How Credit Scores Work: The Basics Everyone Should Know

If you’ve ever applied for a loan, tried to rent an apartment, or even gotten a quote for car insurance, chances are your credit score played a role in the outcome. But what actually is a credit score—and how is it calculated?

Let’s break it down in plain English so you can finally understand the number that’s shaping your financial life.

What Is a Credit Score?

Your credit score is a three-digit number that represents how risky (or trustworthy) you are as a borrower. It’s based on the information in your credit report and is used by lenders to decide whether to approve you, and what interest rate to charge if they do.

Most scores fall between 300 and 850, with higher numbers being better. In general:

- 300–579 = Poor

- 580–669 = Fair

- 670–739 = Good

- 740–799 = Very Good

- 800–850 = Excellent

The most widely used score is the FICO Score, although some lenders use VantageScore, which is similar but slightly different in how it’s calculated.

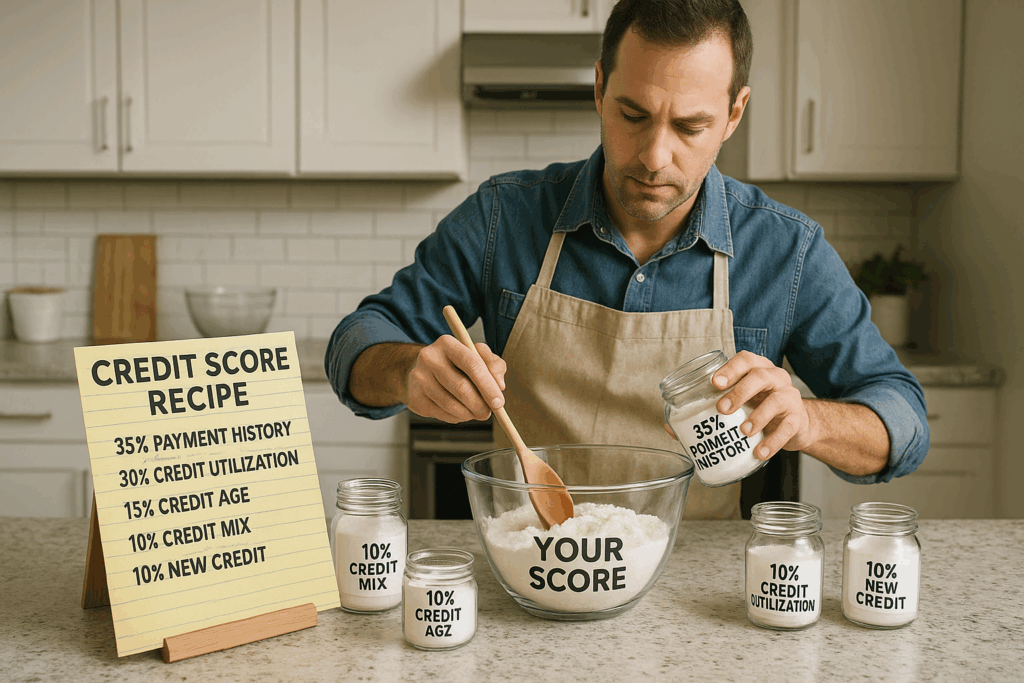

What Makes Up Your Credit Score?

Your credit score is built from five key factors. Here’s how each one works:

1. Payment History (35%)

This is the most important factor. Have you paid your bills on time? Late payments, collections, charge-offs, and bankruptcies all hurt this category.

Tip: One late payment can tank your score—so set up automatic reminders or auto-pay whenever possible.

2. Amounts Owed (30%)

Also known as credit utilization, this is how much you owe compared to your credit limits. If your credit cards are maxed out, your score will suffer—even if you’re making payments.

Tip: Try to keep your credit card balances below 30% of the limit, and under 10% if you’re aiming for a top-tier score.

3. Length of Credit History (15%)

The longer your accounts have been open, the better. Lenders like to see a stable, established track record.

Tip: Keep older credit accounts open, even if you don’t use them often—closing them can shorten your credit history.

4. New Credit (10%)

Every time you apply for new credit, a “hard inquiry” appears on your report. Too many of these in a short time can be a red flag to lenders.

Tip: Avoid applying for multiple new credit lines at once unless absolutely necessary.

5. Credit Mix (10%)

Lenders want to see that you can handle different types of credit—like credit cards, auto loans, student loans, and mortgages.

Tip: You don’t need to open new accounts just to “diversify,” but having both revolving (credit cards) and installment (loans) can help over time.

Your Score Isn’t Static

Credit scores update constantly based on the activity in your credit report. That means your score can rise (or fall) every time you pay a bill, open a new account, or miss a due date.

The Catch? Your Score Can Be Wrong

Here’s what most people don’t know: credit scores are only as accurate as the data on your report. And unfortunately, that data is often wrong. Millions of Americans have credit reports with errors that drag down their scores, and most don’t even realize it.

That’s where credit repair comes in.

Fixing Your Score Starts with Your Report

The first step is to pull your credit reports from all three bureaus. Look for:

- Incorrect personal info

- Duplicate or outdated accounts

- Late payments that weren’t late

- Collections that don’t belong to you

Dispute anything that doesn’t look right. Or, if you want help navigating the process, that’s where we come in.

CreditNerds.com Can Help

We don’t charge upfront. We only get paid when we successfully remove negative items from your report. That’s our model: pay per deletion, not empty promises. If you want help improving, or even understanding, your credit report, CreditNerds.com has your back! Schedule your free consultation today.