Most people think a budget friendly weekend means sitting at home and doing nothing. That is not a reset. That is punishment. A real reset weekend gives you energy, clears your mind, and keeps your wallet safe at the same time. The goal is simple. Recover your mood. Recover your motivation. Recover your money. You […]

The “First 10 Minutes” Budget Habit That Changes Everything

Most people struggle with budgeting not because they’re bad with money, but because life gets busy.The truth is, you don’t need an hour a day, a stack of spreadsheets, or a perfect plan.You just need 10 minutes at the start of each week. The First 10 Minutes Habit is a simple routine that helps you […]

How to Enjoy the Holidays Without Breaking Your Budget

The holidays are supposed to be about joy, connection, and celebration. They’re not made for you to stress over money.But between gifts, travel, food, and festive extras, it’s easy to start the new year with an empty wallet (and a little regret). The good news? You can absolutely enjoy the holidays without going into debt. […]

How to Build a “Flex Fund”

Most budgets break spending into neat boxes: bills, groceries, savings, and maybe a little for fun.But there’s one powerful tool most people overlook: the flex fund. A flex fund is your financial “shock absorber.” It’s a small, separate pool of money you use for life’s in-between moments. The ones that don’t quite fit into your […]

How to Build a “Mini Budget” for Short-Term Goals

Most people think of budgeting as something you do for your entire income. But sometimes, the smartest way to stay consistent is to budget for one specific goal at a time. A mini budget is a focused, short-term spending plan designed to help you reach a financial target faster without overhauling your entire lifestyle. Why […]

The “No-Spend Day” Challenge: A Simple Way to Reset Your Budget

Sometimes, the easiest way to take control of your money isn’t with spreadsheets or complicated plans. It’s by not spending at all for a day. A “no-spend day” is exactly what it sounds like: choosing one day where you spend nothing outside of fixed bills. No coffee runs. No takeout. No impulse buys. It’s a […]

Why “Set It and Forget It” Budgeting Actually Works

If budgeting feels like a chore you can’t keep up with, here’s some good news: it doesn’t have to be complicated. In fact, one of the most effective ways to stick to a budget is to automate it. Set up systems that run quietly in the background, so your money moves where it needs to […]

How to Budget When Your Income Isn’t Consistent

If your paycheck changes from month to month (maybe you’re self-employed, work on commission, or have a side hustle) traditional budgeting can feel impossible. How do you plan for bills when you never know exactly what’s coming in? The good news is that with the right strategy, you can build a stable financial plan even […]

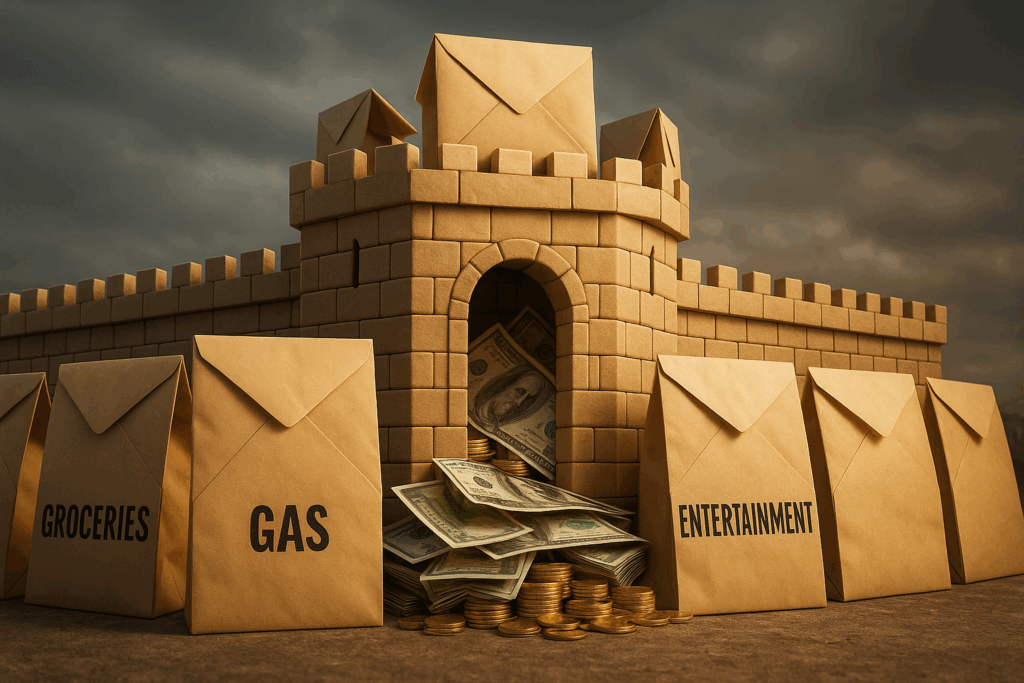

The Envelope Method in the Digital Age: Can Old-School Budgeting Still Work?

Before budgeting apps and online banking, people had a simple, no-nonsense way to control their spending: the envelope method. Cash was divided into separate envelopes labeled “Groceries,” “Gas,” “Entertainment,” and so on. When the envelope was empty, that category of spending stopped. It may sound old-fashioned, but here’s the truth: the envelope method still works, […]

Why Most Budgets Fail (and How to Make Yours Stick)

Everyone knows they should have a budget. But if you’ve ever tried one and given up after a few weeks, you’re not alone. The truth is, most budgets fail not because people are bad with money, but because the budget itself isn’t built to last. Here’s why most budgets collapse, and how to build one […]