Budgeting for Burnout: How to Stay on Track When You’re Tired

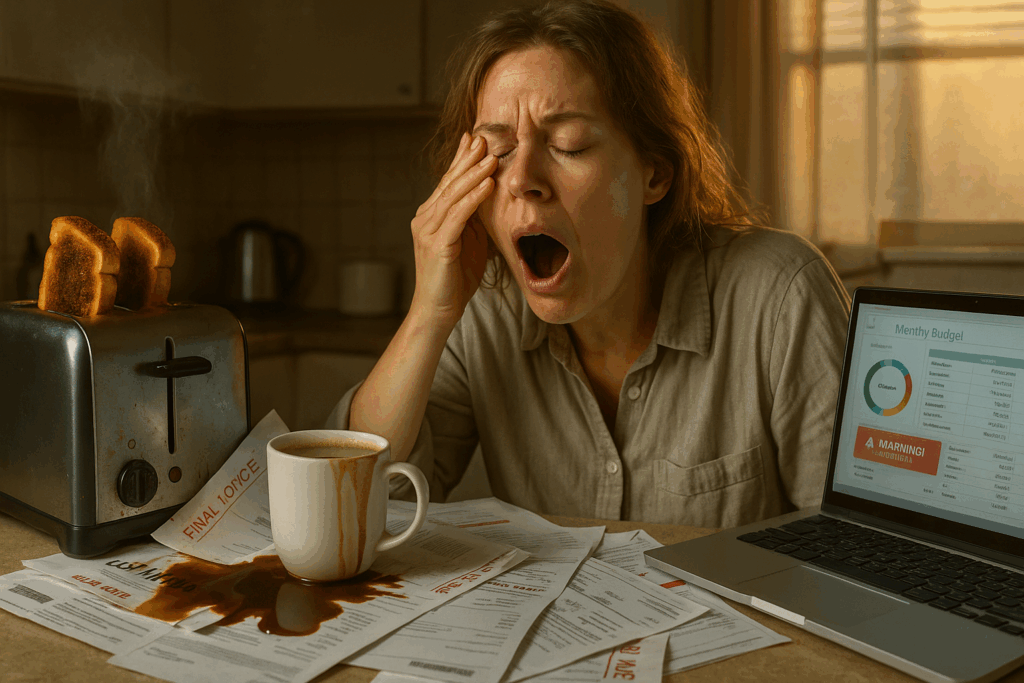

Let’s be real. Budgeting is hard enough when life is calm. But when you’re running on fumes? When work is overwhelming, bills are piling up, and you’re too tired to cook dinner, much less check your budget?

That’s burnout.

And when burnout hits, money management is often the first thing to go.

But here’s the truth: you don’t need to be “on” or perfect to stay financially grounded. You just need a strategy that works even when you’re exhausted.

Let’s talk about how to stick to a budget when you’re mentally, emotionally, or physically wiped out.

1. Lower the Bar (on Purpose)

Burnout thrives on perfectionism.

You tell yourself, “I should update my full spreadsheet, organize receipts, plan meals for the month.” and suddenly you’re doing nothing.

So stop aiming for perfect. Aim for “enough.”

Try this:

- Glance at your bank balance

- Check for any bills due in the next 5 days

- Decide how much you can safely spend this weekend

That’s a budget check-in. That’s a win.

2. Simplify Everything You Can

When you’re burned out, every decision feels heavier.

So set up:

- Auto-pay on fixed bills (like subscriptions or utilities)

- A spending cap on your debit card or a separate “fun money” account

- A weekly money reset reminder on your phone

Your future self will thank you for the simplicity.

3. Plan for the Lazy Moments

Burnout makes quick fixes tempting and expensive.

Takeout, impulse Amazon buys, gas station snacks, late fees from forgetting due dates.

Instead of fighting it, budget for it.

Set aside a small “burnout buffer” each month for convenience or recovery spending.

$30 for takeout when you need a break is better than $200 in random food orders because you gave up altogether.

4. Notice Emotional Spending Triggers

Burnout often leads to:

- “I deserve this” splurges

- “I don’t care anymore” spending

- “I’m too tired to deal with it” decisions

Track those patterns. You’re not bad with money. You’re probably just tired, stressed, or trying to feel better. And you’re human.

Acknowledge the emotion behind the action. Awareness creates space to pause before hitting “buy now.”

5. Focus on Tiny Wins

Right now, a full budget overhaul isn’t the move.

But here’s what is:

- Make one minimum payment

- Skip one impulse purchase

- Transfer $5 into savings

- Cancel one unused subscription

- Cook at home once instead of ordering out

Tiny wins stack up. They rebuild confidence. And they create momentum when you feel stuck.

Final Thought

Burnout doesn’t mean you’ve failed.

It just means your systems need to support you better, not demand more from you.

Budgeting during burnout is about grace, not guilt. Progress, not perfection.

At CreditNerds.com, we work with real people going through real things (burnout, life changes, unexpected expenses) and we help them take back control of their credit one step at a time. No judgment. No upfront cost. Just results. Schedule your free consultation today.