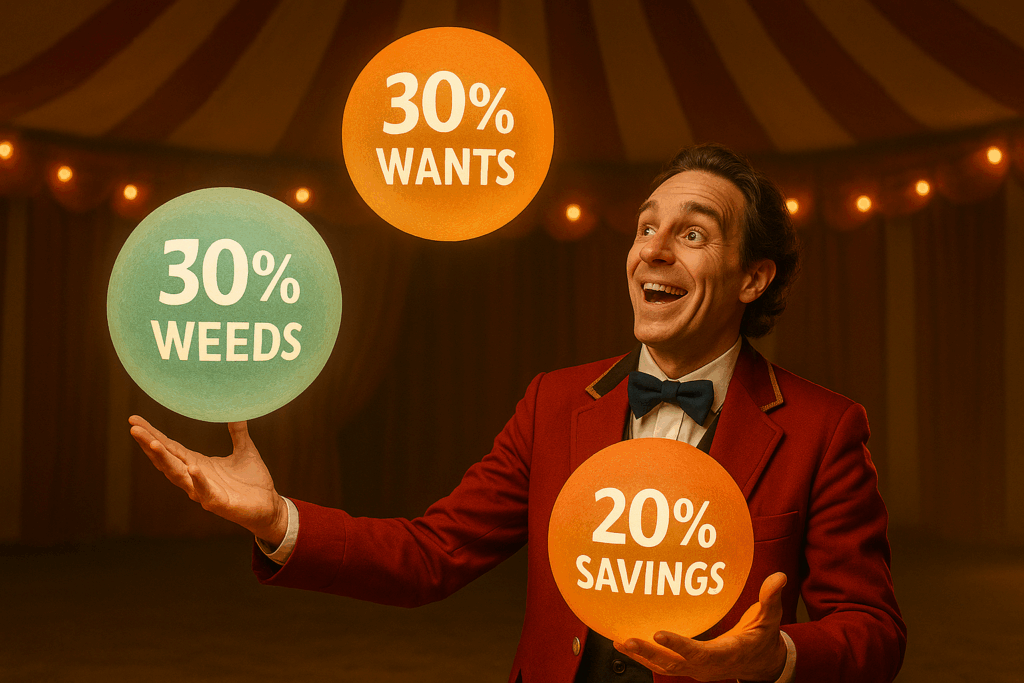

Budgeting has a reputation for being complicated, restrictive, and hard to stick to. But the truth is, it doesn’t have to be. One of the easiest frameworks to follow is called the 50/30/20 rule, and it works because it balances responsibility with freedom. What Is the 50/30/20 Rule? It’s a simple way to divide your […]

Budget-Friendly Hobbies That Still Feel Luxurious

When you hear the word luxury, it’s easy to think of expensive vacations, high-end shopping, or pricey experiences. But the truth is, luxury isn’t always about cost. It’s about how something makes you feel. The right hobby can bring joy, relaxation, and even a sense of indulgence without emptying your wallet. Here are some budget-friendly […]

Budget-Friendly Ways to Improve Your Home

Improving your home doesn’t have to mean draining your savings or taking on debt. The truth is, small, affordable changes can have just as much impact as big renovations. Whether you’re preparing to sell, want to freshen things up, or simply want to enjoy your space more, there are plenty of budget-friendly upgrades that make […]

Date Night on a Budget: Fun Ideas That Don’t Break the Bank

A great date doesn’t have to come with a hefty price tag. Whether you’re in a long-term relationship or just starting out, what matters most isn’t how much money you spend. It’s the time and connection you share. The good news? With a little creativity, you can enjoy meaningful, memorable date nights without straining your […]

