Weekend Spending Traps: Why It’s So Easy to Blow Your Budget on Saturday

You worked hard all week. The weekend hits, and suddenly the world feels full of possibilities: takeout, Target runs, spontaneous day trips, drinks with friends, maybe a little online shopping from the couch at midnight.

We’ve all been there.

But if your budget mysteriously falls apart between Friday night and Sunday evening, it’s not just bad luck. It’s behavioral finance in action.

Let’s break down why weekends are a danger zone for your wallet and your credit, and how to enjoy them without blowing your whole month in two days.

Trap #1: “I Deserve This”

You do deserve good things. But reward spending is one of the fastest ways to derail your goals, especially when it’s tied to emotions like stress, burnout, or boredom.

Friday nights are peak “I earned this” moments. Problem is, they often turn into:

- $60 dinners when a $12 pizza would’ve hit the spot

- $100 in drinks because “everyone else is going out”

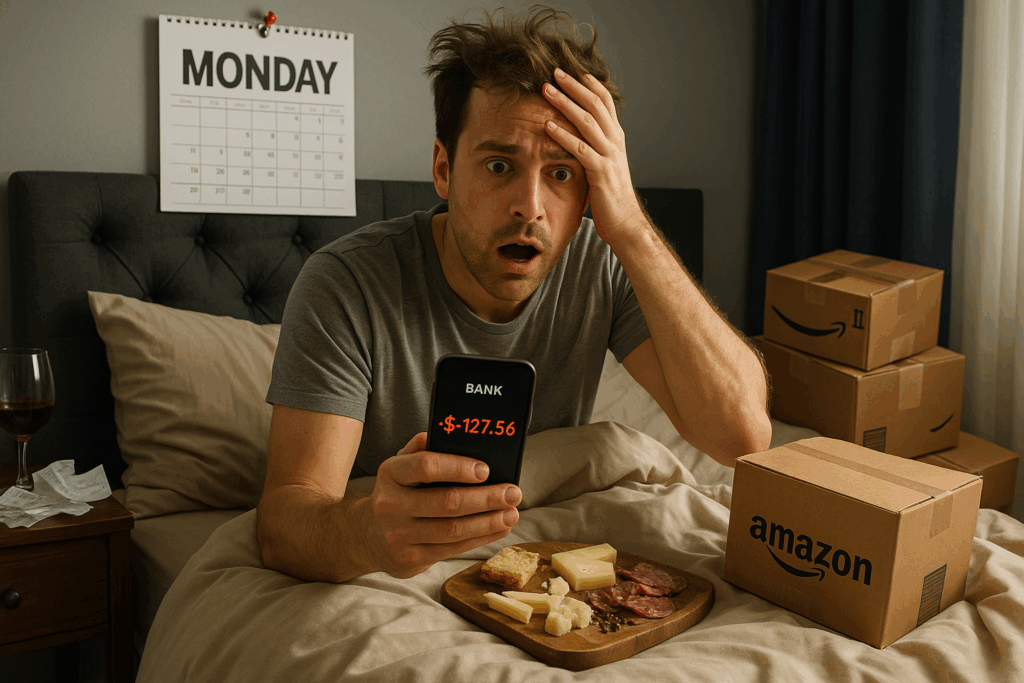

- Impulse Amazon buys that feel justified until they show up with regret attached

Fix it:

Plan one guilt-free reward into your weekend on purpose. That way, it’s fun and budget-friendly.

Trap #2: “It’s Just a Quick Stop”

You go out for one thing. Somehow, you’re $87 in before you even realize it.

Target, Costco, your local farmer’s market—weekend errands have a way of turning into mini shopping sprees, especially when you’re relaxed and moving slow.

Fix it:

Make a weekend list before you leave the house. Bring only what you need, or, even better, shop online for pickup so you’re not tempted in-store.

Trap #3: Boredom + Phone = Damage

It’s late. You’re scrolling. And something catches your eye.

Click. Swipe. Confirm.

This one’s sneaky because it doesn’t feel like spending. It feels like passing time.

Fix it:

If you online shop out of habit, add friction. Remove saved payment info from your favorite apps, unsubscribe from marketing emails, or try a no-spend screen time window after 9PM.

Trap #4: No Plan = No Boundaries

If your paycheck hit Friday morning and you haven’t made a plan by Friday night, your money is already at risk.

Without a clear idea of what needs to be paid, saved, or reserved for the week ahead, weekend spending feels like freedom. But Monday’s reality check is always waiting.

Fix it:

Do a 10-minute “Friday reset.” Look at your account, double-check your budget, and decide what’s fair game for weekend spending.

Trap #5: Charging Now, Regretting Later

Many people don’t feel weekend spending until the credit card statement hits weeks later. But by then, it’s already affecting your credit utilization, which can tank your score if your balances get too high.

Fix it:

Use your credit card with intention. If you’re swiping for points or convenience, make a same-day payment while it’s fresh so the balance never bloats.

Final Thought

Weekends should feel good, but not at the cost of your long-term goals.

With a little awareness, a plan, and a few simple adjustments, you can keep your money (and your credit score) safe and enjoy your downtime.

At CreditNerds.com, we help people clean up the credit messes that often come from years of weekend splurges, life stress, or just not knowing what’s hurting your score. And we don’t charge a dime unless we get results. Schedule your free consultation today.