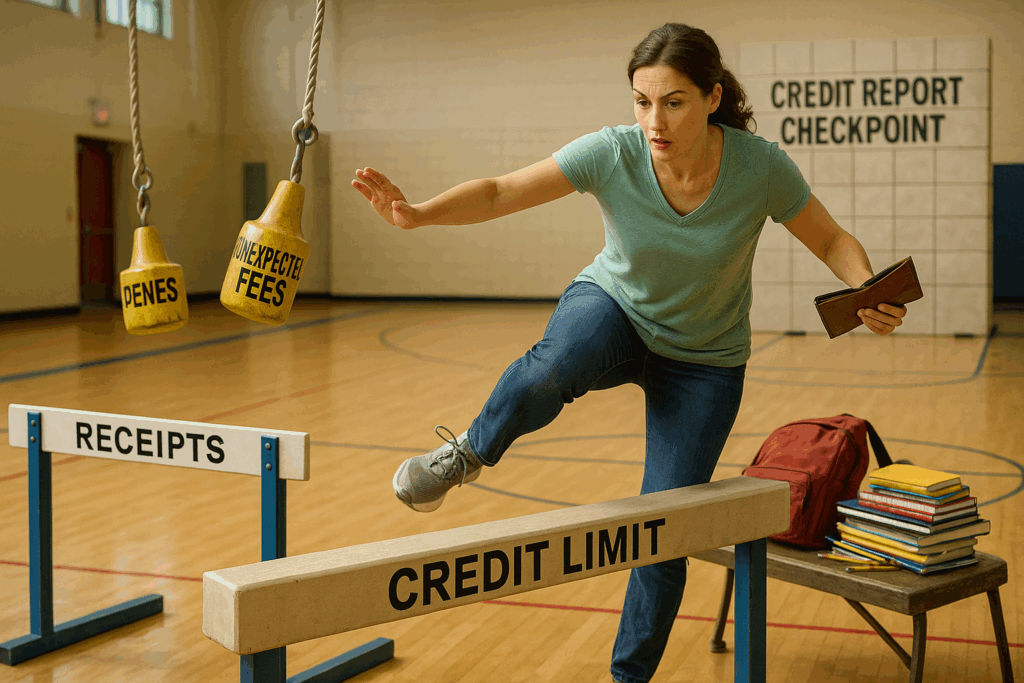

Back-to-School Budgeting with Credit in Mind

As summer winds down, the back-to-school rush kicks into full swing: new clothes, school supplies, tech upgrades, sports fees, and unexpected extras that somehow weren’t in last year’s budget.

Whether you’re a parent, a college student, or even a teacher stocking your own classroom, this season can hit your wallet hard.

And if you’re not careful, it can hit your credit, too.

Here’s how to handle back-to-school spending without sabotaging your financial goals or your credit score.

1. Make a Realistic (Not Aspirational) Budget

Start with what you actually need:

- Basic school supplies

- Backpacks or lunch gear

- Required clothing (not a full wardrobe)

- Technology upgrades (only if necessary)

Then add the optional extras:

- Trendy clothes

- Fancy planners or gadgets

- Sports equipment or club fees

Tip: Don’t rely on memory. Review last year’s receipts if you can. Prices go up, and wish lists grow fast.

Why it matters for your credit:

When you don’t budget for seasonal spending, you’re more likely to lean on credit cards impulsively, and carry balances that hurt your utilization ratio.

2. If You Use a Credit Card, Use It Strategically

Using credit to cover expenses can be smart if you have a plan:

- Choose a card with rewards (especially for school supplies, gas, or groceries)

- Keep spending under 30% of your credit limit

- Set an auto-pay to avoid interest or late fees

- Pay it off quickly

Avoid putting big-ticket items on credit if you can’t pay them off within a month or two.

Why it matters for your credit:

Credit utilization (how much of your limit you’re using) is a huge part of your score. Maxing out a card can cause a quick drop.

3. Check for Buy-Now-Pay-Later Traps

It’s tempting: “Only $28/month for a new laptop!”

But multiply that by 12, and you’ve committed to a $336 hit on your budget and possibly your credit.

Not all Buy Now Pay Later (BNPL) programs report to credit bureaus, but some do. Worse, missed payments can show up fast and hurt your score.

Why it matters for your credit:

A missed BNPL payment can tank your score even faster than a credit card if the lender reports it. And unlike credit cards, BNPL doesn’t build credit when paid on time.

4. Skip the Peer Pressure Purchases

Whether it’s the name-brand sneakers or a $150 calculator, it’s easy to feel like you “have” to buy what others are buying.

Ask yourself:

- Is this item actually required, or just preferred?

- Will it be used daily, or once a semester?

- Can it be bought secondhand, borrowed, or replaced with a cheaper option?

Why it matters for your credit:

Impulse spending on credit for things you don’t need creates long-term debt for short-term satisfaction.

5. Build a Year-Round “School Stuff” Fund

This might not help you today, but it’s gold for next year.

Set up a dedicated savings category in your budget called “school” or “kids’ supplies.”

Add just $25–$50/month starting this fall. By next August, you’ll have a solid fund waiting. No need to stress or swipe.

Why it matters for your credit:

Having a plan reduces panic borrowing, keeps your credit usage low, and gives you flexibility if a true emergency pops up later.

Final Thought

Back-to-school doesn’t have to mean back to bad spending habits.

With a little planning, some smart credit use, and the ability to say “no” when needed, you can navigate this season without damaging your score or your peace of mind.

And if your credit isn’t where you want it to be before the school year starts, don’t panic.

We’re here to help.

No pressure. No gimmicks. Just honest, effective credit repair that works when you need it most.

👉 Schedule your free credit consultation today, so you can focus on what really matters this school year.