Most people think credit repair starts with disputes and payments. Those matter, but they are not the real starting point. The journey begins with a mindset shift. Until that shift happens every strategy feels harder than it needs to be and progress feels slow even when you are doing the right things. The truth is […]

The Three Money Habits That Make Your Credit Score Rise Without Extra Stress

Most people think credit repair requires dramatic changes. Big payments. Complicated strategies. Hours of work. The truth is that your credit score responds more to steady habits than intense effort. You do not need a perfect budget or a huge income to make progress. You only need a few consistent behaviors that build momentum over […]

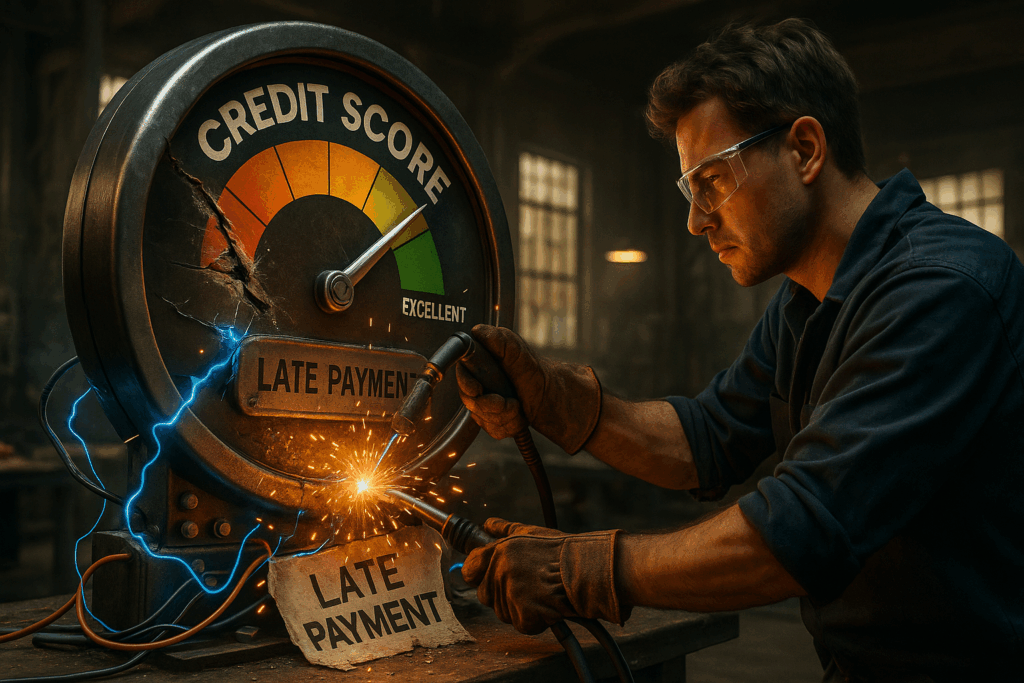

The Credit Comeback: How to Bounce Back After a Financial Setback

Everyone hits financial rough patches. A job loss, a medical bill, a bad loan, or just a few tough months that spiral into late payments. The good news? Credit damage isn’t permanent. Your credit score is designed to reflect your current financial behavior, which means you can recover, rebuild, and come back stronger than before. […]

The Real Reason People Give Up on Credit Repair

Credit repair is one of those journeys that starts with excitement and high hopes. You imagine a higher score, fewer denials, and more opportunities. But somewhere along the way, many people quit before they see real results. Why? It usually isn’t because credit repair doesn’t work. It’s because of how the process feels. The Waiting […]

