Why Your Business Needs a “Money Map” (Not Just a Budget)

Every business has numbers: revenue, expenses, profit margins, projections.

And most business owners keep some kind of budget or spreadsheet to track it all.

But budgets only show what happened.

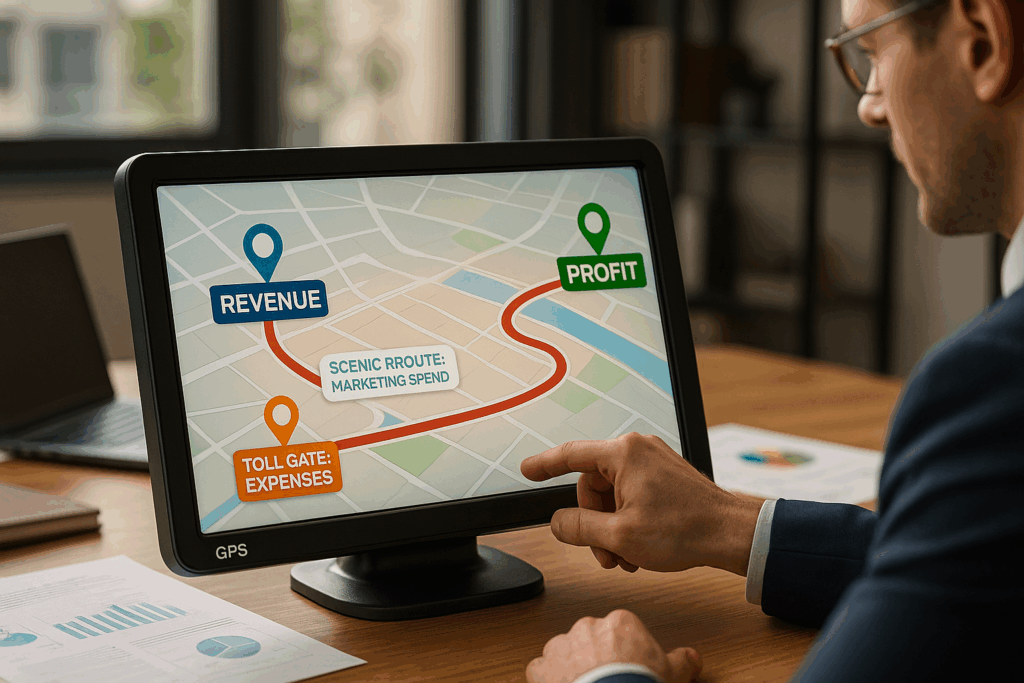

A money map shows where you’re going.

A money map is a simple, visual breakdown of how money flows into, through, and out of your business, and it’s one of the most powerful tools you can use to grow sustainably, avoid cash crunches, and make smarter business decisions.

Here’s why every entrepreneur needs one.

1. A Money Map Shows You Where Your Cash Is Actually Going

Business owners are often surprised when they see their money map for the first time.

Why?

Because a lot of money leaks happen invisibly: subscription creep, marketing spend, payroll drift, vendor increases, or slow-paying clients.

A money map reveals:

- Which expenses fuel growth

- Which expenses drain profit

- Which products carry the business

- Which services aren’t worth the energy

It gives you clarity you can’t get from a basic budget.

2. It Helps You Make Faster Decisions

When you see your financial flow laid out clearly, decisions become easier:

- Can we afford to hire?

- Can we invest in new equipment?

- Should we increase marketing spend?

- Is now the right time to scale?

With a money map, you stop guessing and start knowing.

3. It Prevents Cash Flow Surprises

Every business faces uneven cash flow.

A money map highlights:

- When money typically comes in

- When big expenses hit

- Where the gaps appear

- What needs to be smoothed or adjusted

This helps you prepare before small problems turn into big ones.

4. It Strengthens Your Business Credit Strategy

Business credit isn’t just about approvals. It’s about timing.

A money map shows you:

- The best moments to apply for new credit

- When your utilization might spike

- How financing fits into overall operations

- When a credit line can protect cash flow

This is the difference between borrowing strategically vs borrowing out of panic.

5. It Shows You Your Real Profit (Not Just Revenue)

A lot of business owners grow revenue, but not profit.

A money map highlights where profit is being lost:

- Pricing too low

- Projects that take too much time

- Bloated recurring expenses

- High inventory carrying costs

When you see the path the money takes, you can redirect it with intention.

6. It Makes Scaling Smoother and Safer

Businesses don’t fail from lack of opportunity. They fail from lack of visibility.

A money map gives you a clear picture of:

- What can scale

- What breaks under pressure

- What needs systems

- What needs to be eliminated before growing

It’s one of the most underrated tools in sustainable scaling.

Final Thoughts

Your business doesn’t just need numbers. It needs a narrative.

A money map gives you a story of how money moves in your company, so you can direct it with confidence, clarity, and purpose.

At CreditNerds.com, we teach business owners how to use credit and cash flow wisely, and a good money map is the foundation for every smart financial move.