What Happens to Your Credit When You Freeze Your Report?

Freezing your credit report might sound dramatic like pulling an emergency brake on your financial life. But it’s actually a smart, simple tool that can help protect your identity and credit score from serious damage.

Still, a lot of people avoid it because they’re not sure what a freeze really does, what it doesn’t do, and whether it will hurt their credit.

Let’s clear that up right now.

What Is a Credit Freeze?

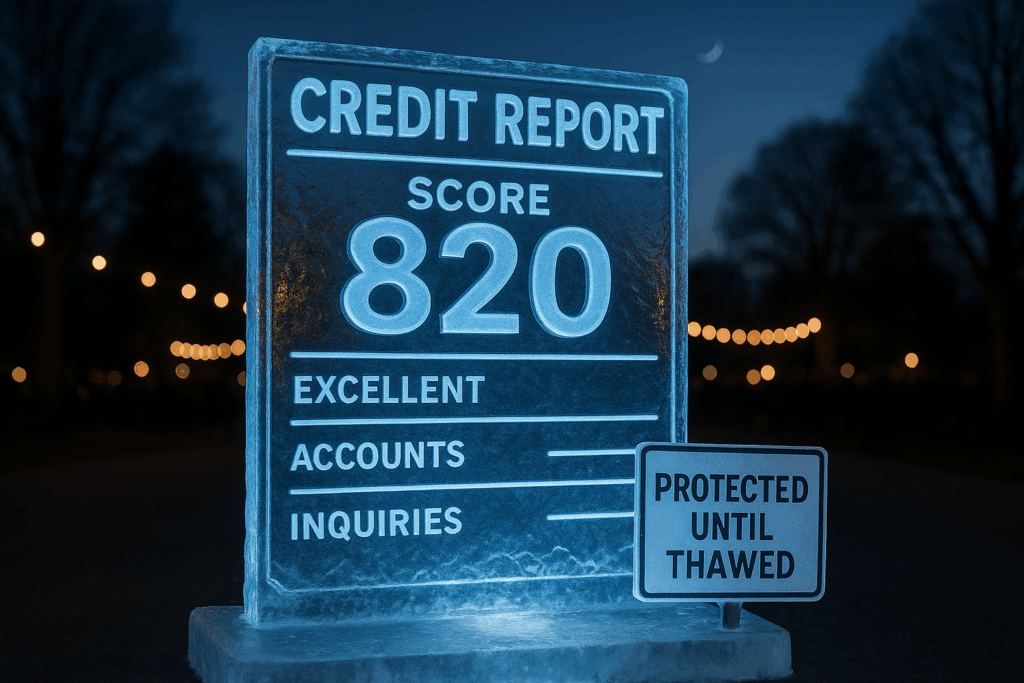

A credit freeze, also called a security freeze, blocks new creditors from accessing your credit report.

This means that if someone tries to:

- Open a credit card in your name

- Apply for a loan using your info

- Get a cell phone, apartment, or car lease

they’ll likely be denied, because the lender won’t be able to pull your credit.

It’s one of the strongest defenses you have against identity theft.

What It Doesn’t Do

Let’s clear up some myths. A credit freeze does NOT:

- Lower your credit score

- Close any of your current accounts

- Stop you from using your credit cards or paying your bills

- Prevent soft inquiries (like background checks or pre-approvals)

And it doesn’t freeze your credit score. Your score will still change based on your existing accounts and payment history.

Why You Might Want to Freeze Your Credit

Credit freezes are most commonly used when:

- Your identity has been stolen

- Your personal information was involved in a data breach

- You want to lock down your credit proactively to prevent fraud

- You don’t plan on applying for credit anytime soon

It’s also a great move for:

- Elderly individuals vulnerable to scams

- Teens and young adults (yes, minors can have their credit frozen)

- People rebuilding their credit who want a cooling-off period

Does a Freeze Hurt Your Score?

Nope. Not even a little.

Freezing your credit report has zero impact on your credit score.

Why? Because the freeze only blocks access to your report. It doesn’t change anything on it. You’ll still get credit score updates, your balances and payments will still be reported, and your credit history continues to build.

Can You Still Apply for Credit Later?

Yes. You’re totally in control.

You can “thaw” (unfreeze) your credit report temporarily or permanently any time you want, and it’s completely free. Most credit bureaus allow you to lift the freeze for a specific timeframe (like 24 hours) or for a specific lender.

You’ll need a PIN or password you set when you froze your report, so keep it safe.

How to Freeze Your Credit (It’s Free)

You’ll need to contact each of the three credit bureaus separately:

- Experian: experian.com/freeze

- Equifax: equifax.com/personal/credit-report-services/

- TransUnion: transunion.com/credit-freeze

It usually takes about 10 minutes per bureau and is free by law.

When Freezing Might Not Be the Best Move

A credit freeze can be a hassle if:

- You’re applying for a mortgage, car loan, or new card soon

- You forget which bureau a lender will use

- You lose your freeze PINs or passwords

If you’re actively working on credit repair, you may need to unfreeze your report so the credit bureaus and creditors can process disputes or updates.

In some cases, a fraud alert (which doesn’t block access but notifies lenders to take extra steps to verify identity) might be more appropriate.

Final Thought

A credit freeze is like putting a lock on your front door. It doesn’t stop everything, but it makes life a whole lot harder for thieves.

It’s smart. It’s free. And it doesn’t hurt your score.

If you’re rebuilding credit, protecting your identity, or just want some peace of mind, freezing your report can be a powerful move, without any downside to your actual credit.

Need help fixing what’s already on your report?

We help everyday people challenge inaccurate or unfair items on their credit report legally and effectively. No upfront fees. Just results.