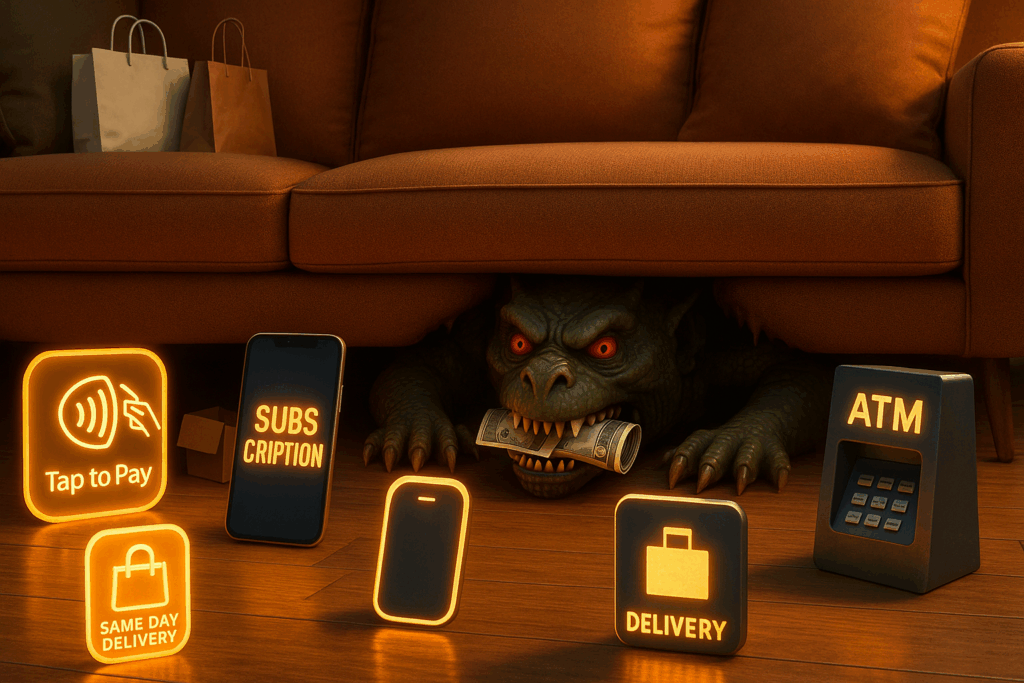

In today’s world, everything is about convenience: tap-to-pay, same-day delivery, subscription services, ATM withdrawals. While these tools save time, they often come with small fees that are easy to overlook. And over time, those “little” charges can quietly cost you hundreds, even thousands, of dollars a year. The Sneaky Fees to Watch Out For Why […]

Why an Emergency Fund Is the Best Financial Safety Net You Can Build

Life has a way of throwing curveballs. Car repairs, medical bills, job changes, or even something as simple as a broken appliance. These surprises are stressful enough on their own, but without a financial cushion, they can quickly turn into debt traps. That’s where an emergency fund comes in. What Is an Emergency Fund? An […]

The Power of Paying Yourself First: The Simple Rule That Builds Wealth

Most people treat saving like an afterthought. Bills get paid, money gets spent, and if there’s anything left over, it might go into savings. The problem? There’s almost never anything left over. That’s where the principle of paying yourself first comes in. A simple shift that can transform your finances over time. What Does “Pay […]

