Let's get you booked...

This is simply to book a funding consultation call with the CreditNerds®. We’d just like to let you know your options and hopefully be able to help you out along the way… Talk Soon!

Frequently Asked Questions

We asked customers and clients to tell us the most common things they might not have fully understood about our services. We listed them below and we will go through each so you can make sure you are making a good decision.

They responded with these things:

- I didn’t understand the Required Monitoring.

- I didn’t realize the fees are “Per Bureau”.

- I didn’t expect to have to give personal info.

- I didn’t expect to have to give payment info.

- I didn’t know I would need to mail anything.

- I didn’t understand the “Guarantee”.

We go through all these answers in the few short sections below.

A common response we get is “THIS SEEMS TOO GOOD TO BE TRUE!”.

We like to think this means we put together a really fair offer.

Yes… We really do the work first and bill after the deletions happen.

We are able to do this by keeping our costs and your costs down to a minimum.

Check out the sections below to get all the answers you will need to make a good decision.

At CreditNerds, we’re committed to delivering efficient and effective credit repair services.

One of the ways we achieve this is by partnering with a trusted monitoring account provider. We do require use of this particular account when working with our Pay For Results program. Here is why we use this account:

Partnership Benefits: Our partnership not only supports your credit goals but also helps us provide exceptional service. When you sign up through our link, our provider pays us a referral fee (around $20 per client). This covers costs like your welcome call and initial data entry, ensuring you receive personalized attention from the start.

System Integration: The monitoring account seamlessly integrates with our proprietary credit repair software. This integration allows us to pull and analyze comprehensive data efficiently. It saves us time by eliminating manual data entry, which means we can focus more on improving your credit and less on administrative tasks.

Consistency and Efficiency: Standardizing the monitoring process ensures every client has equal access to essential tools. This consistency helps us manage and track your progress accurately, making the credit repair journey smoother and more effective for you.

Compliance and Standards: Our chosen monitoring account meets industry best practices and regulatory standards. Using a compliant service reduces legal risks and ensures our credit repair practices meet the highest industry standards.

Support and Training: Clients using our specific monitoring account benefit from dedicated customer support and training resources. These resources empower you to understand your credit reports and scores better. If you have questions, we’re here to help, thanks to our strong relationship with the monitoring provider.

By requiring this specific monitoring account, we aim to deliver the best possible credit repair experience. It’s all about transparency, trust, and maximizing the effectiveness of our services for you.

As we say in the ad… We have no fees to start. We charge based on success.

Below is a list of all possible charges that you could see during our process:

- Deletions – We charge $25 per deletion for standard items on the report and $10 per deletion for inquiries and personal info deletions. This fee is per bureau meaning if an item is removed from all three bureaus, the cost is $75. However, keep in mind that many items may not be reporting on all three bureaus so you only pay for what we ACTUALLY do get done for you.

- Monitoring – It is a requirement of our service to keep an active credit monitoring account. The idea here is that even if a mechanic agrees to fix your car for free, you still have to pay the car payment, right? In order for us to fix your report, we need full 3B access and monthly updates. This is how we “get under the hood” and track the changes on your credit without constant hard pulls bringing down your score. This service is $39.95 monthly. It is paid to the monitoring company, not to us.

- Optional Service – We do offer a premium version of our services which includes additional dispute tactics and mailing all correspondence for you. This is completely optional and is $47 monthly. It is offered during your welcome call but is not required.

That’s it. If you’re looking for the lowest cost service with the least amount of risk. Give us a shot!

The reason we build our fees the way that we do is because no Credit repair company can answer this question.

The only way that we know if an item WILL be removed is after we start working on it. Companies are too worried to just tell you that because most people don’t sign up unless they are promised results.

We go about it different. We start working on the file and the only way you have a fee is if we are successful in getting them removed. If not, no fee. That way there’s no risk with us.

At CreditNerds, we understand the importance of improving your credit score. However, predicting specific score increases is challenging due to several factors, including your unique credit history and how you manage your finances during the process.

Personalized Assessment: We start by conducting a thorough analysis of your credit profile. This helps us identify areas where improvements can be made.

Effective Strategies: Our team employs proven methods to address negative items on your credit report. Removing inaccuracies or outdated information can have a positive impact on your score over time.

Varied Outcomes: Every individual’s credit journey is different. Factors such as the types of negative items, their age, and your overall credit management practices all influence how much your score may improve.

Educational Support: Throughout our services, we provide resources and guidance to help you understand credit scoring and improve your financial habits. This knowledge empowers you to make informed decisions for long-term credit health.

Clear Communication: While we can’t guarantee specific score increases, we’re dedicated to transparency and keeping you informed about progress and results throughout the process.

Improving your credit score is a collaborative effort. By working together and following our tailored strategies, you can maximize your chances of achieving your credit goals. Let’s start this journey towards better credit health together!

Our customers see their first set of results in about 30 days.

