Impulse spending is one of the biggest budget killers. You tell yourself you’ll stick to your plan, but then a sale, a gadget, or a late-night online shopping scroll derails your progress. Enter the 24-hour rule: a simple, powerful habit that can save you hundreds (or even thousands) each year. What Is the 24-Hour Rule? […]

How Credit Score Ranges Really Work (And Why Being “Good” Might Not Be Good Enough)

Most people think of their credit score as just a single number, but lenders don’t view it in isolation. They see it in terms of ranges, or categories that signal how risky or trustworthy you are as a borrower. Understanding where you fall (and how close you are to the next range) can make the […]

5 Simple Financial Habits That Make a Big Difference Over Time

When it comes to money, small actions done consistently often matter more than big, one-time decisions. You don’t have to be a financial expert to build security. You just need to practice a few smart habits that compound over time. Here are five simple financial tips you can start today. 1. Automate Good Decisions Set […]

Why Checking Your Own Credit Score Won’t Hurt It

A lot of people avoid checking their credit score because they’re afraid it will drop if they do. That fear keeps many from monitoring their credit at all, and it can lead to missed errors, surprises, and setbacks when it’s time to apply for a loan. Here’s the truth: checking your own credit score is […]

Why Cash Flow Matters More Than Profit for Small Businesses

Most entrepreneurs dream of seeing big profits on their income statements. But here’s the truth: profit doesn’t keep the lights on. Cash flow does. Cash flow is the movement of money in and out of your business, and it’s often the difference between businesses that survive and those that fail. Profit vs. Cash Flow: What’s […]

The Envelope Method in the Digital Age: Can Old-School Budgeting Still Work?

Before budgeting apps and online banking, people had a simple, no-nonsense way to control their spending: the envelope method. Cash was divided into separate envelopes labeled “Groceries,” “Gas,” “Entertainment,” and so on. When the envelope was empty, that category of spending stopped. It may sound old-fashioned, but here’s the truth: the envelope method still works, […]

Why Your Credit Limits Matter More Than You Think

When people think about credit scores, they usually focus on paying bills on time or keeping balances low. While those are critical, there’s another piece of the puzzle that often gets overlooked: your credit limits. How much credit you’re approved for, and how you manage it, can have a major impact on your score and […]

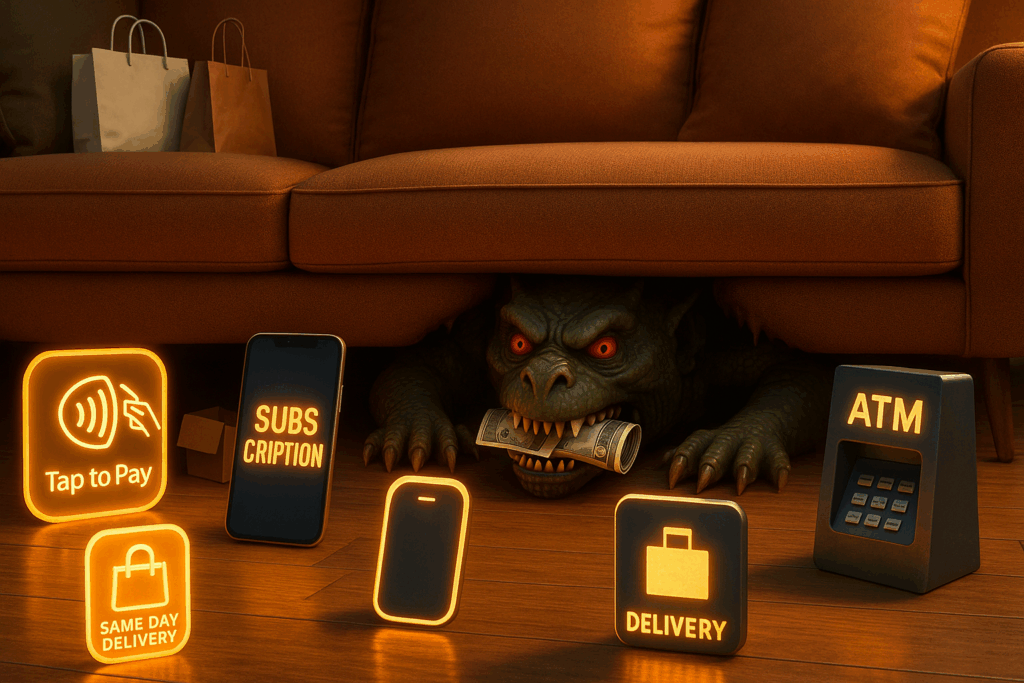

The Hidden Cost of Convenience: How Small Fees Drain Your Wallet

In today’s world, everything is about convenience: tap-to-pay, same-day delivery, subscription services, ATM withdrawals. While these tools save time, they often come with small fees that are easy to overlook. And over time, those “little” charges can quietly cost you hundreds, even thousands, of dollars a year. The Sneaky Fees to Watch Out For Why […]

Why Your Credit Report Dates Matter More Than You Realize

Most people focus on the big items on their credit report: balances, late payments, or collections. But the dates attached to each account are just as important, and overlooking them can create confusion or even lower your score. The Key Dates on Your Credit Report Why These Dates Matter Common Errors to Watch For Even […]

Why Vendor Accounts Are the Secret Weapon for Building Business Credit

When most entrepreneurs think about business credit, they picture loans or credit cards. But here’s a little-known truth: the foundation of strong business credit often starts with something much simpler, vendor accounts. What Are Vendor Accounts? Vendor accounts (often called Net-30 accounts) let you purchase goods or services for your business now and pay for […]