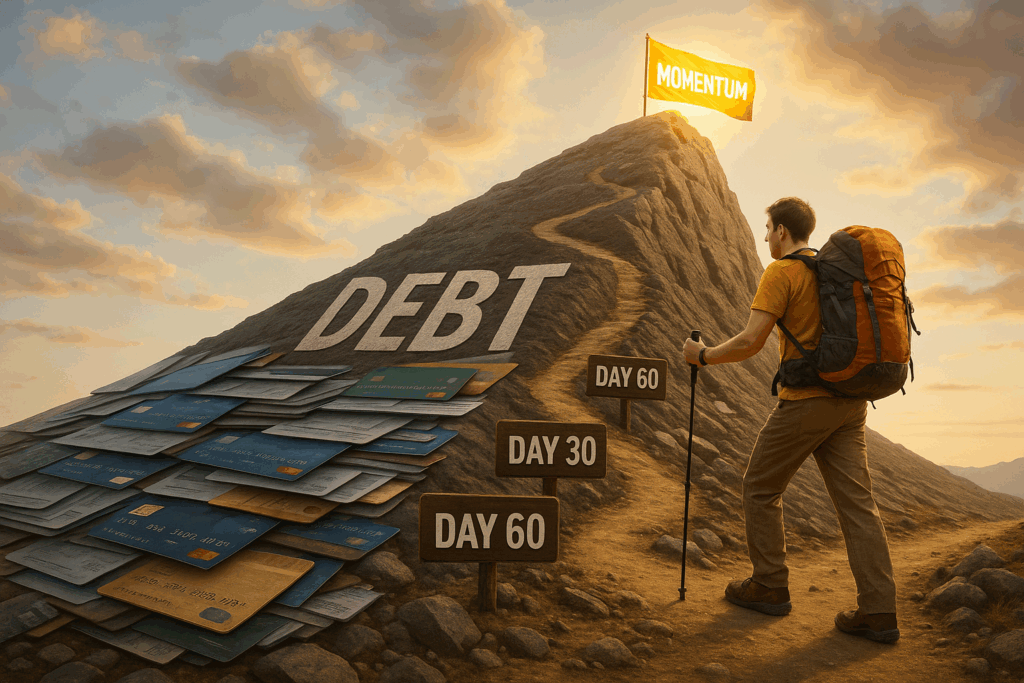

The First 90 Days of Getting Serious About Debt

Getting out of debt is a big goal, and like any big goal, it can feel overwhelming at first. The good news is that the first 90 days are the most important. If you use them wisely, you’ll build momentum, develop new habits, and finally see a clear path forward. Here’s how to make those […]

Frugal vs. Cheap: Knowing the Difference Matters

When it comes to money, people often use the words frugal and cheap interchangeably. On the surface, both describe someone who doesn’t like to spend more than necessary. But in reality, there’s a big difference, and it can have a huge impact on your finances, your relationships, and even your long-term success. What Does It […]

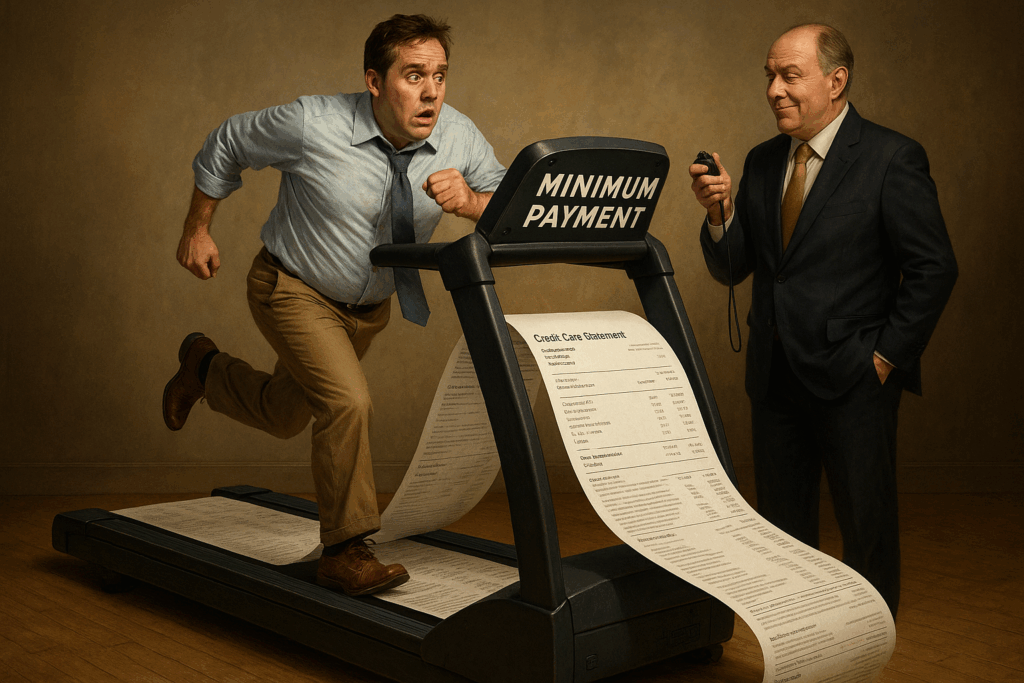

The Hidden Cost of Only Making Minimum Payments

When money is tight, making just the minimum payment on your credit card can feel like a lifesaver. You avoid late fees, keep your account in good standing, and buy yourself a little breathing room. But here’s the catch, minimum payments are designed to keep you in debt for as long as possible. Let’s dig […]

