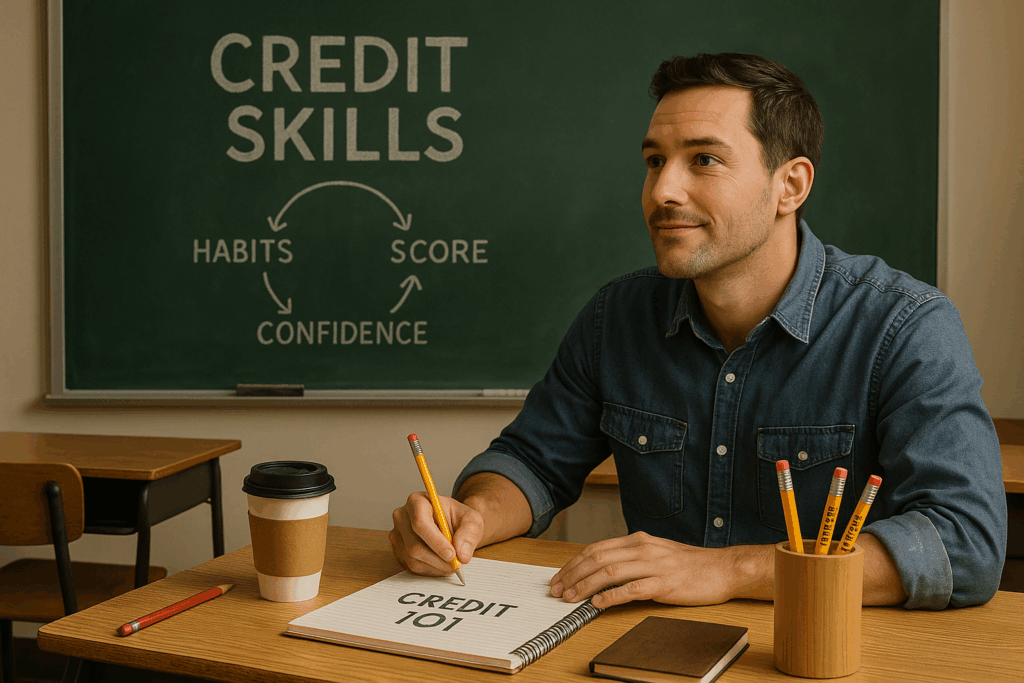

Most people think credit repair starts with disputes and payments. Those matter, but they are not the real starting point. The journey begins with a mindset shift. Until that shift happens every strategy feels harder than it needs to be and progress feels slow even when you are doing the right things. The truth is […]

How To Remove The Invisible Bottleneck That Slows Every Small Business

Most business owners think their biggest problems are external. The market. The competition. The economy. The industry. These matter, but they are rarely the true source of slow growth. The real bottleneck is almost always hidden inside the business itself. It is the moment where your workload, systems, and capacity all collide. It is the […]

How to Give Yourself a “Reset Weekend” on a Budget Without Feeling Broke or Bored

Most people think a budget friendly weekend means sitting at home and doing nothing. That is not a reset. That is punishment. A real reset weekend gives you energy, clears your mind, and keeps your wallet safe at the same time. The goal is simple. Recover your mood. Recover your motivation. Recover your money. You […]

