One of the biggest challenges in credit repair has nothing to do with late payments, collections, or utilization.It’s something far more psychological. The confidence gap. This is the moment when someone’s credit is genuinely improving, but they still don’t trust the process, the score, or themselves.And that lack of confidence often slows the progress more […]

Why Your Score Sometimes Jumps After You Stop Touching It

Most people assume credit repair is all about action.Disputes. Payments. Utilization updates. New accounts. Monitoring.And yes, those things matter. But there’s a part of credit repair almost no one talks about: The quiet period. This is the stage where your score improves the most not because you’re doing more, but because you’ve finally stopped doing […]

Why Credit Scores Drop Even When You’re Doing Everything Right

Nothing is more frustrating than checking your credit score and seeing it fall. Especially when you’ve been making payments on time, keeping balances low, and trying to do everything “right.” The truth is, credit scores don’t just respond to mistakes.Sometimes they shift because of timing, algorithms, or normal fluctuations most people never hear about. Here’s […]

How Checking Your Credit Score Can Actually Improve It

A lot of people avoid checking their credit because they’re afraid it might hurt their score.But here’s the truth: checking your own credit never hurts your score.In fact, keeping an eye on it can actually help you improve it over time. The Myth: “Checking My Score Will Make It Drop” This misconception comes from confusion […]

How Closing Collections Can Help Your Credit Score

If you’ve ever paid off a collection account, you probably expected your credit score to jump right away, but sometimes it doesn’t. In fact, people are often surprised to see little or no change at all. Here’s why that happens, and how to handle collections the right way to actually help your score. 1. Paid […]

The Hidden Power of Small Financial Wins

When people think about improving their credit or finances, they often focus on the big goals: buying a house, paying off all their debt, or hitting a perfect 800 score.But the truth is, big wins are built on small ones. Every small, consistent decision you make (paying one bill on time, lowering one balance, checking […]

How Closing a Credit Card Can Hurt Your Score

It might seem smart to close a credit card you don’t use. Fewer accounts, fewer temptations, right?But when it comes to your credit score, that “clean-up” move can actually backfire. Closing an old or unused credit card can lower your score by increasing your utilization ratio and shortening your credit history. Two major factors that […]

How Paying Your Bills Early Can Boost Your Credit Score

Most people focus on paying their bills on time, and that’s crucial. But what many don’t realize is that paying your credit card bills a little early can actually give your credit score a nice boost. That’s because the timing of your payment can affect what gets reported to the credit bureaus. Why Early Payments […]

Why Credit Score “Milestones” Matter More Than You Think

Most people see their credit score as just a number. But what many don’t realize is that certain score milestones unlock real opportunities, like lower interest rates, easier approvals, and better financial flexibility. The difference between a 669 and a 670 might not feel like much, but to a lender, it can mean everything. What […]

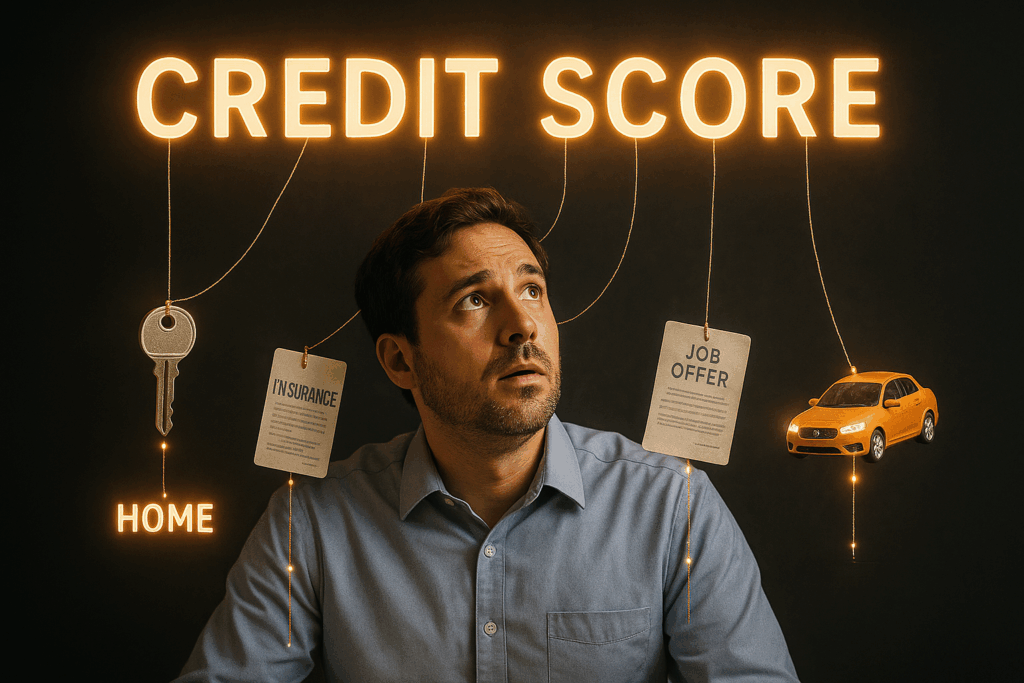

How Your Credit Score Affects More Than Just Loans

Most people know their credit score matters when applying for a loan or credit card, but what many don’t realize is that it reaches far beyond borrowing money. Your credit score can quietly influence your insurance rates, your ability to rent a home, or even your job opportunities. That’s why understanding its impact is so […]