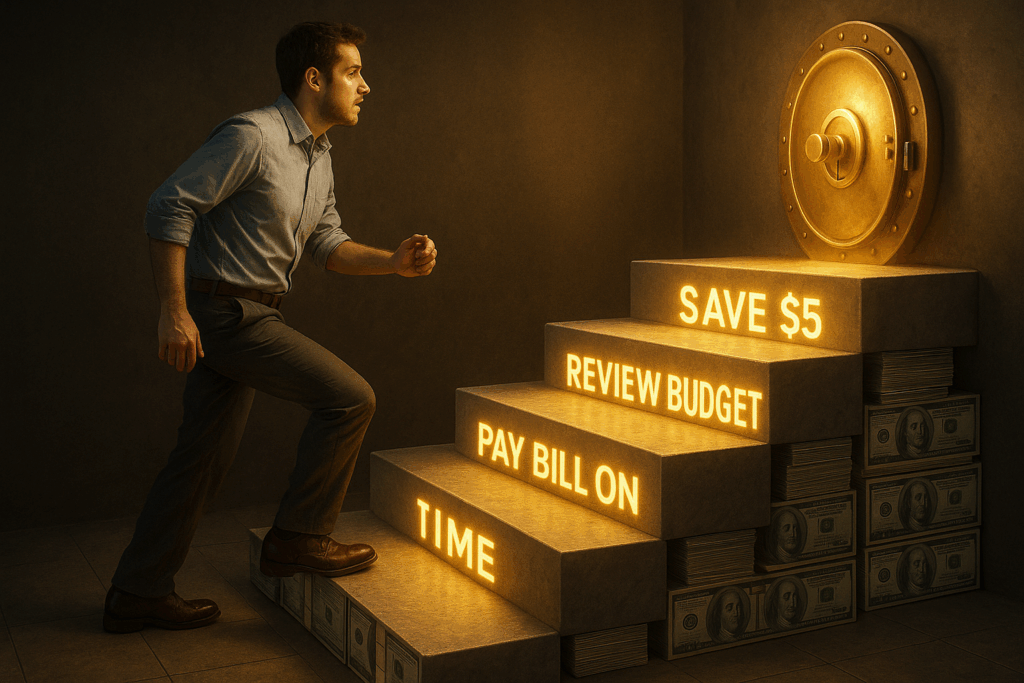

5 Simple Financial Habits That Make a Big Difference Over Time

When it comes to money, small actions done consistently often matter more than big, one-time decisions. You don’t have to be a financial expert to build security. You just need to practice a few smart habits that compound over time.

Here are five simple financial tips you can start today.

1. Automate Good Decisions

Set up automatic transfers into savings or retirement accounts. This way, you’re building wealth in the background without relying on willpower.

2. Use Windfalls Wisely

Tax refunds, bonuses, or even small side hustle income can move the needle fast. Instead of spending it all, direct at least half toward debt, savings, or investments.

3. Protect Your Credit

Strong credit saves you money on loans, insurance, and even housing. Always pay on time, keep balances low, and check your reports for errors.

4. Have a Safety Net

An emergency fund doesn’t need to be huge to make a difference. Even $500–$1,000 set aside keeps unexpected expenses from turning into debt.

5. Review Once a Month

Block out 30 minutes to look at your accounts, bills, and goals. Small check-ins help you catch problems early and celebrate progress.

Final Thoughts

Financial success isn’t about perfection. It’s about consistency. By focusing on these simple, repeatable habits, you’ll protect yourself from setbacks and build a stronger future one step at a time.

At CreditNerds.com, we believe small steps lead to big change. Start with one habit today, and let your money start working for you. If you’re ready to start your credit journey, schedule your free consultation here.