The 7-Day Budget Detox: Reset Your Spending, Regain Control

You know that moment when you open your banking app, take one look, and immediately close it again? Yeah, we’ve all been there. Sometimes your spending habits just… drift. You start with good intentions, then a coffee here, a takeout order there, and suddenly your budget looks like it’s been through a blender. That’s where […]

The Smartest Way to Use Credit Cards Without Going into Debt

Credit cards can be incredible tools.They can build your credit, earn you rewards, and give you a safety net in emergencies. But here’s the truth: for many people, they’re also a trap. The secret isn’t to avoid them altogether. It’s to learn how to use them in a way that works for you, not against […]

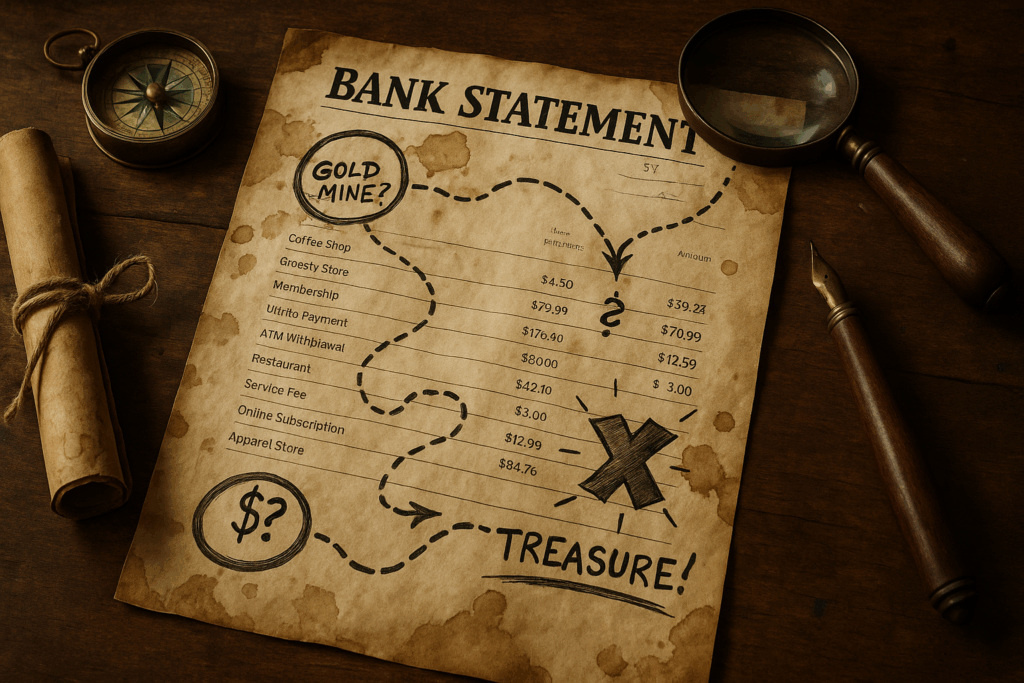

How to Review Your Bank Statements Like a Pro

Let’s be honest: Most people don’t actually read their bank statements. They might glance at the balance, maybe skim a few transactions, and then move on. But hidden in those lines of text are the clues to better budgeting, smarter spending, and even protecting yourself from fraud. If you’re ready to get intentional with your […]

End-of-Summer Financial Cleanup Checklist

Summer is full of good intentions… and spontaneous expenses. Between vacations, back-to-school shopping, weekend road trips, and “just one more dinner out,” your finances might be feeling a little worn out, and that’s totally normal. But before the fall season hits with its own wave of spending (hello, holidays), it’s time for a quick financial […]