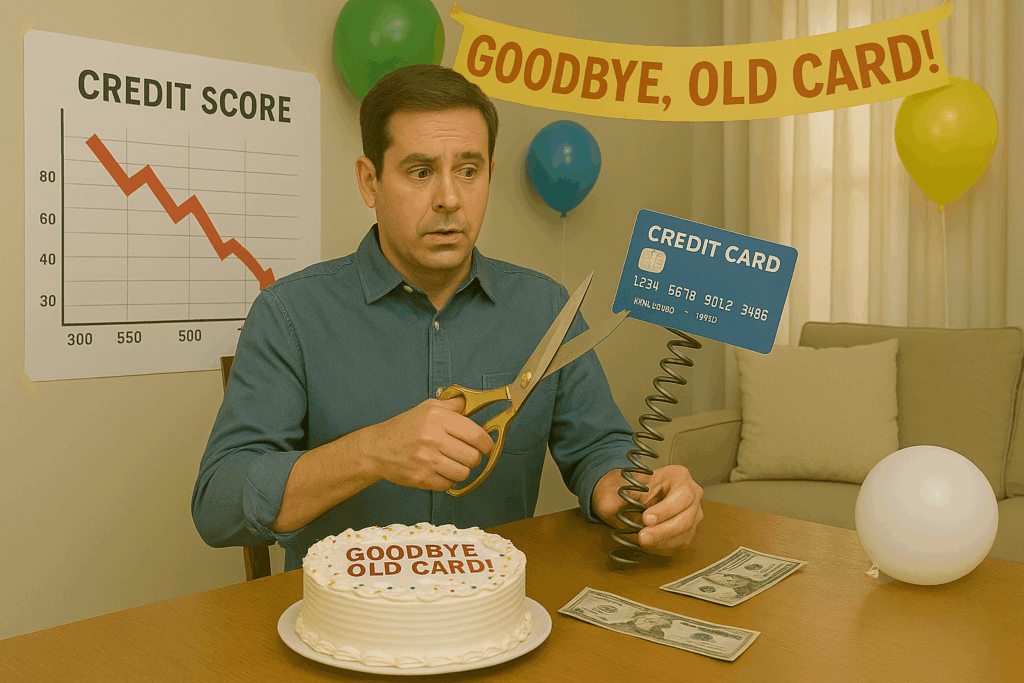

You’ve got an old credit card you never use. Maybe it has no rewards, a high interest rate, or you’ve just moved on to better cards. Closing it seems like the smart, responsible move… right?

Not so fast.

Closing a credit card, especially an old one, can actually hurt your credit score if you’re not careful.

If you’re not sure how closing a card will affect your profile, or want help cleaning up your credit before a big purchase, CreditNerds.com has your back. Reach out to one of our credit experts, and we can begin helping you get your credit report back on track!

Now, before you cut up that card and close the account, let’s break down how it affects your credit and what your better options might be.

What Happens When You Close a Credit Card?

Closing a credit card account affects your credit score in two major ways:

1. It Can Increase Your Credit Utilization

Your credit utilization ratio is how much of your total available credit you’re using. It’s one of the most important factors in your credit score—about 30% of it, in fact.

Let’s say you have two credit cards:

- Card A: $5,000 limit

- Card B: $2,000 limit (the one you want to close)

- You carry $2,000 in total balances

If you close Card B, your total available credit drops from $7,000 to $5,000. That raises your utilization ratio from 29% to 40%, and that can drop your score.

Lower utilization = better score. Keeping that old card open helps cushion your ratio.

2. It Can Lower Your Average Age of Credit

The age of your accounts matters too, especially the average age and the age of your oldest account. That’s about 15% of your FICO score.

If the card you’re thinking of closing is your oldest, closing it might:

- Shorten your credit history

- Lower your average account age

- Make your profile look less stable to lenders

Old accounts = strong history. The longer you’ve managed credit responsibly, the better.

When Is It Okay to Close an Old Card?

There are a few good reasons to close a card, even if it might impact your score slightly:

- The card has an annual fee and no benefits

- It tempts you to overspend or carry debt

- You’re consolidating your finances intentionally

- It’s a joint card and you’re separating finances

- You’re doing a refinance or loan application in the distant future, not the next 90 days

Just know the trade-offs before you act.

Better Alternatives to Closing It

If your goal is to avoid fees or limit spending, but you don’t want to hurt your credit, try one of these options:

Ask for a Downgrade

Many issuers will let you switch to a no-annual-fee version of the card. You keep the account open, and all its history, without paying anything.

Keep It Open, Use It Occasionally

Put a small recurring charge (like a streaming service) on it, and set up auto-pay. That keeps the account active without risk of missed payments or overspending.

Use It for Credit Diversity

Even if you don’t use the card much, having multiple types of credit (revolving and installment) shows lenders you can manage different kinds of debt.

Final Thoughts

Closing a credit card might seem like a smart move, but in most cases, it’s better to keep it open, especially if it’s your oldest account or part of your available credit cushion.

That old card may not be flashy, but it could be quietly helping your score more than you realize.

👉 If you’re looking to clean up your credit report, CreditNerds.com has your back. Schedule your free consultation today! We only charge if we get results. No gimmicks. Just real help.