How to Review Your Bank Statements Like a Pro

Let’s be honest: Most people don’t actually read their bank statements.

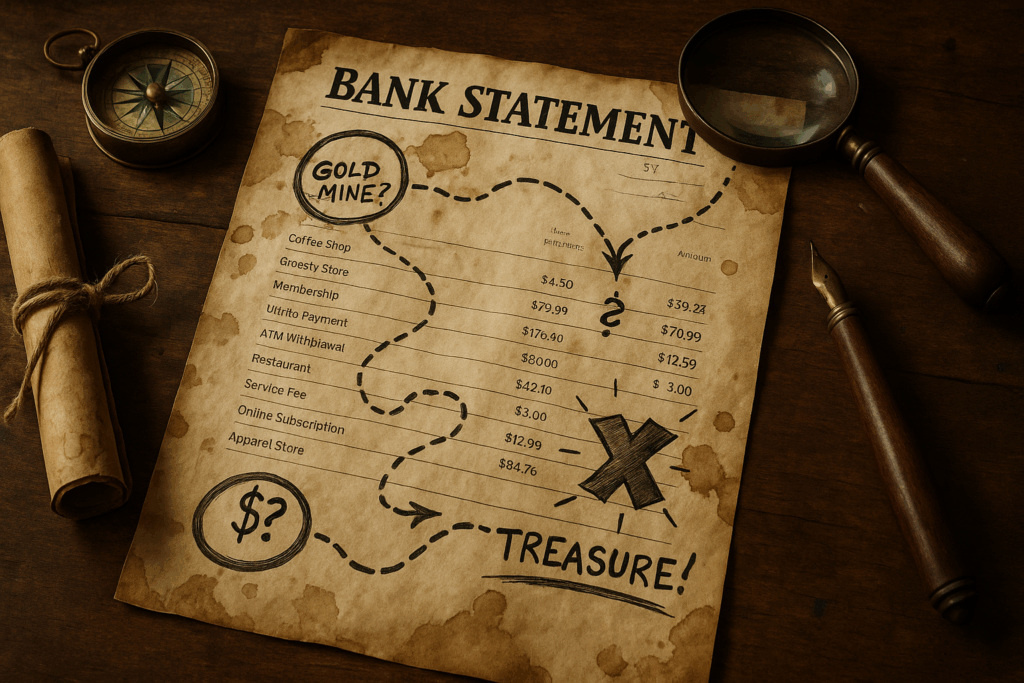

They might glance at the balance, maybe skim a few transactions, and then move on. But hidden in those lines of text are the clues to better budgeting, smarter spending, and even protecting yourself from fraud.

If you’re ready to get intentional with your money, learning how to review your bank statements like a pro is a great place to start.

Here’s how to do it in 15 minutes or less, once a month.

Step 1: Choose the Right Time

Don’t try to review your statements while distracted, rushed, or in a bad mood.

This isn’t punishment. It’s power.

Set aside 15–20 minutes once a month. Some people like to do it:

- On the 1st or last day of the month

- After payday

- While doing their monthly budget

- With coffee in hand on a quiet Sunday morning

The point is: make it a routine, not a reaction.

Step 2: Pull All Your Bank Statements (Not Just One)

Pro tip: If you have multiple accounts (checking, savings, business, etc.) grab all your statements.

Even better? Pull two to three months at a time so you can spot trends.

Look for statements from:

- Bank accounts

- Credit unions

- Prepaid debit accounts

- Online banks (like Chime, Ally, SoFi)

Most banks let you download PDFs or view online.

Step 3: Scan for Red Flags First

Before diving into budgeting categories, scan for anything that jumps out.

Look for:

- Unfamiliar charges

- Duplicate transactions

- Unexpected subscriptions or renewals

- ATM fees, overdraft fees, or maintenance charges

- Returned payments or failed transfers

If anything looks off, don’t ignore it. Call your bank and ask.

Step 4: Categorize Your Spending

Now you’re ready to go line-by-line. It sounds tedious, but it gets easier with practice.

Use a notebook, spreadsheet, or budgeting app to sort each transaction into categories like:

- Housing (rent/mortgage, utilities)

- Transportation (gas, Uber, car payments)

- Food (groceries, dining out)

- Subscriptions (Netflix, Spotify, apps)

- Shopping (clothes, Amazon, fun stuff)

- Debt (credit cards, loans)

- Savings/investments

Highlight the categories that surprised you the most. That’s where the gold is.

Step 5: Look for Leaks

Now that everything’s organized, ask yourself:

- Where did I spend more than expected?

- What categories felt out of alignment with my values?

- Are there recurring expenses I forgot about, or don’t use anymore?

- Am I paying fees I could avoid?

Most people discover at least one leaky spot, like three food delivery orders in one weekend, or a gym membership they never use.

Step 6: Take Action

Information is great, but action is better. Here are a few smart next steps:

- Cancel or pause unused subscriptions

- Set alerts for low balances or large transactions

- Set a monthly cap on a high-spending category

- Transfer any leftover funds to savings

- Set a calendar reminder for next month’s review

Final Thought

Reviewing your bank statements isn’t just about catching fraud or cutting spending (though those are important).

It’s about understanding your habits, aligning your money with your goals, and feeling confident about your finances.

It’s one of the simplest habits you can build, but it pays off in big ways.

And the best part? You don’t need to be a financial expert to do it.

You just need to start.

Need help tackling summer credit issues or rebuilding after a spending slip?

At CreditNerds.com, we help real people fix their credit the right way, and we only charge when we get results. Schedule your free consultation today.