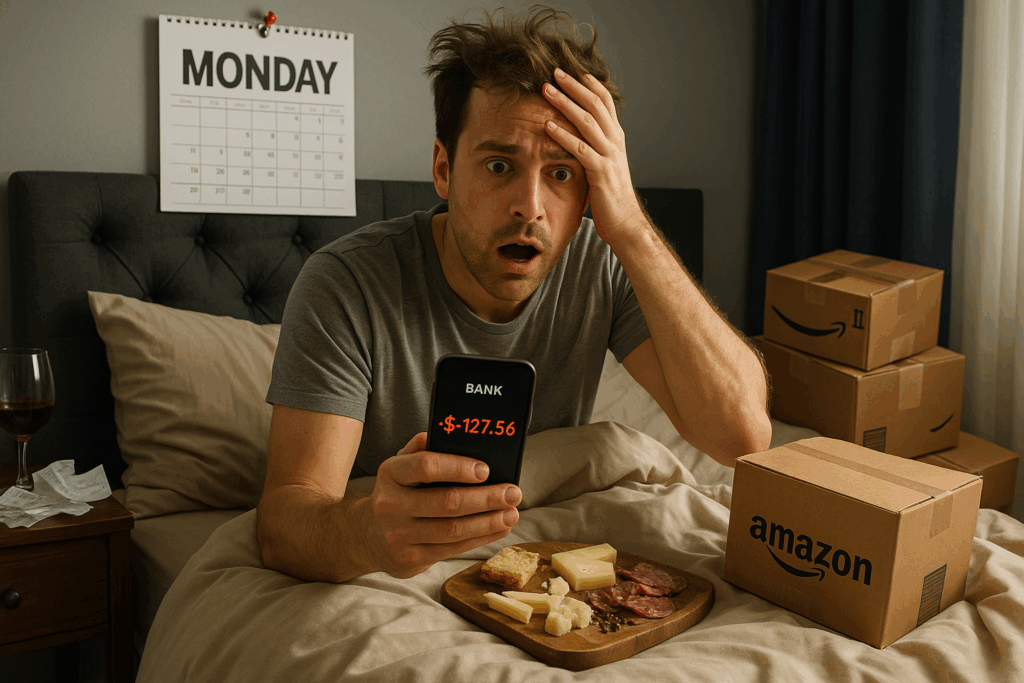

The 7-Day Budget Detox: Reset Your Spending, Regain Control

You know that moment when you open your banking app, take one look, and immediately close it again? Yeah, we’ve all been there. Sometimes your spending habits just… drift. You start with good intentions, then a coffee here, a takeout order there, and suddenly your budget looks like it’s been through a blender. That’s where […]

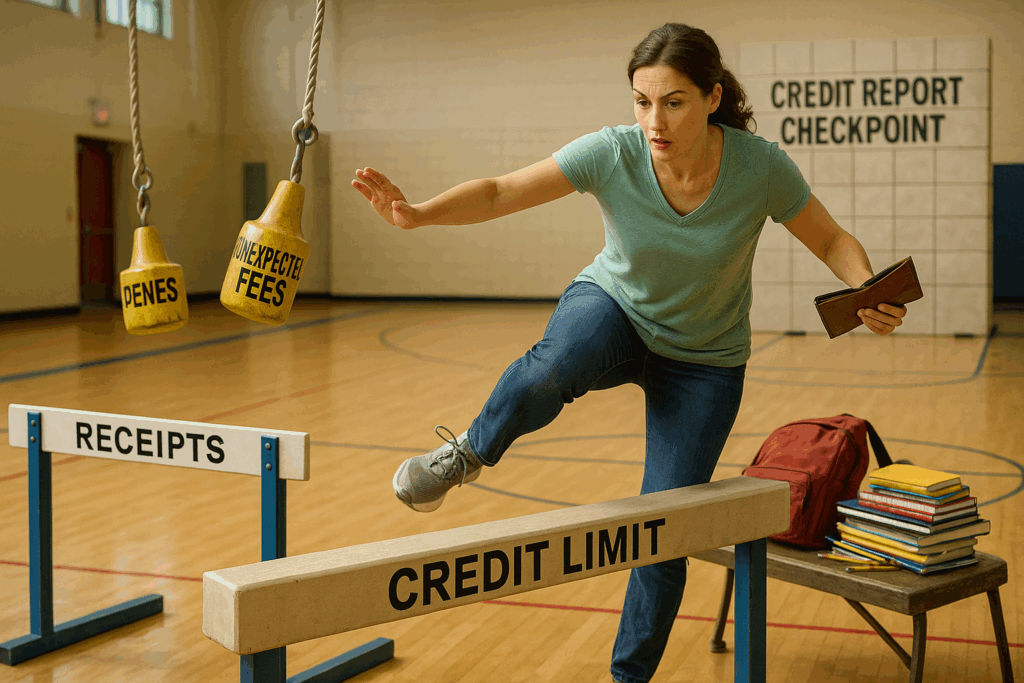

Back-to-School Budgeting with Credit in Mind

As summer winds down, the back-to-school rush kicks into full swing: new clothes, school supplies, tech upgrades, sports fees, and unexpected extras that somehow weren’t in last year’s budget. Whether you’re a parent, a college student, or even a teacher stocking your own classroom, this season can hit your wallet hard. And if you’re not […]