We always recommend expecting 4-6 months total with us.

Most of this time is spent waiting for creditors to respond so there really isn’t a way to legally speed up the process.

Other companies that get items deleted “faster” are using a tactic that claims all the items on your report are fraudulent. This is illegal to do if you know the items aren’t due to identity theft. This tactic also leads to items being put back on the report. This is why you have probably heard that items can get deleted, but they just show back up the next month. It is VERY unlikely that an item we get deleted ever comes back. So much so that we guarantee that if any item we get deleted comes back, we will work on that item again free of charge.

To effectively assist you in your credit repair journey, CreditNerds requires access to certain personally identifying information. This includes:

- Date of Birth: Ensures accurate identification and verification.

- Social Security Number: Essential for accessing and reviewing your credit reports.

- Proof of Address: Such as a utility bill, to verify residency and ensure accurate reporting.

Rest assured, the security and confidentiality of your personal information are paramount to us. We handle all information with strict adherence to privacy laws and industry standards.

By providing these details, you enable CreditNerds to deliver personalized and effective credit repair solutions tailored to your specific needs. Transparency and trust are core values at CreditNerds, ensuring you receive the best possible service and results.

At CreditNerds, we operate on a results-first basis to ensure your peace of mind and trust in our services. While we do not charge upfront for our credit repair efforts, we do require your payment information to begin. Rest assured, we prioritize transparency and accountability:

- Notification Process: Before any charges are made, we notify you first by both text and email. This ensures you are fully informed and prepared for any billing related to successful removal of negative items from your credit report.

Your personal payment information is securely stored and used only for billing purposes after we achieve results. We are committed to providing a straightforward and client-focused experience as you embark on your journey to better credit health with CreditNerds.

To ensure the success of your credit repair journey with CreditNerds, we ask our clients to fulfill the following responsibilities:

Communication: Please answer our calls or promptly return texts related to your credit repair process.

Documentation: Sign and mail any necessary documents or letters as requested by our team.

Monitoring Account: Keep your designated monitoring account open and active throughout the duration of our services.

Review and Action: Review and return the results mailed to you by the credit bureaus to us. We will help interpret them for you and utilize them to improve your credit profile.

By fulfilling these responsibilities, you actively contribute to achieving the best possible outcomes for your credit repair goals. Our team at CreditNerds is committed to guiding you through this process with care and expertise.

At CreditNerds, we stand behind our commitment to helping you achieve better credit health. While we cannot promise the deletion of specific items from your credit report, we offer the following assurances:

Payment for Results: We only charge deletion fees after successfully removing negative items from your credit report. You pay for results, ensuring our services are aligned with your success. So while we can’t legally promise that we WILL remove any item, we can promise that if for any reason we can’t get an item deleted, you will not have any fee for that item. You ONLY pay for what you actually get.

Lifetime Deletion Assurance: If any creditor of an item we have successfully removed from your credit report re-inserts that item, we will work to remove it again at no additional cost to you. Your satisfaction and long-term credit improvement are our priorities.

Our team is dedicated to transparency, integrity, and delivering measurable results in credit repair. Partner with CreditNerds to take control of your credit future with confidence.

Getting started is super simple. You just need to have a quick welcome call with our team.

You can book that call at www.CreditNerds.com/start

This form will take basic info, allow you to select a date and time for your welcome call, and walk you through getting the monitoring account.

Customer Testimonials

We love our clients and they love us

The best way to showcase our commitment is through the experiences and stories of those who have actually worked with us.

Over the last year it has been truly my pleasure to be able to attend multiple of Eric Counts' live training events. The information that I learned was brilliantly mind blowing. Even after attending multiple events I still know that there is more that I can learn from this man and it's also a plus that he is so entertaining to watch!

LaDarrell Lawrence

I had the pleasure of sitting and hearing Eric's credit seminar about at least four times in the last 3 and 1/2 years. Each and everytime I listened to his teachings i walk away with so much helpful information than the previous time. I am also a client of his Credit restoration company and words can not explain how his services has impacted my life tremendously. I was in a bad place credit wise for a period of time until I met Eric and his Nerds! They definitley earn thier bragging rights! Thank you so much Eric and your Nerds! <3

Amanda Glass Robinson

I'm so grateful for CreditNerds help in correcting my credit reports and ratings. I'm just sorry I didn't accept your assistance earlier. With your team's expertise and professional support you helped me improve my credit score by over 100 points in 3 months. What you do works and it is important to follow the directions in a timely manner. Do that and the results are great! I've obtained a number of new credit lines and now have the education to use them wisely. Thank you.

Carol Ann Murray

CreditNerds has opened my eyes about how your credit score is actually formed! The good and the bad, utilization, rules of disputing and maximizing credit worthiness!!! I can't wait to attend his next event, Eric definitely makes learning about credit an absolutely FUN experience!!!

