The Hard Truth About Fixing Your Credit After a Divorce or Breakup

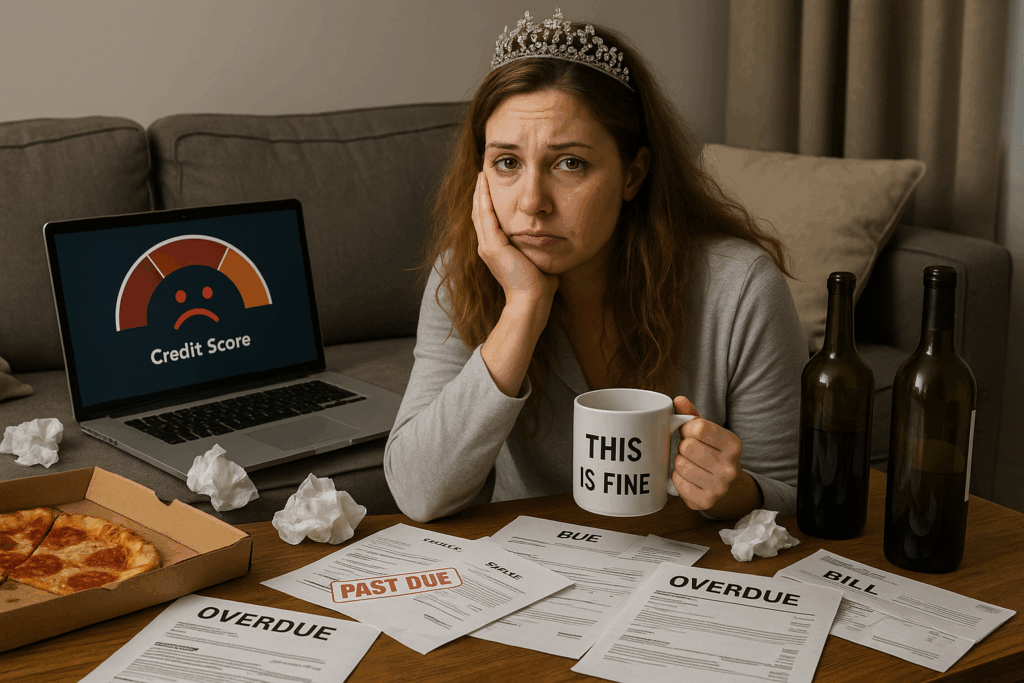

Breakups are hard. Divorce is harder. And when the emotional fallout settles, the financial mess often remains, especially in the form of credit damage.

Maybe your ex racked up debt in both your names. Maybe bills got missed while you were splitting up. Maybe everything just slipped through the cracks because life was falling apart.

Whatever the reason, here’s the truth:

Divorce doesn’t erase debt. And it definitely doesn’t fix your credit.

But you can. And it starts right here. Fixing your credit after a divorce or breakup takes clarity, consistency, and sometimes a little outside help. At CreditNerds.com, we’ve helped thousands of people just like you fight back against bad credit, and we only get paid when we get results.

Step 1: Check What You’re Still Legally Tied To

A divorce decree may say your ex is responsible for the car loan or the credit card, but lenders don’t care what the court says. If your name is still on the account, you’re still legally on the hook.

That means:

- Late payments show up on your credit report

- Defaults can lead to collections (and lawsuits)

- You may still owe the full balance if your ex doesn’t pay

Action:

Pull your credit reports from all three bureaus. Look for any joint accounts, co-signed loans, or shared credit cards that are still active.

Step 2: Close What You Can (Before More Damage Happens)

If your name is still attached to an account your ex can use, close it, or get your name removed. It’s hard to fix your credit when someone else can keep wrecking it.

Tip:

Joint accounts must be closed by both parties. If your ex won’t cooperate, contact the creditor and explain the situation. You may be able to freeze the account or convert it to an individual line.

Step 3: Dispute What’s Inaccurate or Unfair

Divorces often lead to billing mistakes, misreported late payments, or accounts that were settled but still show as open. These errors can drag your score down for years.

Under the Fair Credit Reporting Act (FCRA), you have the right to dispute anything that’s inaccurate, outdated, or unverifiable.

At CreditNerds.com, we can help with this: no upfront fees, and you only pay when we get results.

Step 4: Rebuild With What’s Yours

Once you stop the bleeding, it’s time to start healing.

- Open a secured credit card or credit-builder account in your name only

- Keep your utilization low (under 30%, ideally under 10%)

- Make on-time payments every month with no exceptions

- Avoid unnecessary credit pulls while rebuilding

It’s not about doing it all at once. It’s about showing new positive activity over time.

Step 5: Give Yourself Some Grace

Credit recovery after a breakup isn’t just about numbers. It’s emotional. You may feel overwhelmed, angry, or even embarrassed.

But here’s the thing:

Credit can be fixed.

Your future isn’t defined by your past.

And you are not the only one who’s gone through this.

Give yourself permission to learn, rebuild, and take control of your financial story on your own terms.

Final Thought

You might not have caused the damage. But you still have to clean it up.