The Truth About Hard Inquiries: How Much Do They Really Hurt Your Credit?

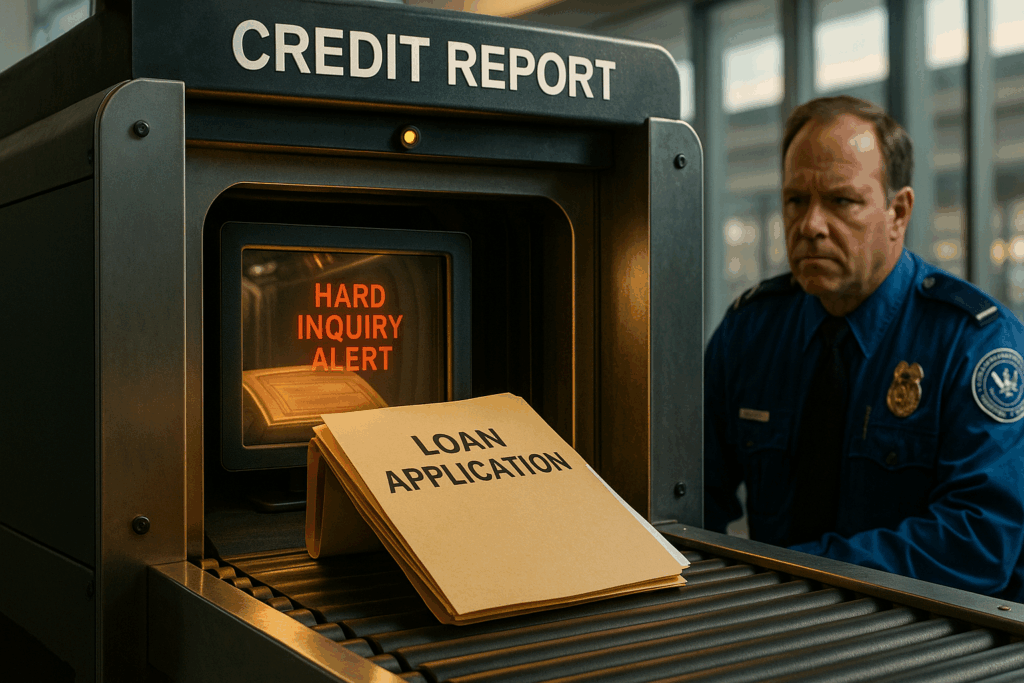

If you’ve ever applied for a loan, a new credit card, or even some apartment leases, you’ve probably seen the warning: “This will result in a hard inquiry on your credit report.” For many people, that phrase sparks panic. But what exactly is a hard inquiry, and how much does it really affect your credit?

What Is a Hard Inquiry?

A hard inquiry (also called a “hard pull”) happens when a lender checks your credit report to make a lending decision. Common examples include:

- Applying for a mortgage or auto loan

- Opening a new credit card

- Requesting a line of credit increase

Hard inquiries are different from soft inquiries (like checking your own credit score or pre-qualification offers). Soft pulls don’t affect your score at all. For more information, check out What Counts as a Hard Inquiry (And What Doesn’t)

How Much Do Hard Inquiries Lower Your Score?

Here’s the good news: hard inquiries usually only lower your score by 5–10 points. And the impact is temporary. Most inquiries fall off your report after two years, and their effect on your score usually fades after 12 months.

Where they can hurt is when:

- You have very few accounts or a short credit history.

- You apply for multiple credit cards in a short time.

- Lenders see too many inquiries without new accounts to match.

When Multiple Inquiries Count as One

Shopping for the best rate on a mortgage, auto loan, or student loan? Credit scoring models recognize this behavior and treat multiple inquiries made within a 14–45 day window as a single inquiry. That means you can rate shop without fear of tanking your score.

How to Handle Hard Inquiries Wisely

- Apply Only When Needed: Don’t open accounts you don’t plan to use.

- Space Out Applications: Give at least 3–6 months between credit card or loan applications.

- Check Before You Apply: Use pre-qualification tools to see your chances without triggering a hard pull.

- Focus on Bigger Factors: Payment history and utilization weigh far more than inquiries.

Final Thoughts

Hard inquiries aren’t the credit-killers many people think they are. Yes, they matter, but only a little and only temporarily. The bigger risks to your score come from missed payments, high balances, or closing accounts too soon.

At CreditNerds.com, we help people see past the myths and focus on what really matters for building strong credit. If you’ve been holding back from applying because of hard inquiry fear, now you know the truth: used wisely, they’re nothing to lose sleep over. If you’re ready to start your credit journey, schedule your free consultation today.