Budgeting for Pick-Me-Ups: How to Plan for Treats Without Sabotage

We all have those days.

You’re drained, frustrated, or just plain tired of being responsible.

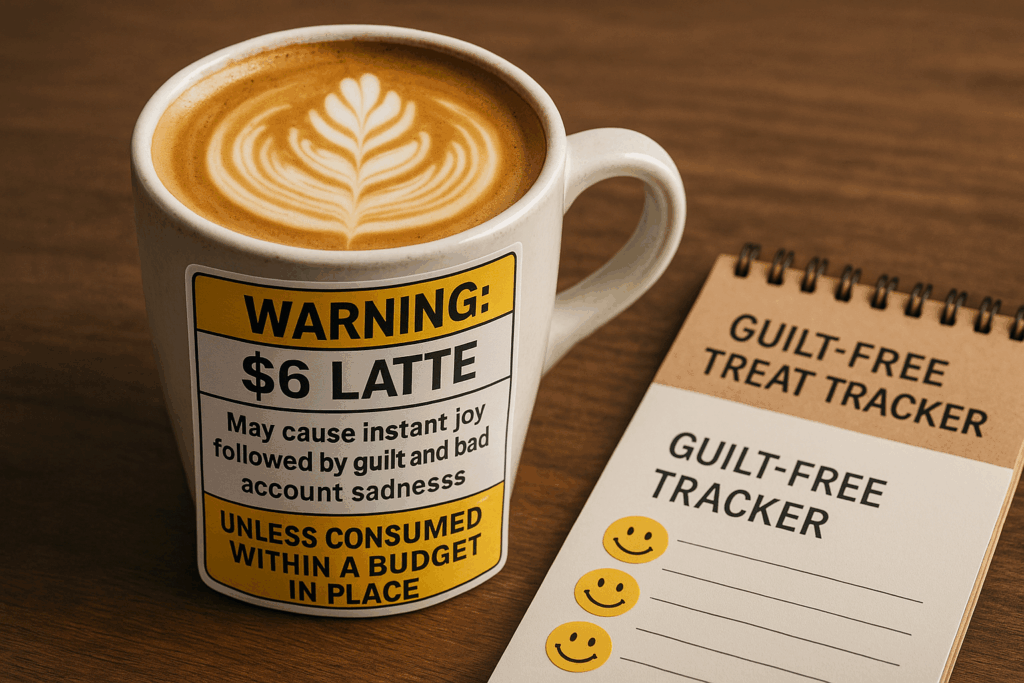

And suddenly, that $6 latte, $28 impulse Target run, or DoorDash delivery feels like therapy.

Spoiler: it’s not.

But here’s the thing, treating yourself doesn’t have to be the enemy of your budget.

You just need a plan that lets you enjoy the occasional pick-me-up without the guilt spiral or overdraft notification.

Let’s talk about how to build small, feel-good moments into your budget without sabotaging your progress.

1. Understand Why Pick-Me-Ups Matter

This isn’t just about coffee or candles.

Pick-me-ups are psychological.

They give you:

- A break from routine

- A hit of dopamine

- A sense of control when everything else feels like chaos

And when done right, they can actually help you stay consistent with your budget, because you don’t feel deprived.

2. Create a “Feel-Good Fund”

Instead of hoping you don’t spend, expect that you will and plan for it.

Set aside a small amount each month specifically for treats or mood-boosters:

- $25 for small splurges

- $10 per week for “fun money”

- 5% of your paycheck, just for you

Label it clearly in your budget or envelope system:

Not “miscellaneous.” Not “leftovers.” This is your joy line item.

3. Pre-Decide Your Pick-Me-Ups

Impulse is the enemy of intention.

So list out a few go-to treats that are satisfying and budget-friendly.

Examples:

- A fancy latte and a good book

- $10 thrift-store budget

- A takeout lunch on Fridays

- A new $5 playlist or app

- Bath bombs, puzzles, or movie nights

Having a list makes it easier to pause and say, “I can treat myself. Just not with this random $140 Amazon cart.”

4. Watch for Emotional Spending Triggers

Ask yourself:

- Am I tired?

- Am I stressed or bored?

- Am I celebrating… or coping?

If it’s a “coping” kind of day, try a non-spending treat first:

- Go for a walk

- Call a friend

- Take a 20-minute nap

- Make something with what you already have

You might still choose to buy something, but now it’s intentional, not reactive.

5. Build Treats Into Your Routine

Instead of emergency retail therapy, schedule joy like a grown-up.

Try:

- Weekly Friday Treat Days

- Monthly “fun money” challenges (who can stretch $10 the farthest?)

- A quarterly splurge reward for hitting a savings or debt goal

When pick-me-ups are part of your routine, you feel more satisfied, and you’re less likely to derail your progress with spontaneous spending.

Final Thought

Treating yourself isn’t the problem.

It’s treating yourself without a plan that wrecks your progress.

You deserve comfort, pleasure, and small joys along the way.

And when your budget includes space for that joy?

You stay on track longer, bounce back faster, and feel a whole lot better about your money.

Plan the pick-me-ups. Enjoy them fully. Then keep going.

Need help getting your finances organized so you can spend without guilt? We help real people build real budgets, repair their credit, and take back control: one small win at a time.