Kid-Friendly Budgeting: Teaching Financial Habits at Home

Most kids grow up learning math, science, and history, but almost nothing about money. By the time they’re old enough to open a bank account or get a credit card, they’re already at a disadvantage.

But it doesn’t have to be that way.

You don’t need to be a financial expert to raise financially smart kids. All it takes is a few intentional habits, some honest conversations, and the willingness to model what good money management looks like.

Why Teach Budgeting Early?

Kids absorb more than we think. When they see you swiping your card at the store or paying bills online, they’re learning something: whether it’s true or not.

Teaching kids about budgeting helps them:

- Understand the value of money

- Make better spending decisions

- Avoid future debt

- Build confidence around money management

Even simple lessons today can create massive financial wins down the road.

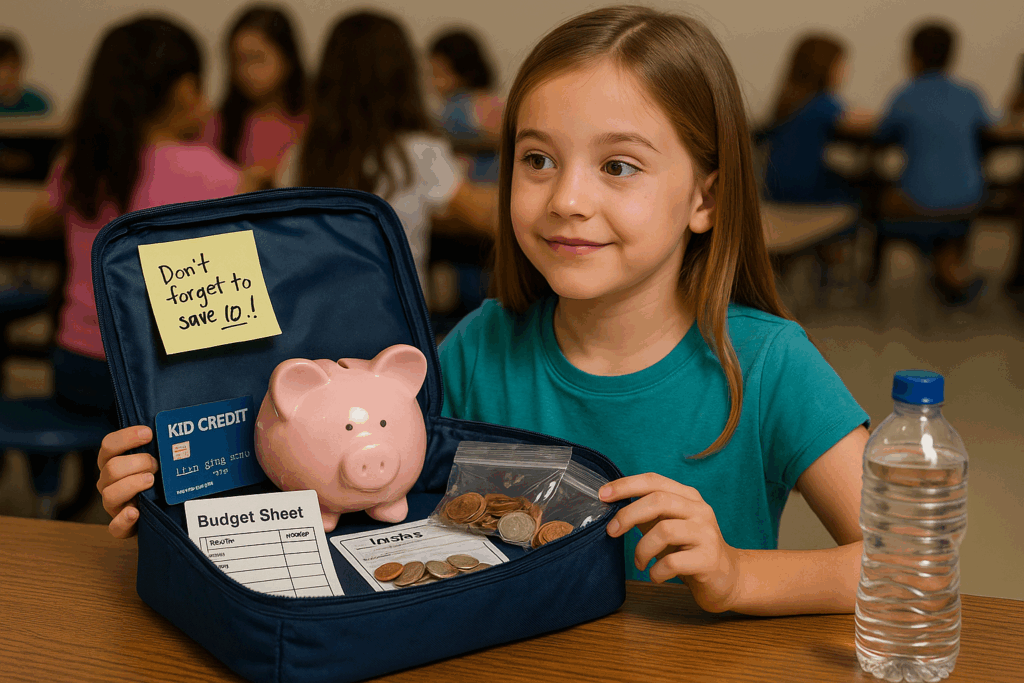

Start With Three Jars: Save, Spend, and Give

This old-school method still works. Get three clear jars or envelopes and label them:

- Save: For bigger goals like a new bike or video game

- Spend: For smaller, everyday wants like snacks or toys

- Give: For charity, causes, or helping others

Every time they get money (allowance, birthday gifts, etc.) help them divide it between the jars. You’re building budgeting muscle in a way that feels visual and rewarding.

Let Them Earn

Kids value money more when they earn it. Instead of giving a flat allowance, tie part of it to age-appropriate tasks like:

- Cleaning their room

- Helping with dinner

- Walking the dog

This teaches them a key truth: money is earned through value and effort, not just handed out.

Show Budgeting in Action

When you’re grocery shopping, planning a vacation, or deciding whether to eat out, talk through the decision out loud. For example:

“We’ve got $150 set aside for groceries this week, so let’s choose meals that help us stay in that range.”

Or:

“We’re saving up for our trip next month, so instead of takeout, we’re doing pizza night at home.”

This normalizes budgeting as part of life. Not a punishment, but a smart way to make things happen.

Make It a Game

Turn money lessons into something fun:

- Give them a “budget” on family outings and let them plan how to spend it

- Play board games like Monopoly or The Game of Life

- Use apps or digital tools designed for kids to track savings

The more engaging it is, the more it sticks.

Lead by Example

This part matters most: if your kids see you stressing about money, overspending, or ignoring bills, they’ll pick up on it, even if you never say a word. But if they see you saving, talking about goals, and sticking to a plan, they’ll start to see budgeting as normal adult behavior.

If you’re still working on your own financial habits, don’t stress. In fact, sharing that journey can make a huge impact. Let them see you improving, and they’ll learn that managing money is a skill.

Final Thoughts

Budgeting isn’t just about spreadsheets or cutting back. It’s about teaching choices, building confidence, and creating freedom.

Start young, keep it simple, and be consistent. You’re not just teaching your kids to budget. You’re teaching them to thrive.

Need help building better financial habits for yourself, too? We’ve got resources for that. Whether you’re cleaning up your credit or planning for bigger goals, CreditNerds.com is here to help. Schedule your free consultation today.