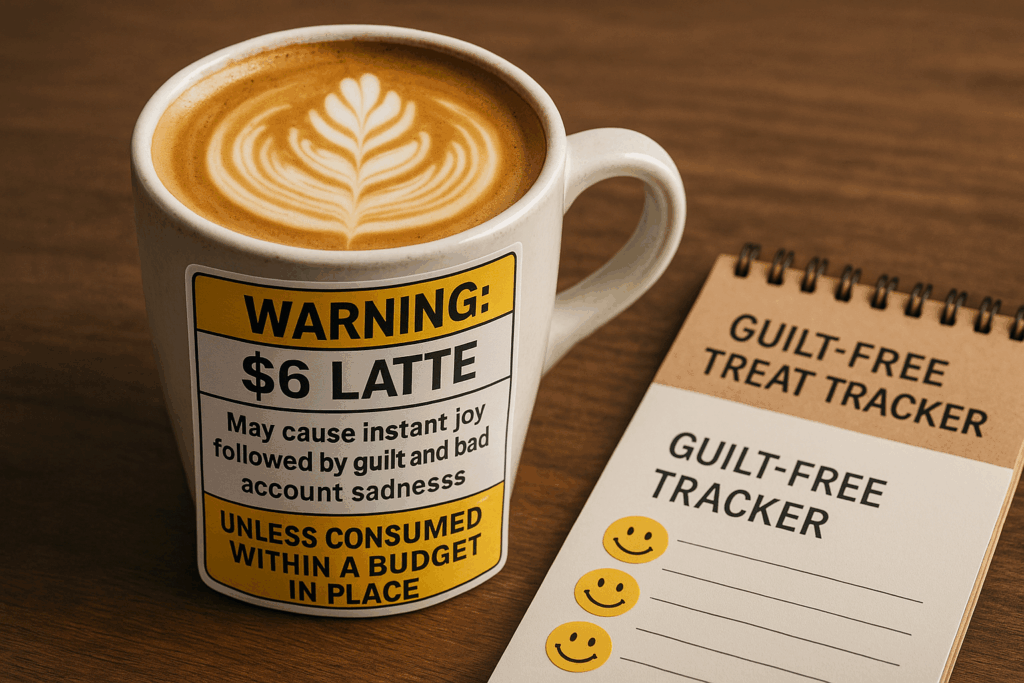

Budgeting for Pick-Me-Ups: How to Plan for Treats Without Sabotage

We all have those days. You’re drained, frustrated, or just plain tired of being responsible.And suddenly, that $6 latte, $28 impulse Target run, or DoorDash delivery feels like therapy. Spoiler: it’s not. But here’s the thing, treating yourself doesn’t have to be the enemy of your budget.You just need a plan that lets you enjoy […]

Budgeting for Burnout: How to Stay on Track When You’re Tired

Let’s be real. Budgeting is hard enough when life is calm. But when you’re running on fumes? When work is overwhelming, bills are piling up, and you’re too tired to cook dinner, much less check your budget? That’s burnout.And when burnout hits, money management is often the first thing to go. But here’s the truth: […]

Weekend Spending Traps: Why It’s So Easy to Blow Your Budget on Saturday

You worked hard all week. The weekend hits, and suddenly the world feels full of possibilities: takeout, Target runs, spontaneous day trips, drinks with friends, maybe a little online shopping from the couch at midnight. We’ve all been there.But if your budget mysteriously falls apart between Friday night and Sunday evening, it’s not just bad […]

The First 3 Things to Do With Your First Paycheck of the Month

It’s payday. That beautiful deposit hits your account, and for a moment, everything feels possible.But let’s be honest, that money can disappear fast if you don’t have a plan. Whether you’re trying to get ahead, fix your credit, or stop living paycheck to paycheck, what you do with that first check of the month matters […]