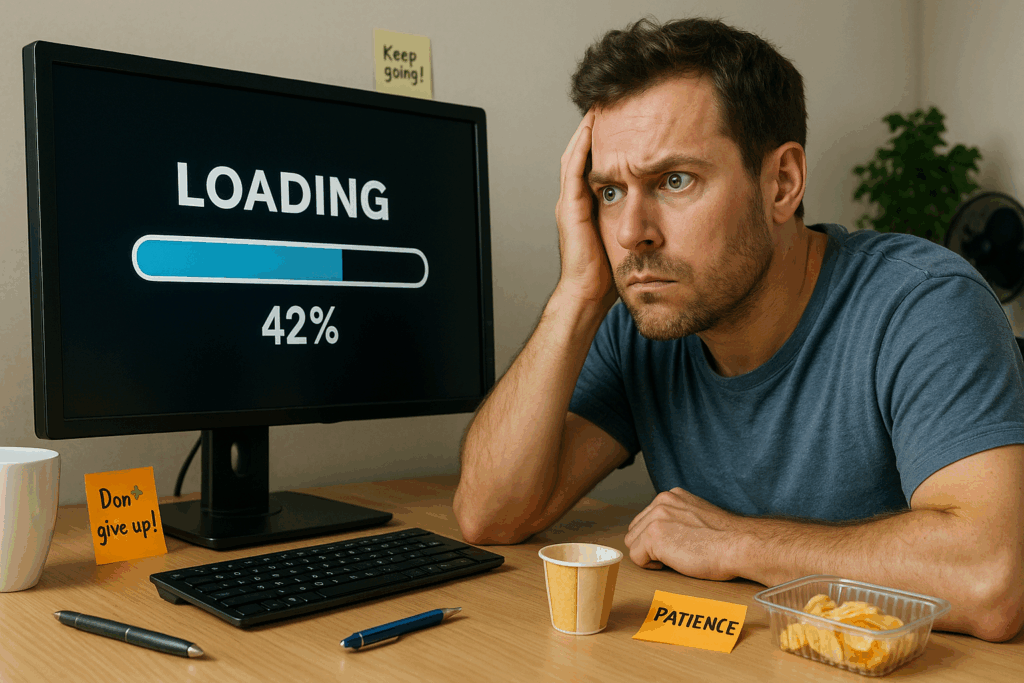

The Credit Comeback Curve and Why Most People Quit Right Before It Turns Up

Credit repair is not a straight line. It rarely moves in a predictable step by step climb. Instead it follows a curve. You put in effort. You build good habits. You wait. Then nothing seems to happen. This is the moment when most people get discouraged. But this quiet middle section is the most important […]

The Three Money Habits That Make Your Credit Score Rise Without Extra Stress

Most people think credit repair requires dramatic changes. Big payments. Complicated strategies. Hours of work. The truth is that your credit score responds more to steady habits than intense effort. You do not need a perfect budget or a huge income to make progress. You only need a few consistent behaviors that build momentum over […]

Why People Don’t Trust Their Scores (Even When They’re Improving)

One of the biggest challenges in credit repair has nothing to do with late payments, collections, or utilization.It’s something far more psychological. The confidence gap. This is the moment when someone’s credit is genuinely improving, but they still don’t trust the process, the score, or themselves.And that lack of confidence often slows the progress more […]

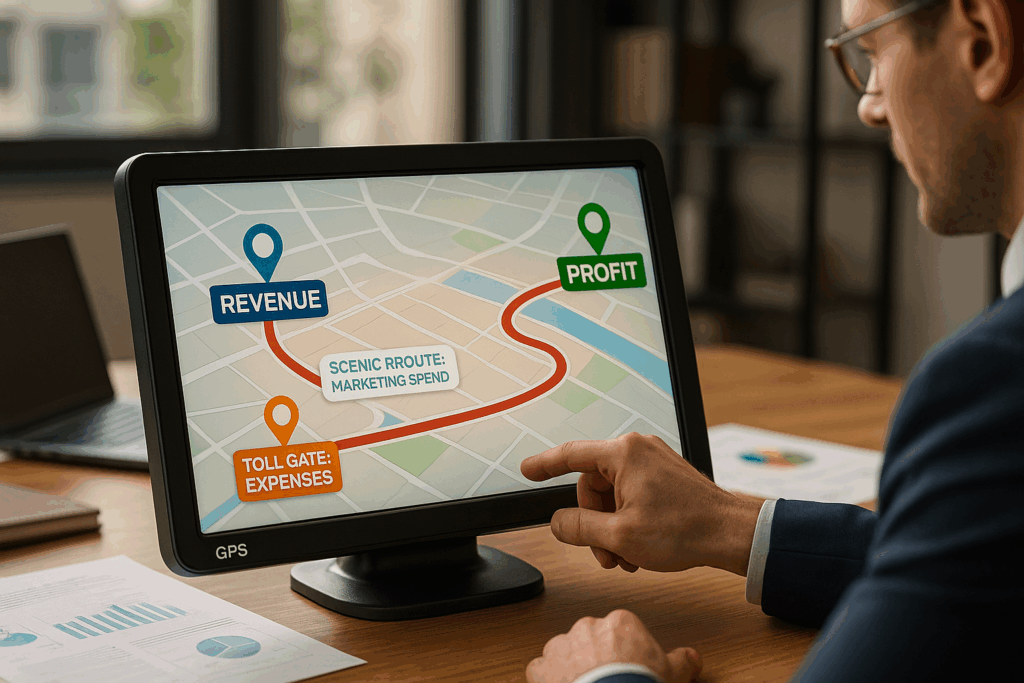

Why Your Business Needs a “Money Map” (Not Just a Budget)

