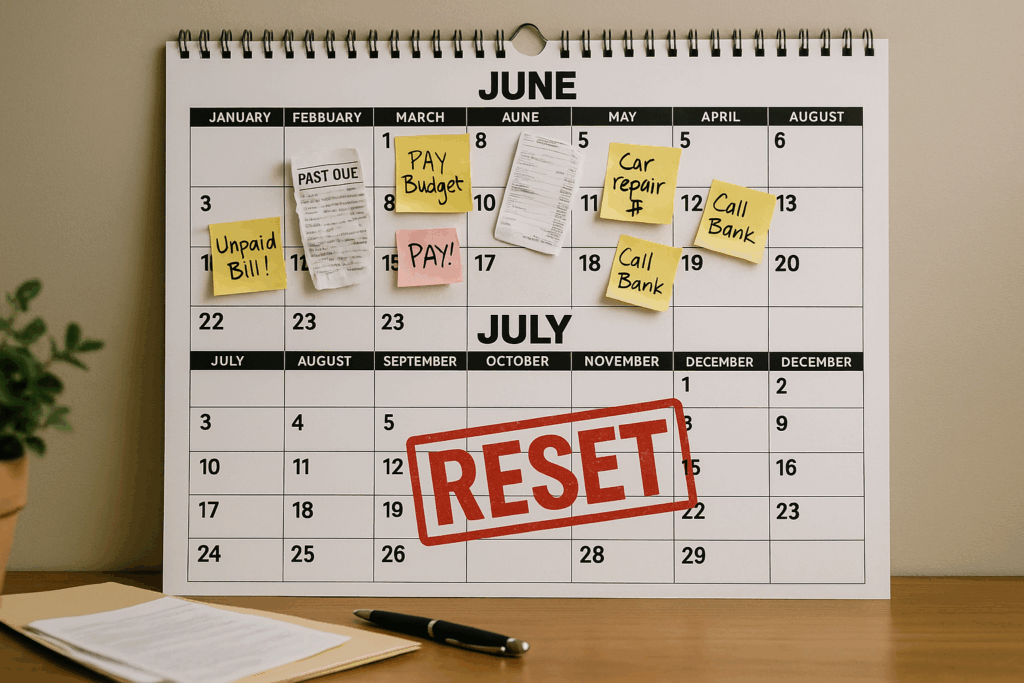

How to Create a Mid-Year Budget Reset (Before the Holidays Sneak Up)

We’re halfway through the year: how’s your budget holding up?

If you’re like most people, you started the year with good intentions. Maybe you even made a detailed plan. But life happens. Bills pile up, unexpected expenses pop in, and suddenly your budget feels more like a loose suggestion than an actual strategy.

Now is the perfect time to pause, reassess, and reset your finances before the chaos of fall and the holidays creeps in.

Step 1: Review the Damage (or the Progress)

Start by looking back at your spending over the past six months. You don’t need to judge yourself! This is about awareness, not guilt.

Ask:

- Where did I overspend?

- What expenses keep showing up that I didn’t plan for?

- What categories did I actually stick to?

Use a budgeting app, bank statements, or a spreadsheet to see the full picture. This isn’t about perfection. It’s about patterns.

Step 2: Rebuild Your Monthly Plan

Now that you see where the money went, it’s time to decide where it should go going forward. Create a new monthly budget based on your current reality (not the one you hoped for back in January).

Adjust for:

- Any income changes

- New or upcoming expenses (school, travel, etc.)

- Emergency savings or debt payoff goals

Even a 5-minute spreadsheet can help you get clarity and feel more in control.

Step 3: Add a “Holiday Buffer” Now

Here’s the trick: the holidays feel like they sneak up—but they’re on the same dates every year. If you wait until November to think about holiday spending, it’ll hit like a financial freight train.

Instead, take your estimated holiday budget (gifts, food, travel, etc.) and divide it by how many paychecks you have left until December.

For example:

Want to spend $600 on the holidays and you’ve got 6 paychecks left? That’s $100 per check to set aside starting now.

Set up a separate savings folder or envelope and treat it like a non-negotiable bill.

Step 4: Re-Evaluate Subscriptions and Auto-Pay Traps

Mid-year is a great time to clean house. Look through:

- Streaming services

- App subscriptions

- Gym memberships

- Free trials you forgot to cancel

Ask yourself: do I actually use this? If not, cancel it and redirect that money to your new priorities.

Step 5: Make One Bold Change

Choose one area to go all-in on for the next 90 days:

- Pay off one credit card

- Save $500 in a new emergency fund

- Track every dollar for a month

- Cut restaurant spending in half

You don’t need to fix everything at once, but small wins now will build momentum before the busy season kicks in.

Step 6: Get Everyone On Board

If you share finances with a partner or family, talk about the reset. Set shared goals, check in regularly, and create some shared accountability. Budgeting works better when it’s not a solo mission.

Final Thoughts

You don’t have to wait for January to start fresh. A mid-year reset gives you space to course-correct, stay ahead of financial stress, and finish the year strong.

The key is being intentional before the holidays show up with their expensive surprises.

Need help getting on track with budgeting and fixing your credit? We’ve got tools, resources, and a credit repair system that works when you do. Schedule your free consultation with us today, and discover the difference you can make on your credit!