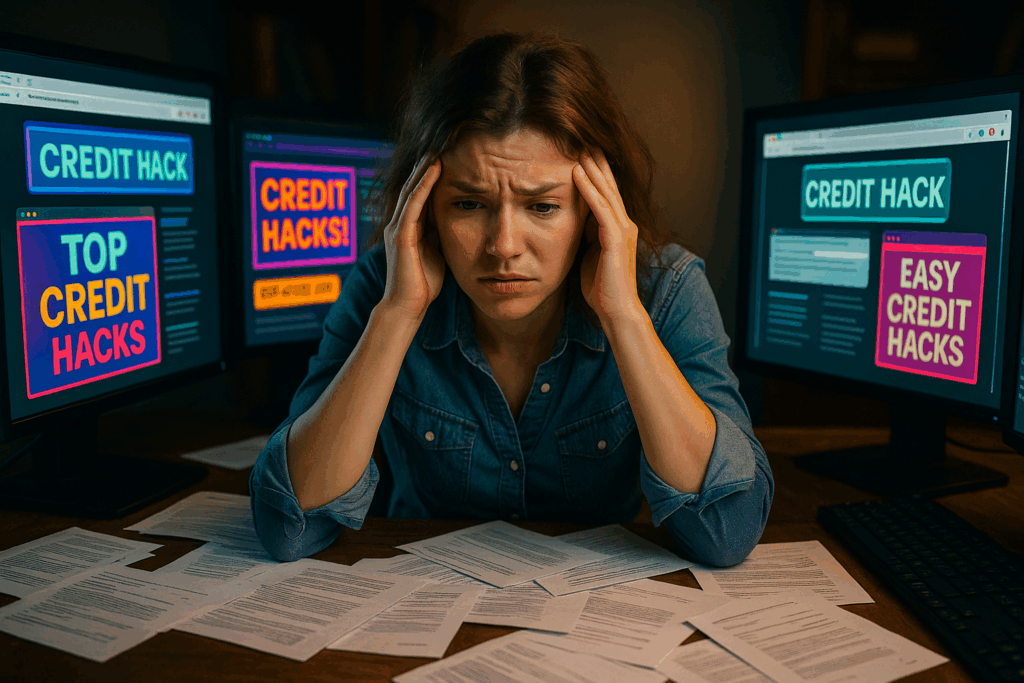

The Dangers of DIY Credit Repair Without a Plan

When you first realize your credit needs work, it’s tempting to jump in and start fixing it yourself. After all, the internet is full of “credit hacks” and step-by-step guides. While there’s nothing wrong with trying to repair your own credit, doing it without a plan can often cause more harm than good. Let’s break […]

Why Credit Repair Takes Time (Even When It’s Done Right)

Let’s get one thing out of the way:Fixing your credit isn’t like ordering fast food. There’s no instant fix, no one-click solution, and definitely no magic letter that wipes your credit clean overnight. Here’s the real reason credit repair takes time, even when you’re doing everything right. Your Credit Didn’t Break Overnight Credit problems usually […]

How to Spot a Fake Credit Repair Offer (Before It Scams You)

When your credit’s in rough shape, it can feel like everyone has a “miracle fix.”Some promise to delete all your negative items overnight.Others guarantee a 700+ score in just 30 days.And some claim they’ve found “a secret credit loophole the banks don’t want you to know.” Let’s be real: There are a lot of scams […]

Credit Monitoring vs. Credit Repair: What’s the Difference?

When it comes to managing your credit, there’s no shortage of services promising to help. But two of the most commonly confused tools are credit monitoring and credit repair. Spoiler alert:They’re not the same thing.In fact, they serve very different purposes, and depending on your goals, you might need one, the other, or both. So […]

The Fair Credit Reporting Act Explained in Plain English

Your credit report can affect nearly every part of your financial life; From buying a car to renting an apartment to getting approved for a mortgage. But here’s something most people don’t realize: You’re not powerless. Thanks to a law called the Fair Credit Reporting Act, or FCRA, you have the right to know what’s […]

Can AI Really Fix Your Credit? What’s Hype and What’s Real

If you’ve spent any time online lately, you’ve probably seen ads or influencers claiming that AI can fix your credit automatically. Some say it can clean up your report in minutes. Others say you can just upload your credit file, push a button, and boom: your score jumps 100 points overnight. So, can AI actually […]