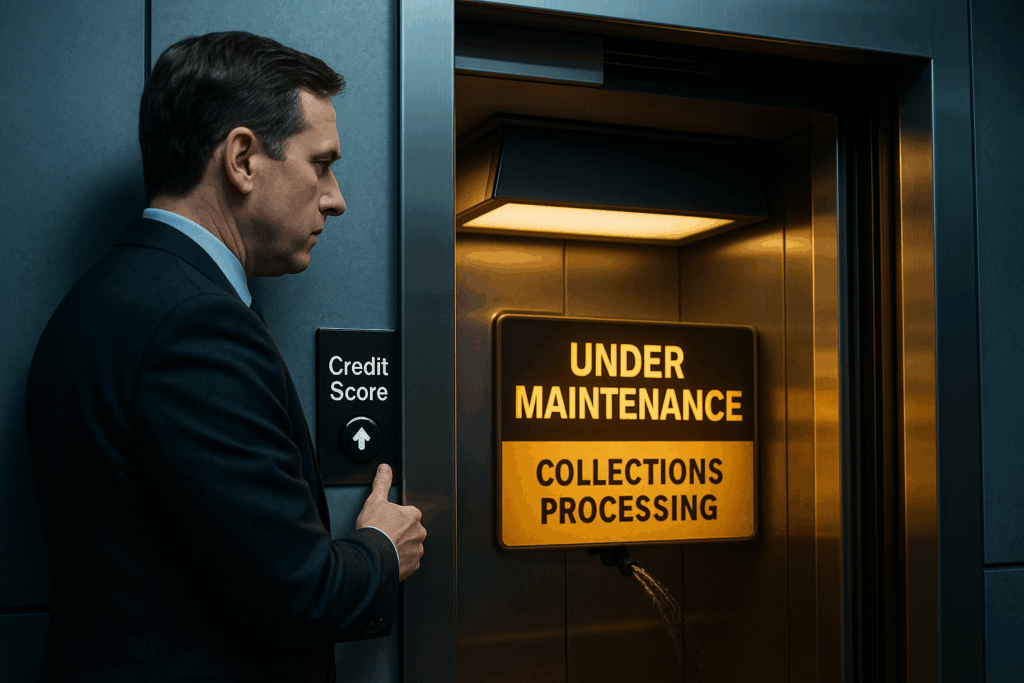

How Closing Collections Can Help Your Credit Score

If you’ve ever paid off a collection account, you probably expected your credit score to jump right away, but sometimes it doesn’t. In fact, people are often surprised to see little or no change at all.

Here’s why that happens, and how to handle collections the right way to actually help your score.

1. Paid Collections Still Show Up, But They Matter

When you pay off a collection, it doesn’t erase the account immediately. It stays on your credit report for up to seven years from the original delinquency date.

However, newer scoring models like FICO 9 and VantageScore 4.0 treat paid collections differently. They ignore them completely when calculating your score.

That means paying off a collection can improve your score. It just depends which version lenders use.

2. Some Lenders Still Use Older Scoring Models

Not every lender or creditor uses the newest FICO or VantageScore versions. Many still rely on older models that don’t distinguish between paid and unpaid collections.

The takeaway: paying off collections is always the right move long-term, even if it doesn’t help your score right away, it improves your creditworthiness in a lender’s eyes.

3. “Pay for Delete” Isn’t a Magic Fix (But Sometimes Works)

Some collection agencies will agree to remove a negative account entirely if you pay or settle the balance, a “pay for delete” deal.

While not all agencies offer it, and bureaus don’t officially endorse it, it can be worth asking.

Just get the agreement in writing before paying.

4. Don’t Forget to Rebuild Positive History

Even if you pay off or remove a collection, that doesn’t automatically boost your score, because it doesn’t add new positive data.

To rebuild, you need fresh, on-time payment history.

Try:

- Secured credit cards

- Credit-builder loans

- Being added as an authorized user

These new positive lines balance out the old negatives over time.

5. Check Your Reports After It’s Closed

After you pay or settle a collection, check all three bureaus (Experian, TransUnion, and Equifax) about 30–45 days later to ensure it’s marked “Paid” or “Closed.”

If it still shows an outstanding balance, dispute it immediately.

Final Thoughts

Paying off collections doesn’t always deliver instant results, but it’s still one of the smartest moves you can make for your long-term credit health.

Because while scoring models may differ, lenders always reward responsibility and recovery.

At CreditNerds.com, we help people navigate the gray areas of credit repair, so you can rebuild confidence, not just your score. Start your journey to fresh credit here.