The Simple Budget Hack That Actually Works: The 50/30/20 Rule

Budgeting has a reputation for being complicated, restrictive, and hard to stick to. But the truth is, it doesn’t have to be. One of the easiest frameworks to follow is called the 50/30/20 rule, and it works because it balances responsibility with freedom.

What Is the 50/30/20 Rule?

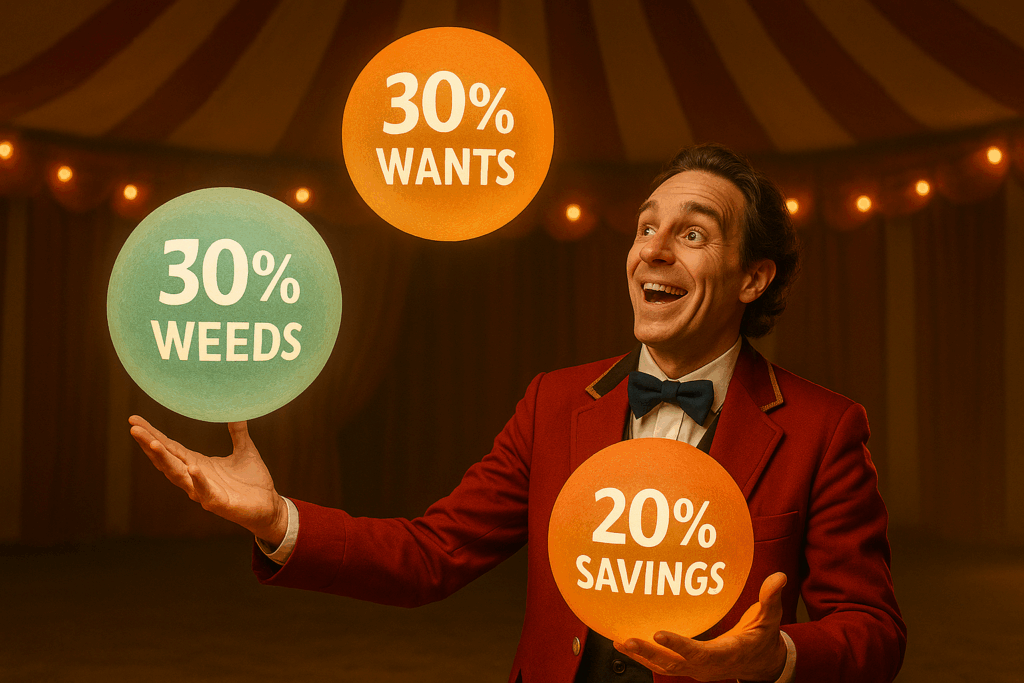

It’s a simple way to divide your income into three categories:

- 50% Needs: The essentials: housing, utilities, groceries, transportation, insurance, minimum debt payments.

- 30% Wants: Dining out, entertainment, travel, subscriptions, hobbies.

- 20% Savings and Debt Payoff: Emergency fund, retirement accounts, extra debt payments, investments.

By giving every dollar a job, you avoid the trap of wondering where your money went at the end of the month.

Why It Works

- It’s Simple

You don’t need spreadsheets or dozens of budget categories. Just three buckets. - It’s Flexible

The percentages can be adjusted based on your life. Maybe 60/20/20 works better for you. The point is structure, not perfection. - It Balances Life

Unlike restrictive budgets that eliminate fun, this one makes room for enjoyment while still prioritizing savings.

How to Get Started

- Know Your Take-Home Pay

Base the percentages on what actually hits your bank account after taxes. - Review Your Current Spending

Track the last 30 days and see how your spending compares. - Make Adjustments

If your “wants” are closer to 50%, look for areas to trim back. If savings is under 20%, start small, even an extra 5% is progress. - Automate Where You Can

Set up automatic transfers for savings and debt payments so you don’t have to rely on willpower.

Final Thoughts

The 50/30/20 rule isn’t about being perfect. It’s about giving your money direction. With a plan this simple, you’ll finally feel in control of your finances without feeling like you’re missing out on life.

👉 At CreditNerds.com, we believe strong credit and strong budgets go hand in hand. When you manage your money with purpose, you’re not just fixing the past. You’re building a future. If you’re ready to take control of your credit, schedule your free consultation here.