How to Protect Your Credit If You Lose Your Job

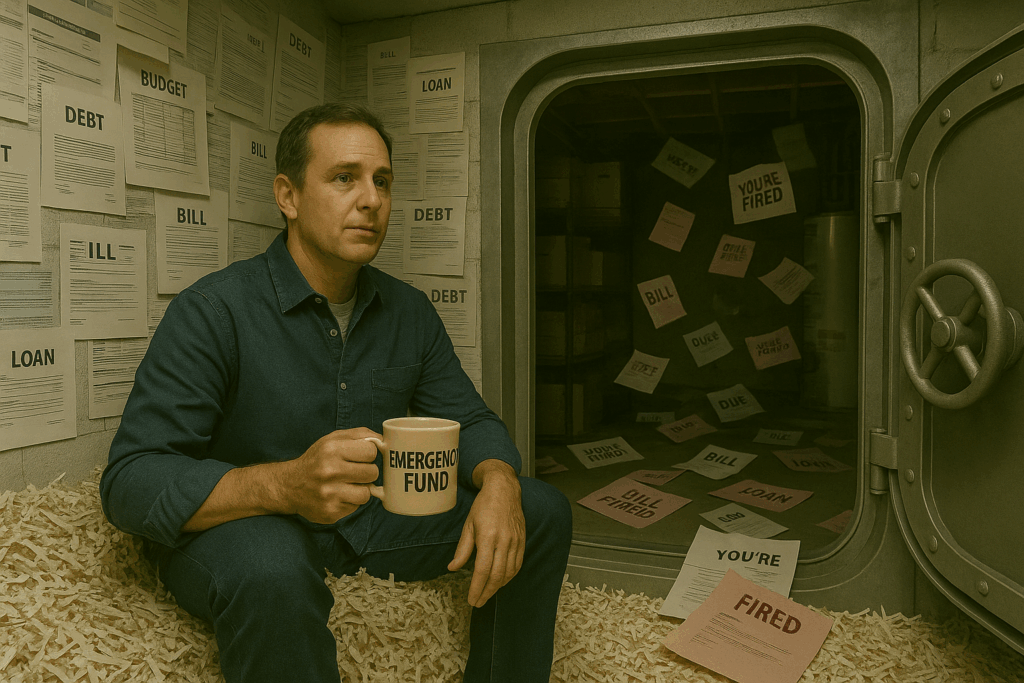

Losing your job can feel like your world just flipped upside down. Between the emotional stress and the financial uncertainty, your credit might be the last thing on your mind, but protecting it now can save you a lot of pain down the road.

The good news? Even during tough times, there are smart moves you can make to protect your credit score while you focus on finding your next opportunity.

1. Review Your Budget Immediately

Start by understanding exactly what money is still coming in (if any) and what expenses are non-negotiable. Create a lean budget that covers essentials like:

- Rent or mortgage

- Utilities

- Groceries

- Insurance

- Minimum debt payments

Look for anything you can cut or pause, like streaming subscriptions, dining out, or unused memberships.

Goal: Make your emergency funds (if you have them) stretch as far as possible.

2. Continue Making Minimum Payments

Even if you can’t pay your balances down aggressively, keeping up with minimum payments on your credit cards and loans is crucial.

Why? Because payment history is the #1 factor in your credit score (35% of your FICO score). One missed payment can drop your score by 60–100 points or more.

If things get tight, call your lenders right away and explain your situation. Many offer:

- Temporary forbearance or deferment

- Hardship programs

- Interest reductions

3. Prioritize the Right Debts

When money is tight, not all bills are created equal. Prioritize:

- Secured debts like your mortgage or car loan (missing these can mean foreclosure or repossession)

- Credit cards and personal loans (to avoid credit damage and collections)

If you must choose between bills, pay at least the minimum on accounts that report to the credit bureaus to protect your score.

4. Avoid Taking on New Debt—If Possible

When your income drops, it’s tempting to rely on credit cards or personal loans to get by. While sometimes necessary, be cautious—racking up balances can quickly make things worse.

Consider zero-interest balance transfer offers only if you’re sure you can pay them off before the intro period ends.

5. Check Your Credit Reports for Free

You’re entitled to free credit reports from Experian, Equifax, and TransUnion.

Review them for:

- Errors

- Unexpected balances

- Fraudulent accounts

Catching problems early can protect your score while you’re focused on more urgent things.

6. Use Forbearance the Right Way

Some lenders offer forbearance that allows you to pause payments. This won’t hurt your credit as long as:

- It’s approved by the lender

- You resume payments as agreed

- The lender reports your account as “current”

But be cautious: deferred payments don’t go away. They may just pile up for later.

7. Communicate Proactively with Creditors

Don’t wait until you’ve missed a payment. Call your creditors the moment you lose income and ask about hardship programs. They’re often more flexible when you communicate early.

8. Consider a Side Hustle or Gig Work

Even if it’s temporary, bringing in extra income can help you stay afloat without damaging your credit. Driving for delivery apps, freelancing, or part-time work can buy you time and peace of mind.

9. Pause Non-Essential Credit Activity

Now’s not the time to apply for new cards, close accounts, or co-sign loans. These actions can lower your credit score or add unnecessary risk.

Final Thoughts

Losing your job is hard, but it doesn’t have to destroy your credit. With a smart strategy, open communication, and a clear plan, you can weather the storm and keep your score intact.

At CreditNerds.com, we help people protect and rebuild their credit through life’s toughest challenges. If you’re facing uncertainty and want a second set of eyes on your credit, we’ll review it for free, and you only pay if we get results.