The Truth About Credit Bureaus: What They Don’t Tell You

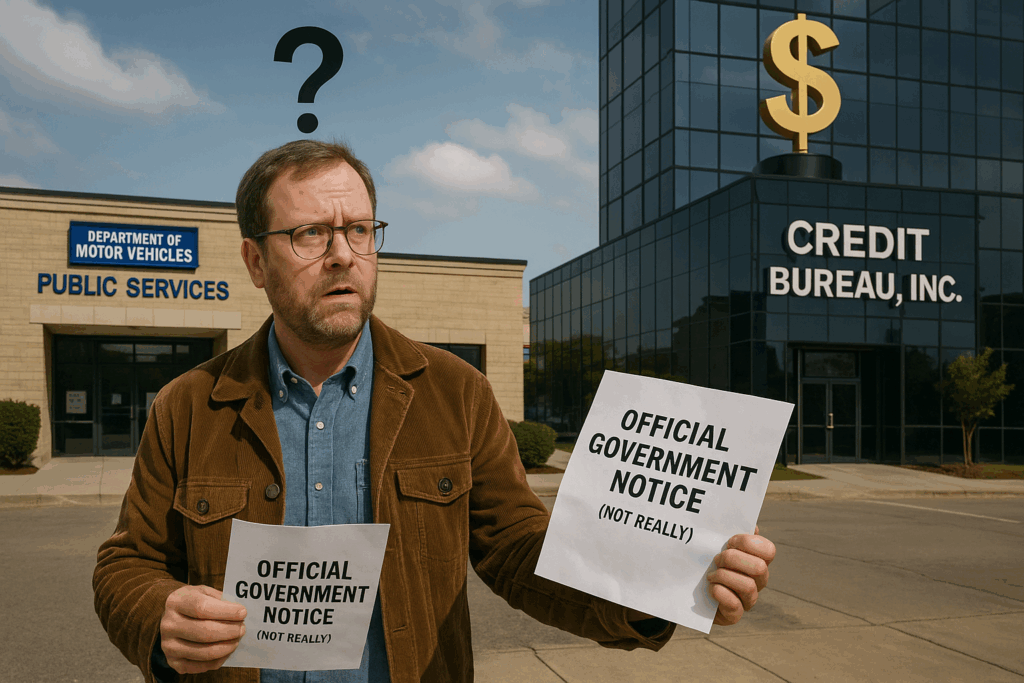

When most people think of credit bureaus, they imagine some official government agency keeping tabs on their financial behavior. But here’s the truth: credit bureaus aren’t government-run at all. They’re for-profit companies. And what they don’t tell you could be costing you thousands of dollars.

What Is a Credit Bureau?

There are three major credit bureaus in the U.S.:

- Equifax

- Experian

- TransUnion

Their job is to collect data on your credit activity (loans, credit cards, payment history, balances, and more) and package that data into a credit report. This report then becomes the basis for your credit score.

But here’s the kicker: these companies don’t actually verify the information that gets reported.

The Bureaus Don’t Work for You

Credit bureaus serve lenders, not consumers. Their real customers are banks, credit card companies, and other businesses that buy access to your credit data. When a mistake shows up on your report, don’t expect the bureaus to bend over backward to fix it.

Their attitude is often: “If you want it corrected, you prove it.”

Mistakes Are Common—And Costly

Studies show that 1 in 5 credit reports contain errors, and about 1 in 10 have mistakes serious enough to affect your ability to get approved for credit. These errors can include:

- Accounts that don’t belong to you

- Late payments that were actually on time

- Debts listed twice

- Collections that were already paid

- Outdated negative information

And yet, most people never even check their reports.

Disputes Are Your Legal Right

Under the Fair Credit Reporting Act (FCRA), you have the right to dispute any item you believe is inaccurate or unverifiable. The bureaus are required to investigate and respond within 30 days. But just because they’re required doesn’t mean they make it easy.

Many disputes are denied on technicalities or ignored altogether. And because most people don’t know the law or how to navigate the process, they just give up. For more information, check out How to Dispute Credit Report Information and Correct Errors.

Why the System Stays Broken

Let’s be honest, credit bureaus have little incentive to fix these problems quickly. They’re not penalized when they make mistakes. In fact, inaccurate negative information can lead to higher interest rates, which benefits the lenders they serve.

Meanwhile, consumers are left confused, frustrated, and financially stuck.

So What Can You Do?

- Pull your credit reports from all three bureaus.

- Look for errors even small ones.

- Dispute anything inaccurate, and keep records of your communication.

- Work with professionals (like us!) if the process feels overwhelming or if you’ve been stonewalled.

You Don’t Have to Accept Bad Data

Credit reports are supposed to reflect your financial behavior, but only if the information is correct. Don’t let a flawed system decide your financial future.

At CreditNerds.com, we specialize in helping everyday people clean up their credit reports, one item at a time. Our pay-per-deletion model means we only get paid when something is successfully removed. That’s the kind of accountability credit bureaus don’t offer.

Schedule your free consultation today at CreditNerds.com/Start.