Christine Devore

I didn't know what I didn't know about the credit system in our country until I attended one of the CreditNerds training sessions. They know the industry inside and out so can certainly provide the information, but they also speak in layman's terms so that you can actually understand what they are saying. The fact that you enjoy yourself and have a few good laughs along the way is just icing on the cake. I would highly recommend any program or training that CreditNerds puts on, without hesitation.

Liz Skoglund Lewis

I come from 12 years in the retail banking industry...and I know more than the average Jill about credit and the reporting agencies. I sat thru my 1st Eric Counts class on Credit Repair and Management, and within 20 minutes I was blown away! I "thought" I knew a thing or three about credit... but this guy...is a credit genius. He is knowledgeable, he is real, and he is funny! He is that proverbial "Bag of Chips!"

Cynthia Calhoun

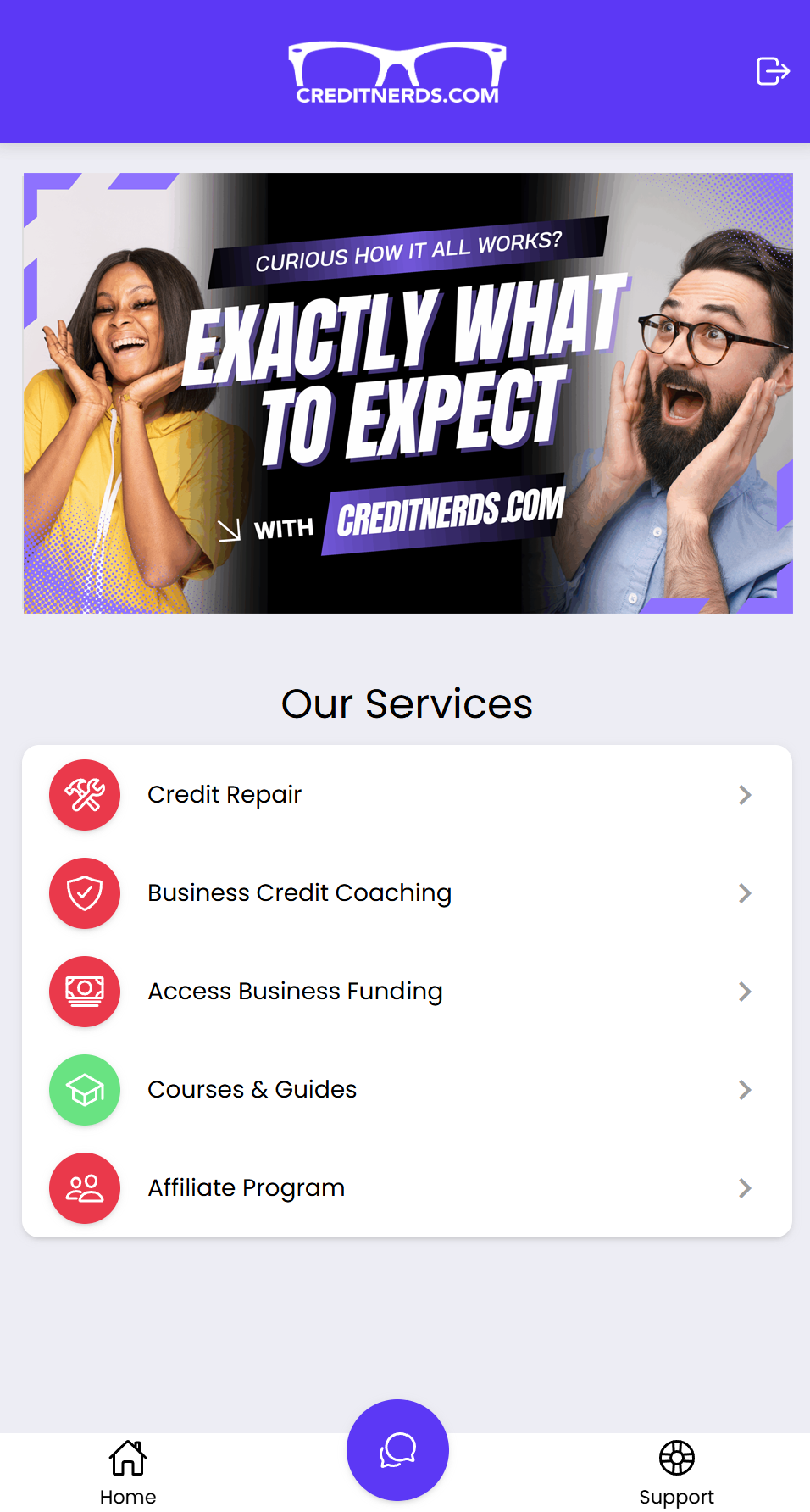

24/7 Online Access

Our Portal makes it easy for you to track your progress.

Need to know how its going at 2:38 am? We got you. With our always on portal, you can get an update 24 hours a day, 7 days a week.