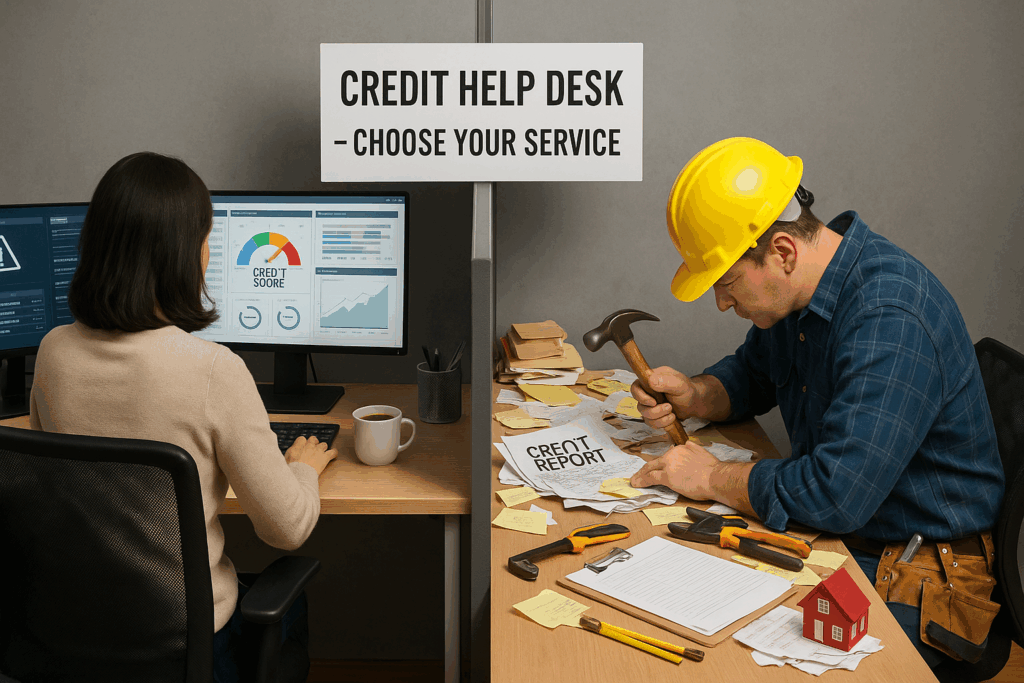

Credit Monitoring vs. Credit Repair: What’s the Difference?

When it comes to managing your credit, there’s no shortage of services promising to help. But two of the most commonly confused tools are credit monitoring and credit repair.

Spoiler alert:

They’re not the same thing.

In fact, they serve very different purposes, and depending on your goals, you might need one, the other, or both.

So let’s break it down in plain English.

What Is Credit Monitoring?

Credit monitoring is like putting security cameras on your credit profile. It doesn’t fix anything, but it alerts you when something changes like:

- A new account is opened in your name

- Your score goes up or down

- A hard inquiry appears

- A delinquent account is added

- Your personal information shows up on the dark web (with some services)

Credit monitoring is proactive protection, not repair. It helps you catch errors or fraud quickly, but it won’t correct them.

Benefits of Credit Monitoring

- Early alerts if someone tries to steal your identity

- Real-time score tracking to stay aware of changes

- Peace of mind while building or protecting your credit

- Many services include identity theft insurance or restoration help

But here’s the key thing to remember:

Monitoring doesn’t fix anything. It just lets you know something happened.

What Is Credit Repair?

Credit repair is the process of finding and challenging inaccurate, outdated, or unfair information on your credit report.

This includes:

- Incorrect account balances

- Accounts that don’t belong to you

- Items reported after bankruptcy

- Duplicate entries

- Outdated personal information

- Collections that should’ve been removed

Credit repair works by using your rights under laws like the Fair Credit Reporting Act (FCRA) to request corrections or verifications from the credit bureaus. If you’d like to know more about your rights, check out The Fair Credit Reporting Act Explained in Plain English.

If a creditor can’t prove something belongs on your report?

It must be removed.

Benefits of Credit Repair

- Fixes mistakes that drag down your score

- Removes outdated or unverifiable accounts

- Helps you get approved for loans, credit cards, and housing

- Makes sure your credit reflects your real financial behavior

Credit repair is an action step. It’s not just a notification system. If you’d like to know more of the basics, we have a blog that breaks down credit repair. Check it out here.

So Which One Do You Need?

That depends on your situation.

| If you… | Then you probably need… |

|---|---|

| Want to know when something changes | ✅ Credit Monitoring |

| Found errors or want to clean up your file | ✅ Credit Repair |

| Just filed for bankruptcy | ✅ Both (to track and clean) |

| Suspect identity theft | ✅ Monitoring + Repair (as needed) |

| Are preparing for a big purchase | ✅ Repair first, then monitor progress |

In many cases, using both together gives you the best protection and control. One helps prevent damage, the other helps fix it.

Final Thought

Credit monitoring and credit repair aren’t competitors. They’re teammates.

One watches. The other works.

If your credit report is accurate and clean, monitoring helps you keep it that way.

If it’s full of errors or old baggage, credit repair helps you get a fresh start.

And if you’re not sure where to start?

That’s what we’re here for.

At CreditNerds, we offer credit repair services that only charge when we get results.

We’ll help you fix what’s broken, so your monitoring alerts can finally be good news.

Click here to see how we can help you take control of your credit.