Every business has numbers: revenue, expenses, profit margins, projections.And most business owners keep some kind of budget or spreadsheet to track it all. But budgets only show what happened.A money map shows where you’re going. A money map is a simple, visual breakdown of how money flows into, through, and out of your business, and […]

Why Your Score Sometimes Jumps After You Stop Touching It

Most people assume credit repair is all about action.Disputes. Payments. Utilization updates. New accounts. Monitoring.And yes, those things matter. But there’s a part of credit repair almost no one talks about: The quiet period. This is the stage where your score improves the most not because you’re doing more, but because you’ve finally stopped doing […]

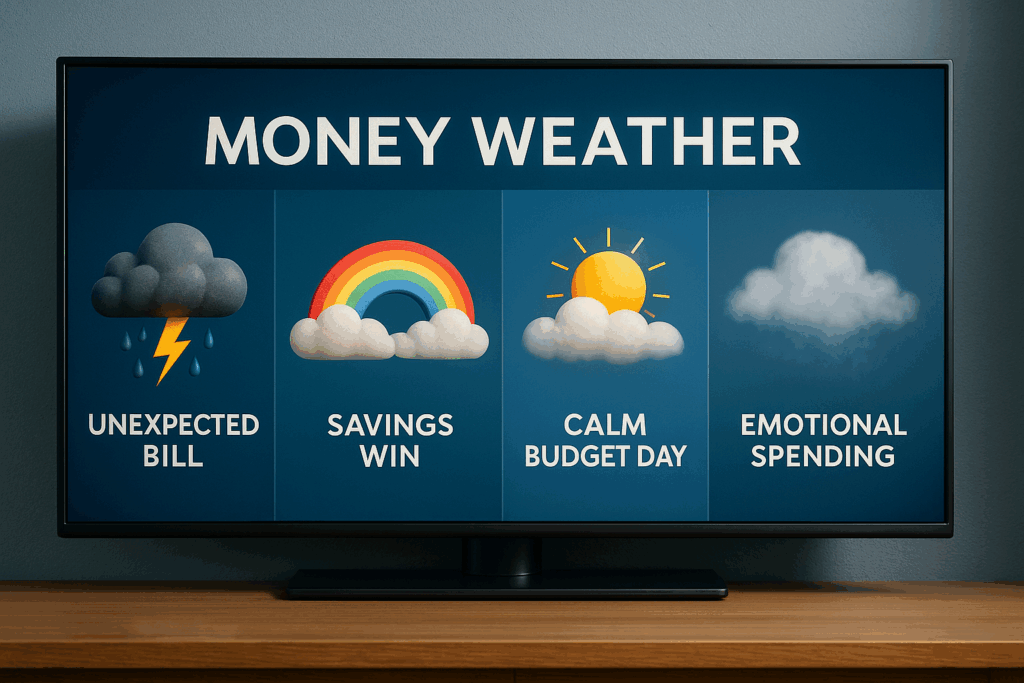

Why Your Financial Mindset Shapes Your Results

Most financial advice focuses on numbers: income, expenses, interest rates, credit scores, debt payoff strategies.But there’s another part of money that gets overlooked, even though it quietly influences every decision you make: Your money energy. Money energy is the mindset, emotion, and intention you bring to your financial life.It’s how you think, how you react, […]

How to Spot Financial Problems Before They Get Big

Most people don’t get into financial trouble overnight.It happens slowly. A few skipped habits, a few unnoticed changes, and then suddenly the budget feels tight and the stress feels heavy. But just like a car gives you warning signs before the engine fails, your finances do too.You just have to know what to look for. […]