Most financial advice focuses on numbers: income, expenses, interest rates, credit scores, debt payoff strategies.But there’s another part of money that gets overlooked, even though it quietly influences every decision you make: Your money energy. Money energy is the mindset, emotion, and intention you bring to your financial life.It’s how you think, how you react, […]

How to Spot Financial Problems Before They Get Big

Most people don’t get into financial trouble overnight.It happens slowly. A few skipped habits, a few unnoticed changes, and then suddenly the budget feels tight and the stress feels heavy. But just like a car gives you warning signs before the engine fails, your finances do too.You just have to know what to look for. […]

How Small Financial Tweaks Create Big Results

When people think about improving their finances, they often imagine huge overhauls: strict budgets, cutting all fun spending, or saving half their paycheck. But real progress doesn’t come from doing everything at once. It comes from doing one thing at a time. That’s what we call the One Change Rule. Instead of trying to fix […]

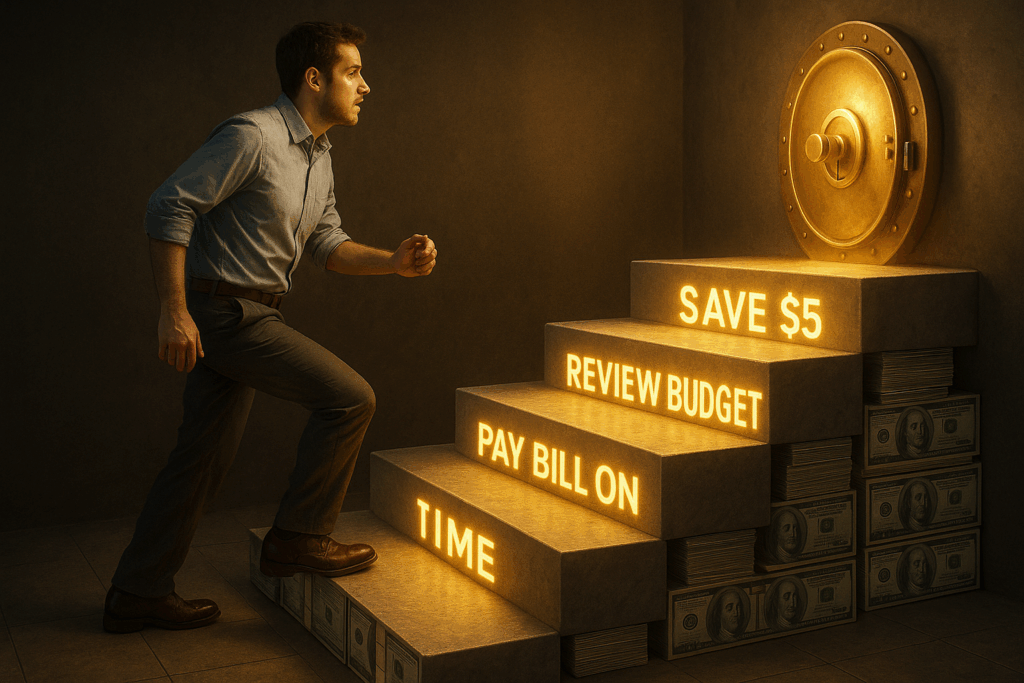

The Hidden Power of Small Financial Wins

When people think about improving their credit or finances, they often focus on the big goals: buying a house, paying off all their debt, or hitting a perfect 800 score.But the truth is, big wins are built on small ones. Every small, consistent decision you make (paying one bill on time, lowering one balance, checking […]

How to Give Yourself a “Pay Raise” Without Earning More

Everyone wants to make more money, but what if you could give yourself a pay raise right now, without waiting for one? The truth is, a lot of people don’t need a bigger paycheck. They need a better plan. By taking a few smart steps, you can stretch your income further and make it feel […]

Why Consistency Is Important to Building Strong Business Credit

When it comes to business credit, most people focus on the big steps: getting an EIN, opening business accounts, or applying for funding. But what really separates strong credit profiles from weak ones isn’t just setup. It’s consistency. Steady, responsible activity over time can do more for your business credit than one big loan ever […]

4 Money Moves That Take Less Than 10 Minutes

Building financial stability doesn’t always require big, overwhelming steps. In fact, some of the most powerful money moves can be done in just a few minutes, and over time, they can make a real difference. Here are four quick financial habits that can give your money a serious boost. 1. Set Up an Automatic Transfer […]

The “No-Spend Day” Challenge: A Simple Way to Reset Your Budget

Sometimes, the easiest way to take control of your money isn’t with spreadsheets or complicated plans. It’s by not spending at all for a day. A “no-spend day” is exactly what it sounds like: choosing one day where you spend nothing outside of fixed bills. No coffee runs. No takeout. No impulse buys. It’s a […]

The 24-Hour Rule: A Simple Trick to Curb Impulse Spending

Impulse spending is one of the biggest budget killers. You tell yourself you’ll stick to your plan, but then a sale, a gadget, or a late-night online shopping scroll derails your progress. Enter the 24-hour rule: a simple, powerful habit that can save you hundreds (or even thousands) each year. What Is the 24-Hour Rule? […]

5 Simple Financial Habits That Make a Big Difference Over Time

When it comes to money, small actions done consistently often matter more than big, one-time decisions. You don’t have to be a financial expert to build security. You just need to practice a few smart habits that compound over time. Here are five simple financial tips you can start today. 1. Automate Good Decisions Set […]