Nothing is more frustrating than checking your credit score and seeing it fall. Especially when you’ve been making payments on time, keeping balances low, and trying to do everything “right.” The truth is, credit scores don’t just respond to mistakes.Sometimes they shift because of timing, algorithms, or normal fluctuations most people never hear about. Here’s […]

Why Lenders Care About Your Business Address

When people think about business credit, they usually focus on things like EINs, vendors, or payment history.But there’s one factor almost no one talks about, and it can make or break your ability to get approved: Your business address. It sounds simple, but lenders use your address as a credibility signal.And the wrong address can […]

The “First 10 Minutes” Budget Habit That Changes Everything

Most people struggle with budgeting not because they’re bad with money, but because life gets busy.The truth is, you don’t need an hour a day, a stack of spreadsheets, or a perfect plan.You just need 10 minutes at the start of each week. The First 10 Minutes Habit is a simple routine that helps you […]

How Checking Your Credit Score Can Actually Improve It

A lot of people avoid checking their credit because they’re afraid it might hurt their score.But here’s the truth: checking your own credit never hurts your score.In fact, keeping an eye on it can actually help you improve it over time. The Myth: “Checking My Score Will Make It Drop” This misconception comes from confusion […]

How Small Financial Tweaks Create Big Results

When people think about improving their finances, they often imagine huge overhauls: strict budgets, cutting all fun spending, or saving half their paycheck. But real progress doesn’t come from doing everything at once. It comes from doing one thing at a time. That’s what we call the One Change Rule. Instead of trying to fix […]

How Closing Collections Can Help Your Credit Score

If you’ve ever paid off a collection account, you probably expected your credit score to jump right away, but sometimes it doesn’t. In fact, people are often surprised to see little or no change at all. Here’s why that happens, and how to handle collections the right way to actually help your score. 1. Paid […]

How Strong Business Credit Makes Growth Easier

Every business owner dreams of growth: opening a second location, expanding operations, or finally hiring the help they need. But many never get there because growth takes capital, and capital requires trust. That’s where business credit comes in. Strong business credit doesn’t just help you borrow money. It helps you grow strategically, sustainably, and confidently. […]

How to Enjoy the Holidays Without Breaking Your Budget

The holidays are supposed to be about joy, connection, and celebration. They’re not made for you to stress over money.But between gifts, travel, food, and festive extras, it’s easy to start the new year with an empty wallet (and a little regret). The good news? You can absolutely enjoy the holidays without going into debt. […]

The Hidden Power of Small Financial Wins

When people think about improving their credit or finances, they often focus on the big goals: buying a house, paying off all their debt, or hitting a perfect 800 score.But the truth is, big wins are built on small ones. Every small, consistent decision you make (paying one bill on time, lowering one balance, checking […]

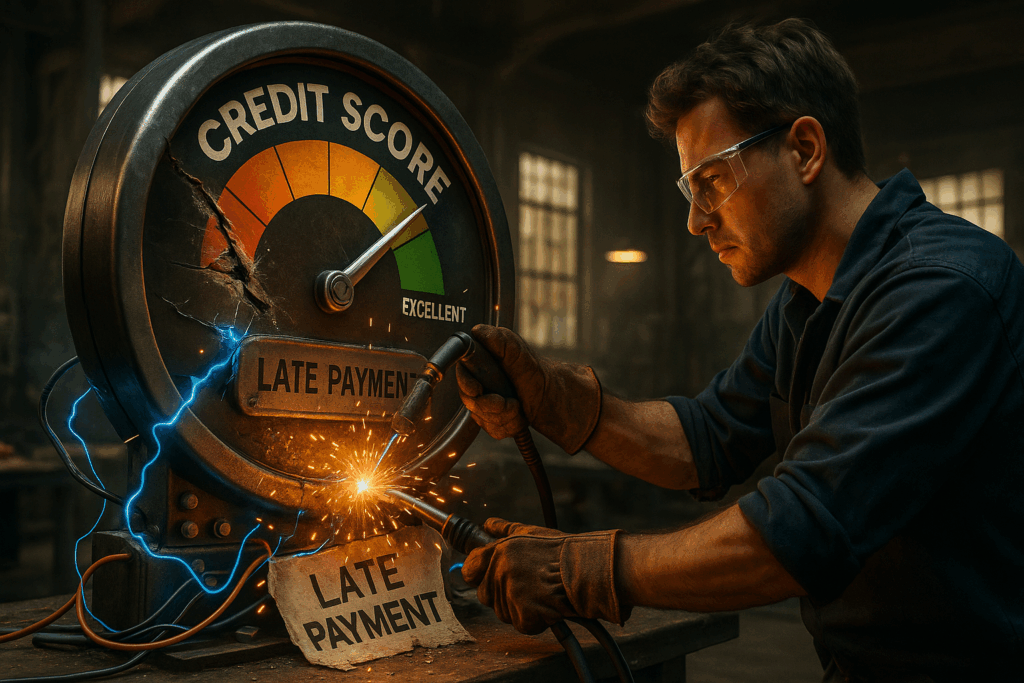

The Credit Comeback: How to Bounce Back After a Financial Setback

Everyone hits financial rough patches. A job loss, a medical bill, a bad loan, or just a few tough months that spiral into late payments. The good news? Credit damage isn’t permanent. Your credit score is designed to reflect your current financial behavior, which means you can recover, rebuild, and come back stronger than before. […]